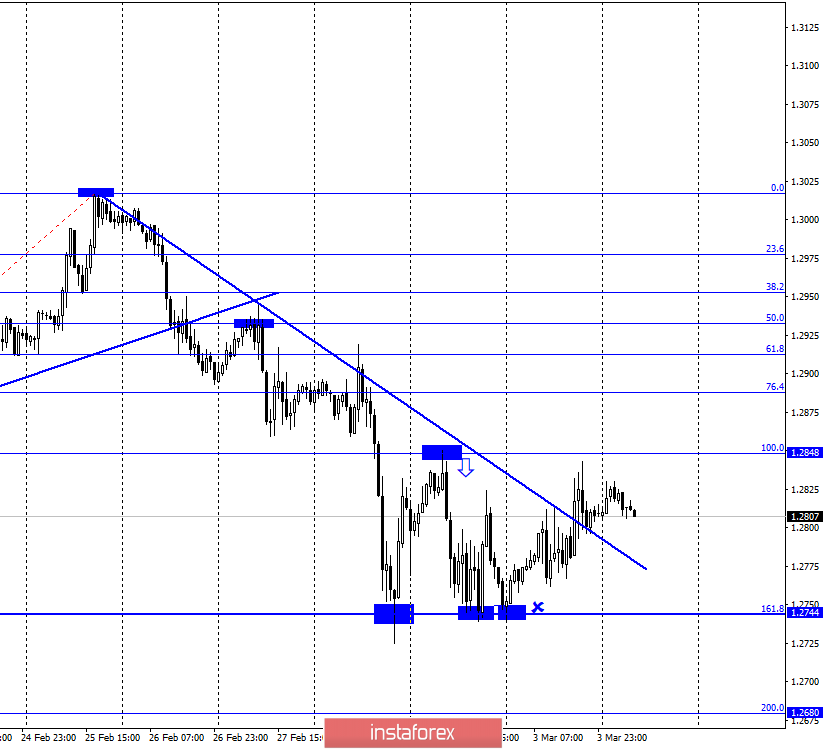

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair made three rebounds from the corrective level of 161.8% (1.2744) and failed to gain a foothold below. As a result, a reversal was made in favor of the British currency and the growth process began in the direction of the corrective level of 100.0% (1.2848). Along the way, the quotes closed above the downward trend line, changing the short-term mood of traders to "bullish". Since the closing of the pound/dollar pair under the Fibo level of 161.8% did not take place, the signal for new sales was not received. And now all sales can be canceled as trading ideas.

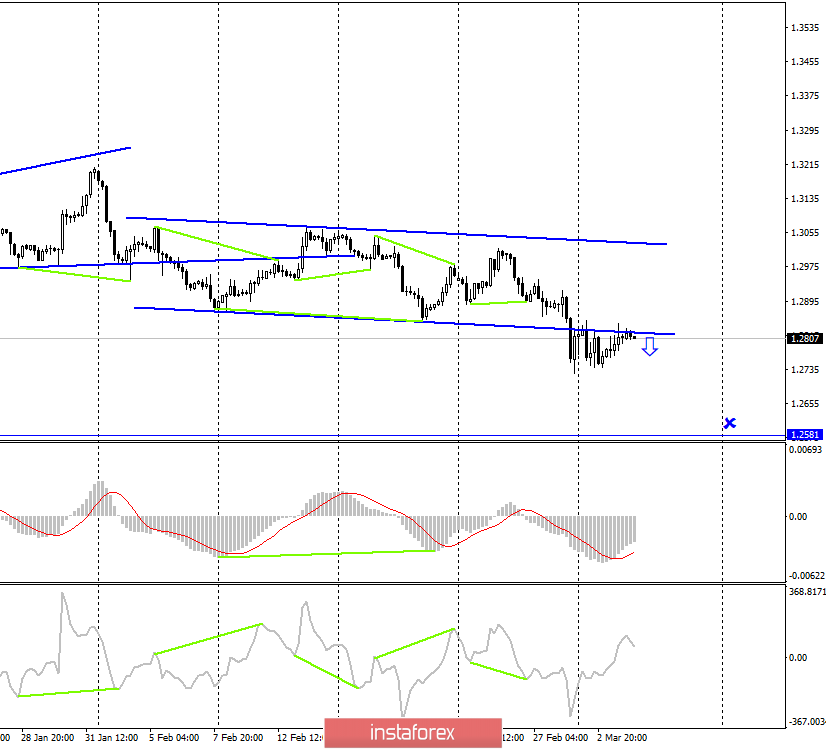

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair made a return to the lower line of the almost sideways trend corridor. A rebound from this line may work in favor of the US dollar and resume the fall in the direction of the low level of 1.2581. However, the lower line of the corridor itself is not a strong barrier when the pair is not in the corridor. Thus, there may be a rebound, however, it will not be a strong signal to sell the British currency. No indicator has any pending divergences on March 4.

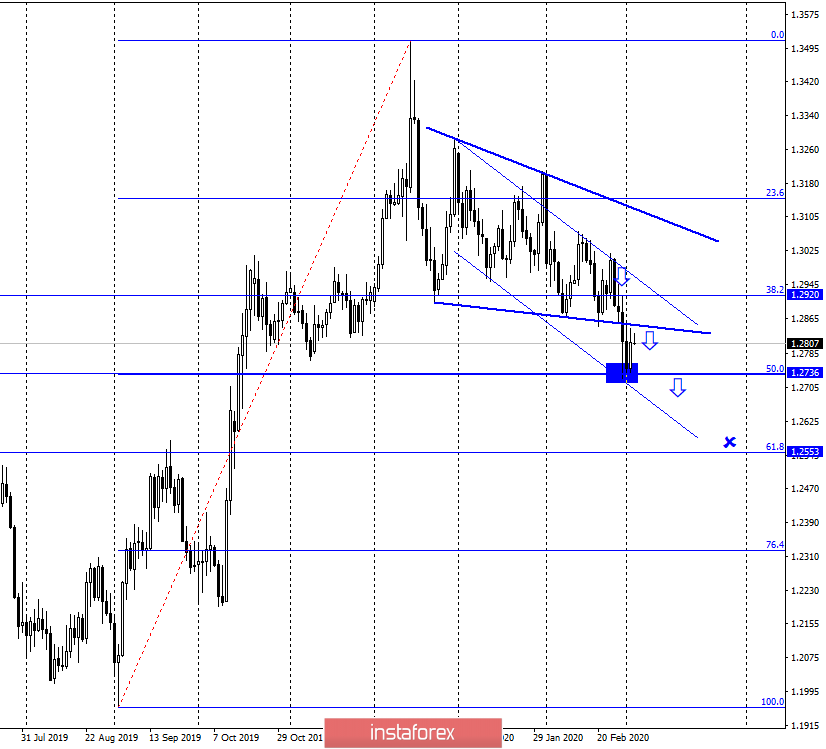

GBP/USD – Daily.

According to the daily chart, the graphic picture remains the most interesting. From the corrective level of 50.0% (1.2736), the rebound was performed with a reversal in favor of the British. As a result, the growth process started in the direction of 38.2% (1.2920). This is the scenario I warned about yesterday, which says that the total long and short positions are almost equal based on the COT report. That is why I believe that traders should not expect a strong fall or growth. It is not excluded that the pair's quotes will rise to the upper line of the downward trend corridor, which continues to determine the current mood of traders as "bearish". Thus, the situation is now ambiguous. There are no clear signals for sales or purchases.

Overview of fundamentals:

No economic reports were released in the UK and America on Tuesday, March 3. However, quite unexpectedly for traders, the Fed lowered the key rate by 0.5%, which led to a reversal of the pair in favor of the British currency. It was the Fed's decision that prevented the pound from fixing under the 161.8% Fibo level on the hourly chart.

The economic calendar for the US and the UK:

Great Britain - composite index of business activity in the manufacturing sector (09:30 UTC+00).

Great Britain - index of business activity in the service sector (09:30 UTC+00).

USA - change in the number of employees from ADP (13:15 UTC+00).

USA - composite index of business activity in the manufacturing sector (14:45 UTC+00).

USA - index of business activity in the service sector (14:45 UTC+00).

USA - ISM composite index for non-manufacturing sector (15:00 UTC+00).

On March 4, there will be a lot of important news. Traders can continue to be under the influence of a rate cut by the Fed. However, in addition to this, important data will be released today on changes in the number of employees, as well as the business activity index in the UK and the US.

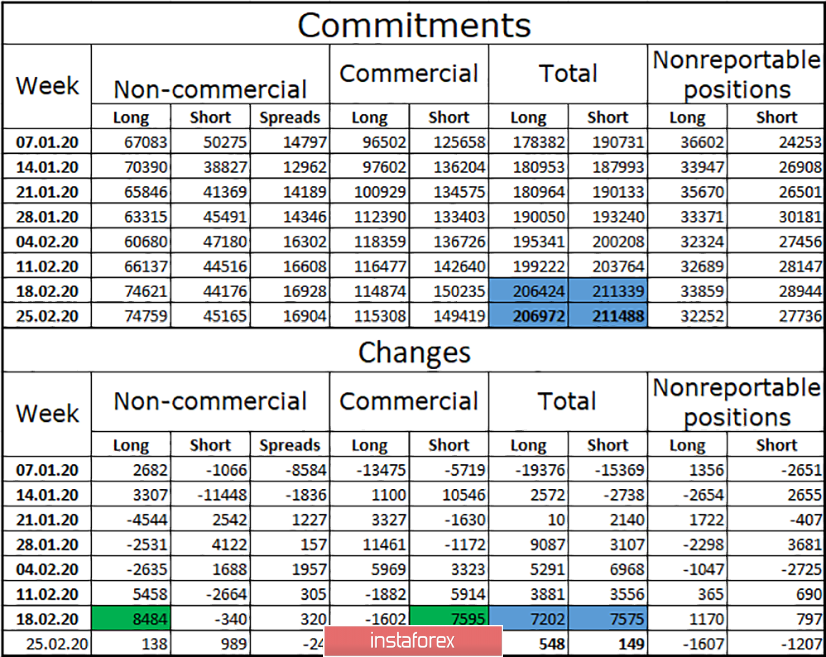

COT survey (Commitments of traders):

The latest report from February 25 shows that equality between major market participants remains. There are no significant changes. The total number of long and short positions remains approximately the same. The changes for the reporting week were just minimal. Thus, the mood of major market players has not changed at all. A small advantage remains on the side of bear traders, however, it is really minimal. Thus, I still tend to believe that traders should not expect strong exchange rate changes from the GBP/USD pair in the near future.

Forecast for GBP/USD and recommendations for traders:

There are no trading ideas for March 4 due to yesterday's growth of the pair, which broke the graphic patterns on many charts. Nevertheless, I expected this outcome based on the COT report and warned about it. Now we need to wait for new trading signals to appear.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but for current operations or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.