Yesterday, I said that the G7 countries are going to join efforts in order to combat the economic consequences of the coronavirus. Today, there is information that the European Central Bank is considering several support measures regarding the situation.

Amid the coronavirus epidemic, the French government said that it would give struggling companies a tax delay, as well as help struggling companies get bank loans. At the same time, the International Monetary Fund also said that it is ready to help all those affected by the spread of the virus. As for the European regulator, the central bank may expand its targeted long-term refinancing program, in order to increase the liquidity of companies. Surprisingly, this program will be aimed specifically at small and medium-sized companies.

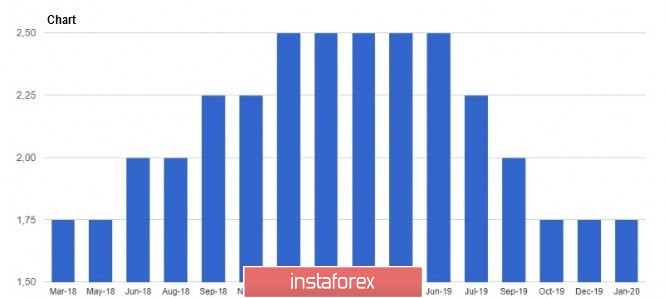

Nevertheless, the most interesting thing that happened yesterday was the unexpected decision of the Fed to lower interest rates by half a percentage point to 1%-1.25%. The committee did not rule out possible additional incentives in order to support the economy from the negative effects of the virus.

At the press conference, Fed Chairman Jerome Powell said that the US economic fundamentals are still strong, but the spread of the coronavirus is causing new difficulties and risks to the economy. Thus, further monitoring of the situation is now a priority, and the use of additional tools is possible if necessary. Nevertheless, the Fed is optimistic and expects a return to a strong economic growth in the second half of the year. For now though, Powell is not going to talk about reducing interest rates, so it is not worth counting on the introduction of an asset purchase program. If we talk about it, the pressure on the US dollar will increase even more. At the end of the press conference, the head of the Federal Reserve once again noted that the decision to lower rates is not political.

However, shortly after that, US President Donald Trump said that the Fed should continue easing the monetary policy.

In this regard, we should also pay attention to the speech of the US Treasury Secretary, Steven Mnuchin, who is determined to work with the US Congress and the government to develop a package of emergency funding measures. According to him, assistance will be provided as part of general measures to mitigate the economic impact of the spread of the coronavirus. Let me remind you that last week, the Trump administration offered to allocate $ 2.5 billion for this case, but the proposal was rejected. Yesterday though, there were talks of higher figures in the region of $ 7-8 billion.

In terms of fundamental statistics, the reports of the Retail Economist and Goldman Sachs did not affect the situation of the US dollar. The data indicated that the US retail sales index fell by 0.3% from February 23 to 29, but increased by 2.1% over the same period in 2019. Reedbook's data on retail sales also had no effect. It showed that the retail sales in the United States fell by 0.1% in the first 4 weeks of February, and increased by 5.9% in the week of February 23 to 29 if compared to 2019.

As for the technical picture of EUR/USD, on one hand, the bulls managed to update new highs, which kept the upward trend. On the other hand, there are no active purchases above 1.1190, as the expectation of the Fed lowering the interest rates is no longer working, since the rates are now actually reduced. Most likely, everyone will now remember the recession and low inflation in the Eurozone, as well as the necessary measures needed to stimulate the economy. The problem is that if the Fed has a place to ease monetary policy, the European Central Bank does not have such a lever, as the key interest rate is at zero, and the deposit rates have been negative for quite a long time. Now, let's see how the buyers of risky assets will act on the situation. Nevertheless, to continue the bullish trend, a breakout of the resistance at 1.1190 is needed, which will open a direct path to the highs in the area of 1.1260 and 1.1315. The downward correction will be limited to the large support at 1.1097, where the lower border of the upwards channel passes. If this area is broken, it will quickly push the EUR/USD pair to the lows of 1.1040 and 1.0990.