Again, we have to start the review with the topic of the notorious coronavirus. Late last night, the Federal Reserve System (FRS) urgently lowered the refinancing rate by 50 basis points without a scheduled meeting, from 1.5%-1.75% to 1%-1.25%. The last time such a sharp reduction in the main interest rate was during the global financial crisis of 2008-2009.

Federal Reserve Governor Jerome Powell said that the US economy is still strong, however, the spread of the coronavirus epidemic around the world creates new risks and threats to the global economy, which is why the US regulator made an emergency decision to reduce the rate.

Oddly enough, the euro/dollar currency pair reacted quite calmly to the unexpected decision of the Fed. We will return to the technical picture for the euro/dollar a little later. Now, about the macroeconomic data that will be presented to the market participants today.

At the time of writing, Germany published data on retail sales, which were mixed. Thus, retail sales increased by 0.9%, although an increase of 1% was expected. But retail sales excluding seasonal adjustments were better than the forecast of 1.5% and amounted to 1.8%. At 11:00 (London time), retail sales data will be published by the eurozone.

Reports on changes in the number of employees from ADP are expected from the US today at 14:15 (London time). At 20:00 (London time), investors will get acquainted with the Fed's Beige Book.

I don't know how much these events will affect the price dynamics of the main currency pair. It is possible that the market will still be influenced by the Fed's decision to cut the rate by 50 bps and will continue to play this event.

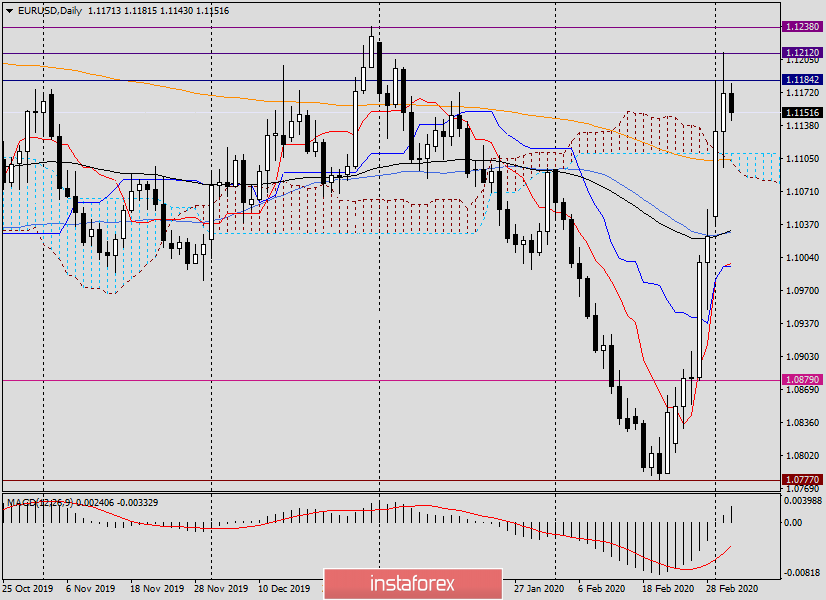

Daily

At yesterday's auction, after the emergency decision of the Federal Reserve to reduce the rate, the euro bulls attempted to storm the important and significant mark of 1.1200. Previously, I noted the price zone of 1.1180-1.1238 as extremely strong and difficult to pass. At the moment, it remains so.

Yesterday's attempts to break through the sellers' resistance at 1.1184 were limited to 1.1212, after which the pair rolled back down and finished trading on March 3 at 1.1171. The picture, as well as the market behavior, is quite contradictory. On the one hand, it is not possible to break through 1.1200 and, most importantly, to gain a foothold above it. As for the maximum values, they decreased after 1.1238, but after the trend changes from bearish to bullish, the maximum values, as well as the closing prices of daily trading, gradually increase.

Please note that there has not been a correction on the daily chart as such. Starting from February 21 (not counting the candle for February 26), all candles are bullish. Looking at the daily chart, it still suggests a pullback to the 200 area of the exponential moving average, where the upper border of the Ichimoku indicator cloud passes just above. In this timeframe, the price zone for purchases is 1.1110-1.1100. Moving on to smaller time intervals.

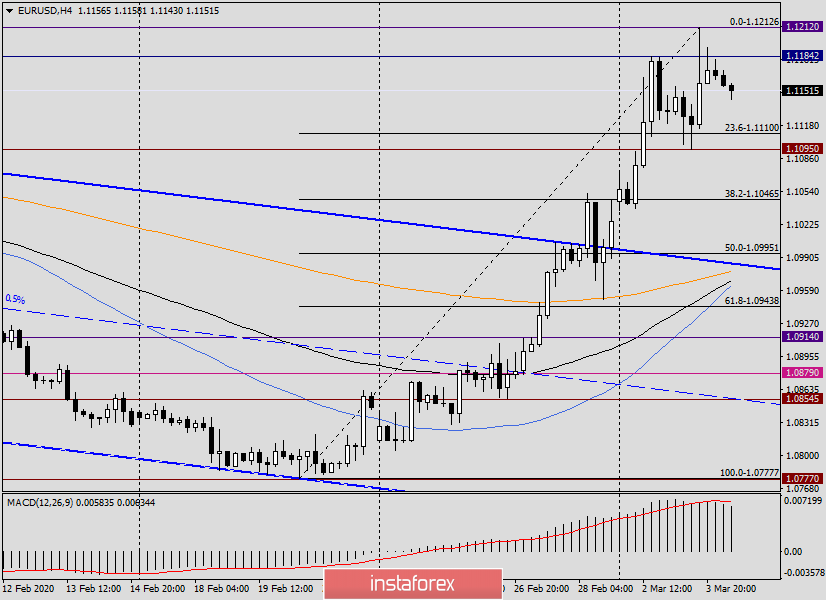

H4

On the 4-hour chart, there are attempts to adjust the rate, however, trading will show how successful they are. Given the level of 23.6 Fibo from the growth of 1.0777-1.1212, as well as the support level of 1.1095, a corrective pullback to the area of 1.1110-1.1095 should be considered for opening long positions. An additional signal will be the appearance of a candle or candles in this area, which will signal the return of the pair to the upward movement.

In the event of a breakdown of the support of 1.1095, you will need to carefully monitor the market situation and the attitude of investors to the US currency. However, it is unlikely that after the rate cut immediately by 0.50%, the US dollar will find support and will strengthen.

The main trading idea for EUR/USD remains purchases, which are better to open after corrective rollbacks in the area of 1.1110-1.1100. It is more risky and aggressive to try to buy a pair near 1.1140, but in this case, you need to be prepared for a possible drawdown, since the probability of a corrective pullback remains.

Good luck!