The pound reacted with a small increase to statements made by Bank of England Governor Mark Carney. However, the pair did not receive long-term support and the euro fell slightly after a weak report on inflation, which slowed down amid lower oil prices. Attention should be paid to the G7 summit, as well as the statements of the head of the European Central Bank, which are related to the topic of the association to combat the economic consequences of the spread of coronavirus.

As noted above, Mark Carney spoke about the economic shock that is now caused by the coronavirus, however, its impact will not last long. The head of the Bank of England also added that the monetary policy committee of the Bank of England is considering various options for action. In this regard, all necessary measures will be taken to support the economy and the financial system. The Governor also called for a joint set of fiscal and monetary measures from central banks around the world.

The French government did not take long to say that it will give struggling companies a delay in paying taxes against the background of the coronavirus epidemic, and will also help struggling companies get bank loans.

During the G7 meeting, Finance Ministers and heads of central banks of the G7 countries also expressed their readiness to take various measures, including fiscal stimulus. However, it was not indicated what specific measures were discussed.

As for joining efforts to combat coronavirus in an economic context, the President of the European Central Bank, Christine Lagarde, said yesterday that she would like to hold a telephone conference with representatives of the G-7 countries on this topic.

Thus, it is already clear that governments and central banks will not sit on the sidelines, which has a positive effect on stock indices, which are gradually adjusted after the major falls recorded last week. Meanwhile, a number of major economic agencies and leading analysts have expressed concerns about the likelihood of a recession in both the US economy and the eurozone economy. The global economy will definitely slow down because of the coronavirus outbreak, but much will depend on the speed of the measures taken.

The likelihood of lower interest rates in the US is already putting pressure on the US dollar, however, the main issue for everyone is the duration of the downturn in the activity. If the global economic downturn is observed only during the first two quarters of this year, and the threat of worsening of the situation with the coronavirus is gradually smoothed out, we can expect a strong recovery in the second half of the year. The negative outlook includes a longer economic downturn, in which global central banks will be forced to resort to unconventional stimulus measures.

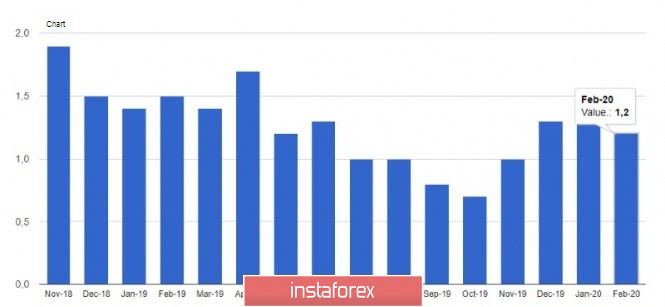

As for today's data on inflation in the eurozone, the report had a negative impact on the European currency, as it was worse than economists' forecasts. As noted above, the slowdown in inflation in February this year is directly related to the decline in oil prices, which is directly intertwined with the spread of the coronavirus. According to the report, overall inflation in the eurozone slowed to 1.2% in February this year from 1.4% in January. Economists had expected it to remain unchanged. In this regard, expectations have also increased that the European Central Bank will take a number of more drastic measures to stimulate economic growth during its meeting in March. It is possible to expand the bond purchase program and lower deposit rates, which are already at a negative level.

As for the technical picture of the EURUSD pair, there was no strong pressure on the euro, but the upward momentum slowed down. Now the bears are focused on the support of 1.1045, but buyers of risky assets need to return to the resistance of 1.1135, which can lead to a surge in purchases and update the highs around 1.1180 and 1.1240.