Hello, colleagues!

At yesterday's trading, the main currency pair of the Forex market showed a moderate decline and performed a pullback to the previously indicated price zone near the important level of 1.1100. We will turn to the technical picture for EUR/USD a little later, but for now, we will talk about yesterday's macroeconomic data and what is expected today.

Yesterday, the eurozone presented reports on retail sales, which were generally quite good. In annual terms, retail sales in the euro area increased by 1.7%, although an increase of only 1.1% was expected. On a monthly basis, the indicator coincided with expectations and amounted to 0.6%.

Now about the American statistics, where first of all you need to pay attention to the change in the number of employees from ADP. Employment in the private sector of the American economy (with the exception of the agricultural sector) grew stronger than expectations, which were reduced to 170,000 and in fact, the figure was at the level of 183,000.

This is a good signal before Friday's official data on the US labor market, as the change in the number of employees from ADP is often a leading indicator of Nonfarm Payrolls. Well, let's see. We don't have to wait long. Let me remind you that tomorrow at 14:30 (London time), the data on the US labor market will be released, which will affect the closing of weekly trading.

If we talk about the publication of the Fed's Beige Book, the main message in it is the thesis about moderate economic growth in the United States of America. That is, the stability of the American economy was confirmed, and moderation is explained by the spread of the coronavirus and the upcoming US presidential election. These factors were identified as risks that will constrain the economic activity of corporations and companies.

No statistics are expected from Europe today. Several reports will be received from the United States, which should pay attention to initial applications for unemployment benefits and production orders. I do not think that these data will have a strong impact on the price dynamics of the euro/dollar and radically change the technical picture. After all, the main events will be published tomorrow.

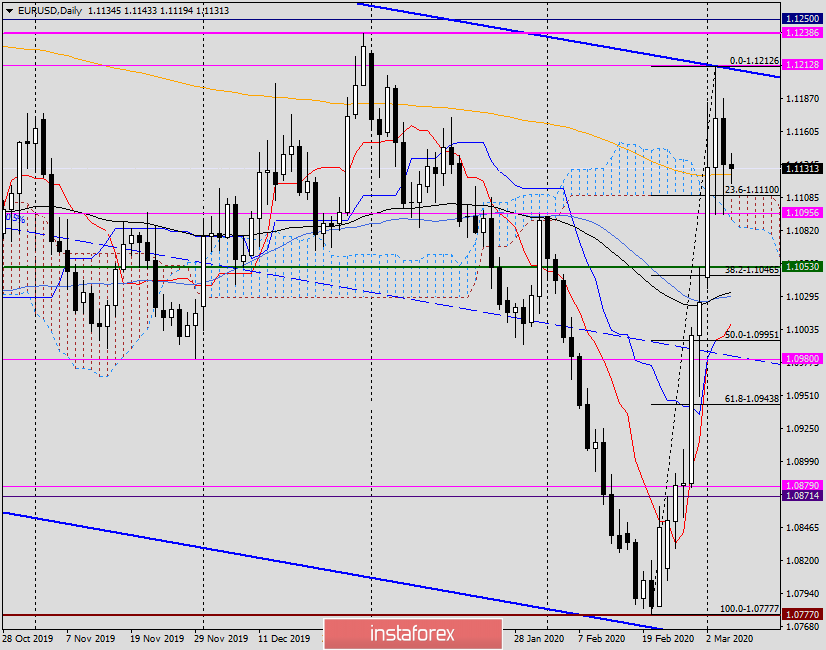

Daily

As expected, the pair retreated to the price zone, where the following are located: 200 exponential moving average, the upper limit of the Ichimoku indicator cloud, and the support level of 1.1095. By the way, this level turned out to be quite strong, since it held back the further decline of the quote for two days in a row. Thus, for those who wanted to buy euro/dollar, this opportunity was provided yesterday.

Yesterday's trading closed at 1.1334. This is above 200 EMA, which is extremely important. Since yesterday's daily candle was the third in a row to close above the 200 exponential, we can assume that the pair has fixed above this moving average.

At the time of writing the review, the euro/dollar is moderately strengthening. If the rise continues, you should wait for the pair in the area of 1.1187-1.1210, where the maximum values of yesterday's trading are shown, as well as the blue resistance line drawn at 1.1411-1.1212 points. The breakdown of this resistance line and the mark of 1.1212 will signal further growth of the pair and testing for the breakdown of the key resistance level of 1.1238 at the moment. If the euro bulls manage to complete this task, the road will open to higher targets, which will be indicated later, after the true breakdown of 1.1238. Do not forget that Nonfarm Payrolls can significantly affect the technical picture of the main currency pair and the results of the closing of trading on March 2-6.

If we consider an alternative downward scenario, it will begin to be implemented after the breakdown of the support level of 1.1095. In the event of such a development, we should expect a deeper corrective pullback towards the level of 1.1050.

Taking into account yesterday's correction candle with a long lower shadow, as well as the closing of trading on March 4 above 200 EMA, today's strengthening of the pair looks reasonable from the point of view of technical analysis. However, it is not necessary to forget about the factor of coronavirus, which had previously supported the US currency.

Nevertheless, I consider the main trading idea today is purchases that are better planned after a short-term decline in the price zone of 1.1110-1.1055. The confirmation signal for opening long positions on EUR/USD will be the appearance of candlestick patterns that are typical for the resumption of growth on the 4-hour and (or) hourly charts.

Successful and profitable trades!