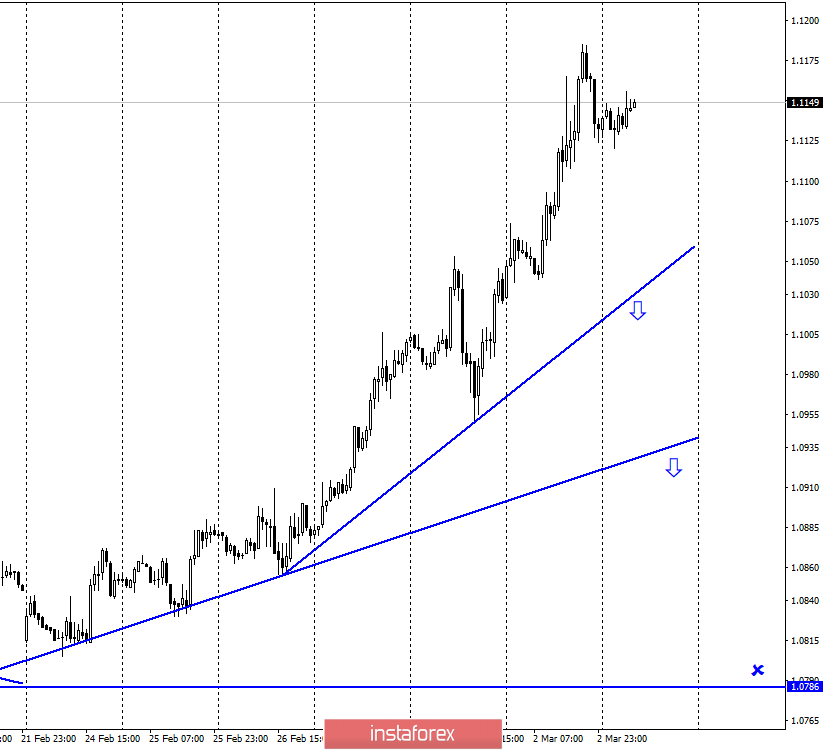

EUR/USD – 1H.

Hello, dear traders. According to the hourly chart, the EUR/USD pair continues rising. Nobody expected that bulls would start buying the euro from the lows of three years. However, it is better to refrain from hasty conclusions. In recent weeks, many different events have taken place that caused panic in the foreign exchange and stock markets. Thus, the pound is expected to return to its normal state after a while. So far, a second upward trend line was formed. The trade line maintains bullish sentiment among traders. If the pair closes below the line, the pair is expected to pull back and fall.

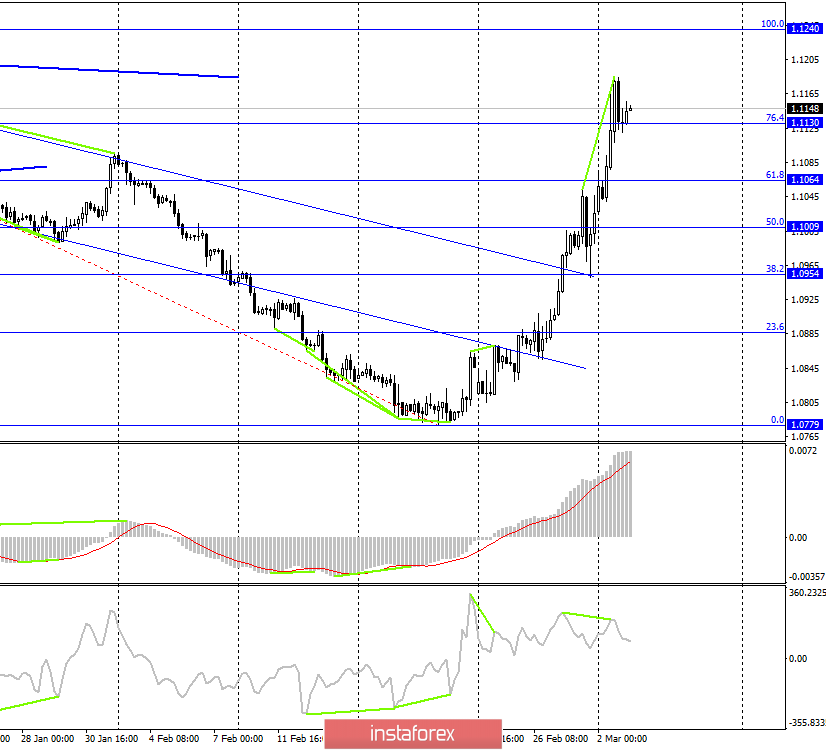

EUR/USD – 4H.

The 4-hour chart indicates that the bullish trend continues. The pair consolidated above the correction level of 1,1130 (76.4%). As a result, the quotes can rise to the next Fibonacci level of 1.1240 (100,0%). A bearish divergence is formed near the CCI indicator signaling that the pair can pull back and fall to the correction level of 1.1064 (61.8%). At the moment of writing, the pair failed to close below Fibonacci level of 76.4%. Thus, despite the bearish divergence, the price can grow further.

EUR/USD – Daily.

The daily chart indicates that the euro-dollar pair rose to the upper line of the downtrend corridor and reached the target of 1.1150. As a result, only the daily chart can show what is going to happen with the euro next. The price can pull back from the upper line and fall to the lower border. The downside potential of the euro is around 400 pips. The quotes are likely to rise if the price closes above the corridor.

EUR/USD – Weekly.

The weekly chart indicated the pair rebounded from the lower border of the tapering triangle. Thus, the bullish trend is expected to continue, and the price may reach the top line of the triangle, approximately to the level of 1,1600. However, this will require the pair to close above the downtrend corridor on the daily chart.

News review:

Manufacturing PMI data from Germany, the eurozone, and the US was released on March 2. The euro continued rising despite the reports. Business activity in Germany and the EU rose to 48.0 and 49.2, while in the US it fell to 50.7 and 50.1.

Economic Calendar for USA and EU:

European unemployment and consumer price index are on tap later today.

Today, the most important report will be from the EU. The unemployment rate is likely to remain at around 7.4%, while inflation in the eurozone, according to various forecasts, can either stay at 1.4% y/y or drop to 1.3% y/y. In any case, traders are not affected by the information background at the moment.

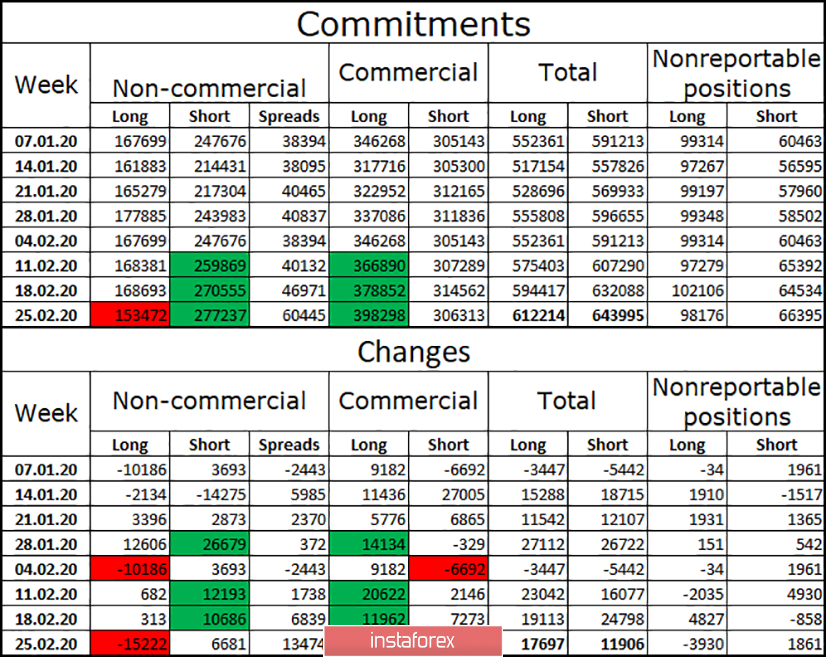

COT report (Commitments of traders):

The weekly COT report as of February 25 shows that major market players increased the number of Longs. Speculators prefered to get rid of Longs while hedgers, on the contrary, chose to add Long positions. From my point of view, it is the end of the downward trend. Looking ahead, the price is likely to rise to 1.1600. However, the COT report reflects only the sentiment of major market players and with a 3-days delay. That is why graphical analysis is more important.

Forecast for EUR/USD pair:

Longs are preferable as the daily chart indicates a possible pullback. The daily chart can determine a trend at the moment. Thus, it is preferable to sell the pair after a rebound from the top line of the corridor. At the same time, it is better to buy the pair after the price closes above the top line of the corridor. Targets will be determined on the smaller time-frame.

TERMS:

Non-commercial are major market players: banks, hedge funds, investment funds, private and large investors.

Commercial are commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

Non-reportable positions are small traders who do not have a significant impact on the price.