The Fed reducing the key interest rate immediately by 0.50% at an extraordinary meeting could not reassure investors. It has increased tensions in financial markets and their fears that the impact on the American economy from the effects of the coronavirus could be very serious.

The Fed's decision to lower interest rates was expected, but still, the first reaction as a whole turned out to be negative, as the markets took this decision as confirmation of the Fed's concerns about the probably noticeable grave consequences of the influence of the coronavirus on the American economy. This was reflected in the fall of US major stock indexes on Tuesday trading results by almost 3.0%.

At the same time, their decision led to a resumption of demand for defensive assets. The benchmark yield of 10-year-old treasuries declined below 1.0%, which was not even during the acute phase of the 2008-09 crisis. At the time of writing, the paper shows a yield of 0.981% before the opening of trading in Europe. The decline was 3.53%.

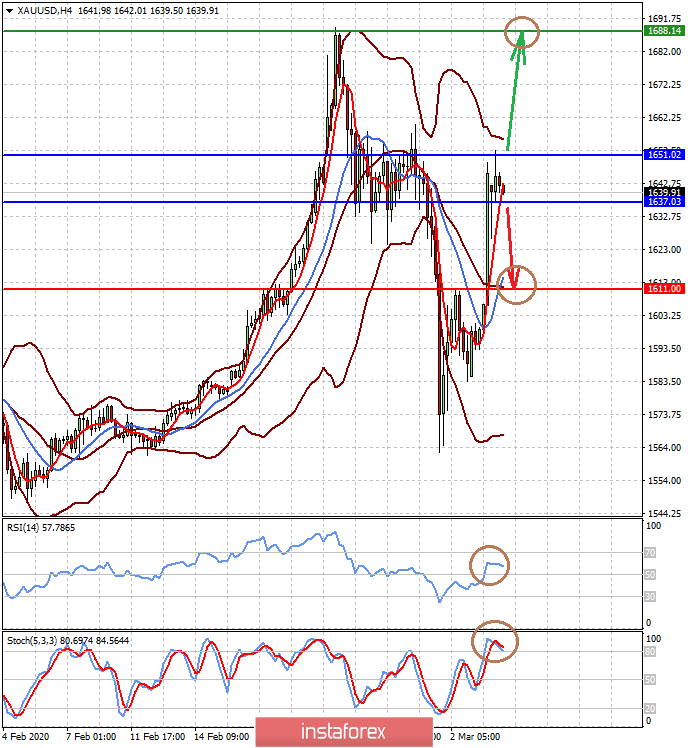

Naturally, in the wake of the market's reaction, gold began to be in demand, which already confidently consolidated above the level of $ 1,600.00 per ounce. The Japanese yen and Swiss franc are also growing in relation to the US currency.

The dollar received a significant blow, and although it is partially recovering to a basket of major currencies today, as shown by its ICE index, it can expect further local decline, which, however, will be limited. This is due to the fact that other world central banks will simply be forced to resort to lower borrowing costs, as the RBA did this week, cutting the level of interest rates. In this case, the weakening of the dollar will stop. By the way, this attitude of investors towards the American currency is clearly demonstrated by the dynamics of the net positions of the futures on the American currency. According to the latest COT report (Commitments of Traders), large market players (Large Traders) continue to hold long positions in the dollar, and this happened, despite its weekly exchange rate drop.

Nevertheless, we believe that the situation may change before the end of this week. It is likely that the American stock market will rebound up today, as shown by futures on major stock indexes, could change the mood of market players.

Today, the market will closely monitor the publication of business activity index data in the non-manufacturing sector and the US services sector, as well output values for employment from ADP. According to the forecast, the number of new jobs in February will decline to 170,000 against the value of 291,000 last January. So, it is difficult to say how the market will respond to these weak numbers, but in general, it can be said that the overall negativity from coronavirus and the impending weakness of the US economy already taken into account by the markets. Thus, only extremely weak values of the indicators published today can lead to the resumption of a limited drop in the local stock market and the dollar.

Forecast of the day:

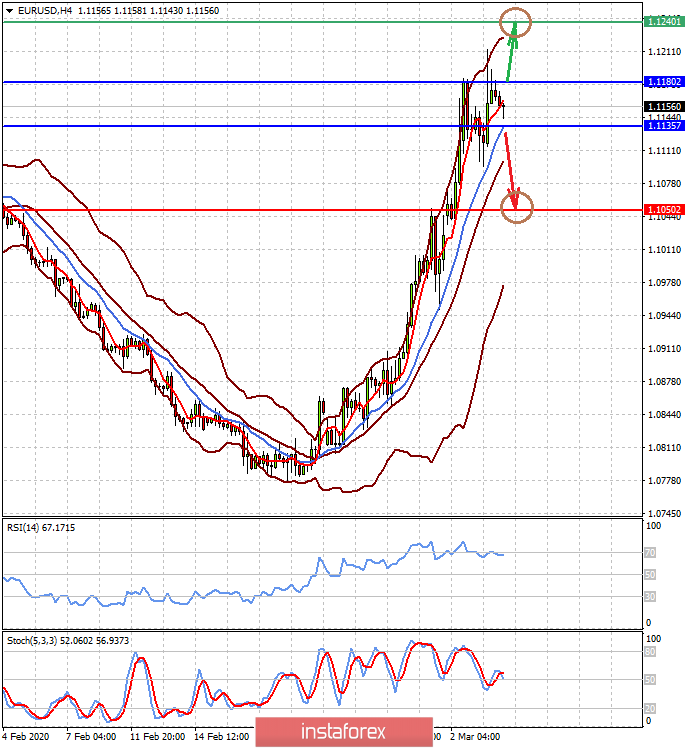

EUR/USD is trading at a local maximum of 1.1200. We believe that if the statistics from the USA turn out to be worse than the forecast, this could lead to a resumption of price growth to 1.1240. At the same time, if they are slightly better, this may become the basis for the correction of the pair. In this case, it may rush to the level of 1.1050.

The price of gold is balancing in the range of 1637.00-1651.00. Its growth above the upper boundary can lead to the level of 1688.15, while a decline below the level of 1637.00 may lead to a decline to the level of 1611.00