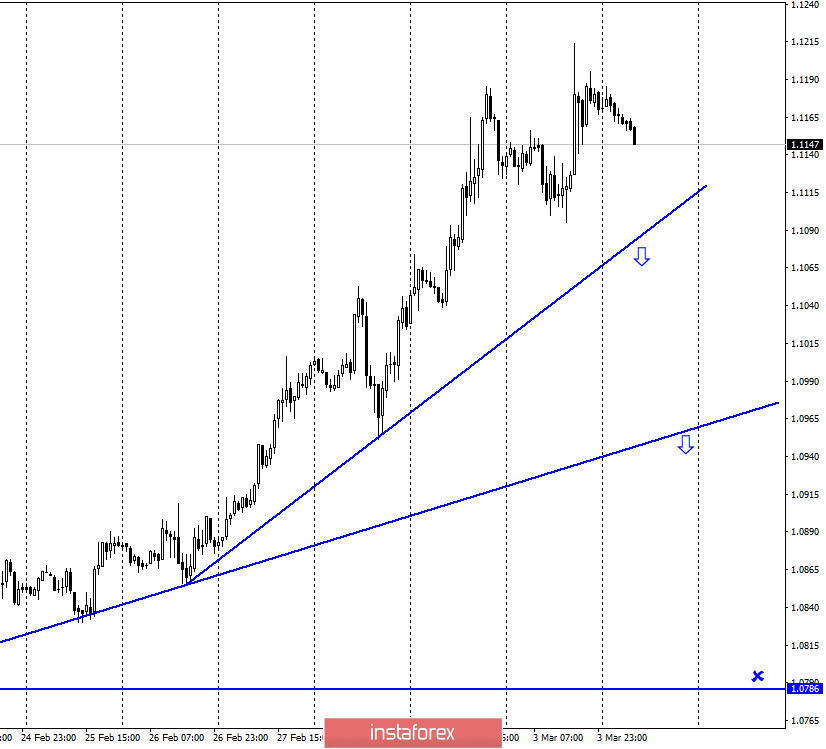

EUR/USD – 1H.

Hello, traders! According to the hourly chart, the EUR/USD pair continues to grow. The upward trend line is the second in a row and continues to maintain a "bullish" mood among traders. There are no specific goals on the hourly chart. However, closing the pair's rate below the trend line will work in favor of the US currency and some drop in quotes in the direction of the second trend line. The hourly chart best shows the short-term mood of traders.

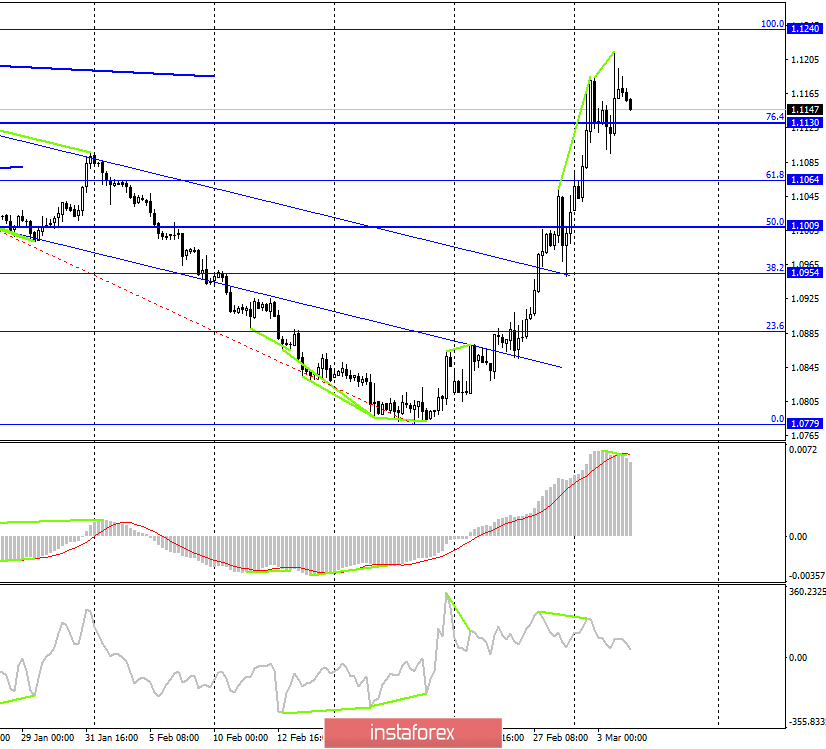

EUR/USD – 4H.

As seen on the 4-hour chart, after the formation of the first bearish divergence in the CCI indicator, the pair's quotes performed a slight drop, then resumed the growth process, failing to consolidate under the Fibo level of 76.4% (1.1130). After that, another bearish divergence was formed for the MACD indicator, which again worked in favor of the US currency and the process of returning to the corrective level of 76.4% began. Thus, two bearish divergences at once indicate the end of the upward trend. On the daily chart, there are also good reasons to expect the pair to fall. Thus, closing quotes below the 76.4% Fibo level will significantly increase the probability of a further fall of the euro/dollar pair in the direction of the levels of 61.8% (1.1064) and 50.0% (1.1009).

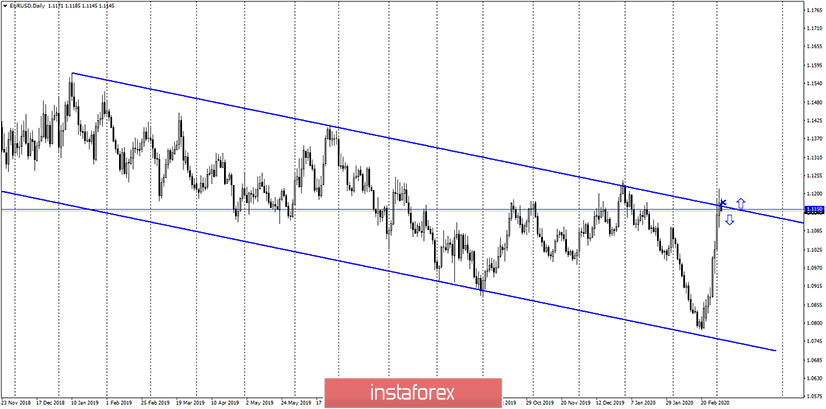

EUR/USD – Daily.

According to the daily chart, the euro/dollar pair made a rise to the upper line of the downward trend corridor and worked out the target level of 1.1150. Thus, there is now a high probability of a rebound from this corridor line with a reversal in favor of the US dollar and the beginning of a possibly long fall in the European currency. In any case, traders do not have to expect a new growth until the pair's rate is fixed above the trend corridor.

EUR/USD – Weekly.

The weekly chart indicates that the euro has growth potential. However, this is a weekly schedule, meaning that goals can be worked on for months. The lower charts are in favor of a pullback of quotes down, after which it is quite possible to resume a more global growth of the euro.

Overview of fundamentals:

On March 3, the European Union released an inflation report. The consumer price index fell from 1.4% y/y to 1.2%. Thus, this is bad news for the euro. However, the bear traders did not experience any particular frustration. Yesterday, we also received news from the Fed, which lowered its key refinancing rate by 0.5% at an emergency meeting. If it were not for the strong resistance around 1.1150 and the previous increase of 400 points, the euro would have a chance of even greater growth.

News calendar for the United States and the European Union:

Germany - composite index of business activity in the manufacturing sector (08:55 UTC+00).

Germany - index of business activity in the service sector (08:55 UTC+00).

EU - composite index of business activity in the manufacturing sector (09:00 UTC+00).

EU - index of business activity in the service sector (09:00 UTC+00).

EU - change in retail trade volume (10:00 UTC+00).

USA - change in the number of employees from ADP (13:15 UTC+00).

USA - composite index of business activity in the manufacturing sector (14:45 UTC+00).

USA - index of business activity in the service sector (14:45 UTC+00).

USA - ISM composite index for non-manufacturing sector (15:00 UTC+00).

Today, there will be quite a large number of economic reports in America and the European Union. I recommend paying the most attention to the composite ISM index for the non-manufacturing sector, which will be the latest release, as well as to the ADP report.

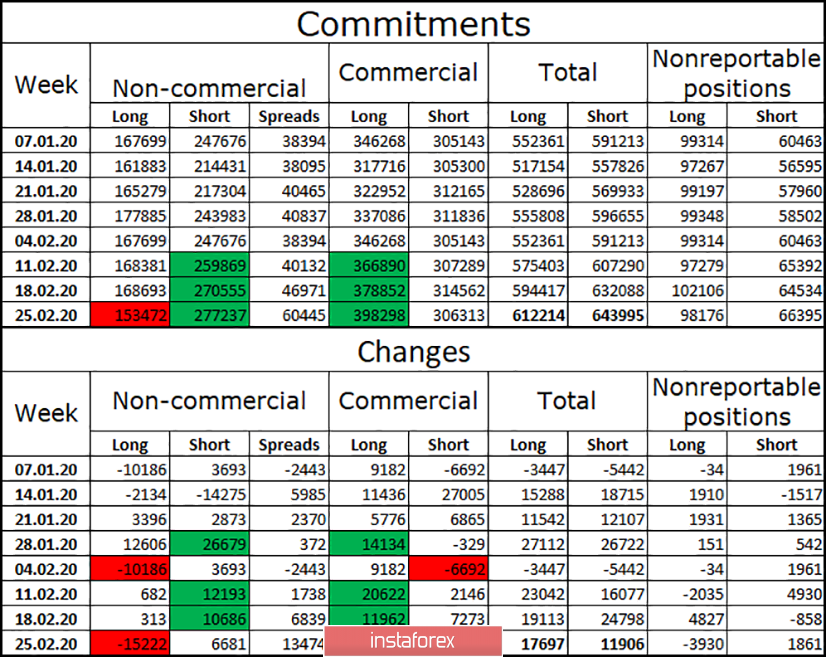

COT survey (Commitments of traders):

A new COT report for the week of February 25 showed that long positions are being built up by major market players. At the same time, speculators prefer to get rid of long positions and hedgers – on the contrary, to increase. From my point of view, this means that the downward trend is complete. Thus, in the future, we can expect growth to 1.1600, as the weekly chart predicts. However, the COT report only shows the mood of major players and with a delay of three days. Therefore, graphical analysis remains more important. Plus, you can't determine the short-term outlook from the COT report.

Forecast for EUR/USD and recommendations for traders:

In this situation, I recommend looking closely at the closing of long positions, as the daily chart shows a possible rebound and reversal of the pair in favor of the US dollar around the level of 1.1150. It is on the daily chart that the trend should now be determined. As I said, the rebound from the upper line of the corridor will allow you to sell the pair with the targets of 1.1064 and 1.1009. The 4-hour chart also contains sell signals in the form of bearish divergences. Thus, if you work with a short stop, you can sell the pair already.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but for current operations or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.