On the one hand, it is clear why the euro is falling. Market participants expect the ECB to ease interest rates. Moreover, it does not matter whether the regulator lowers the discount rate or the deposit rate. The European Central Bank simply has no choice especially after the Fed unexpectedly slashed interest rates. At the moment, the world's central banks are in an unfavorable position. However, the pound is rising despite possible rates cut. Such an eccentric growth is the result of optimism among investors.

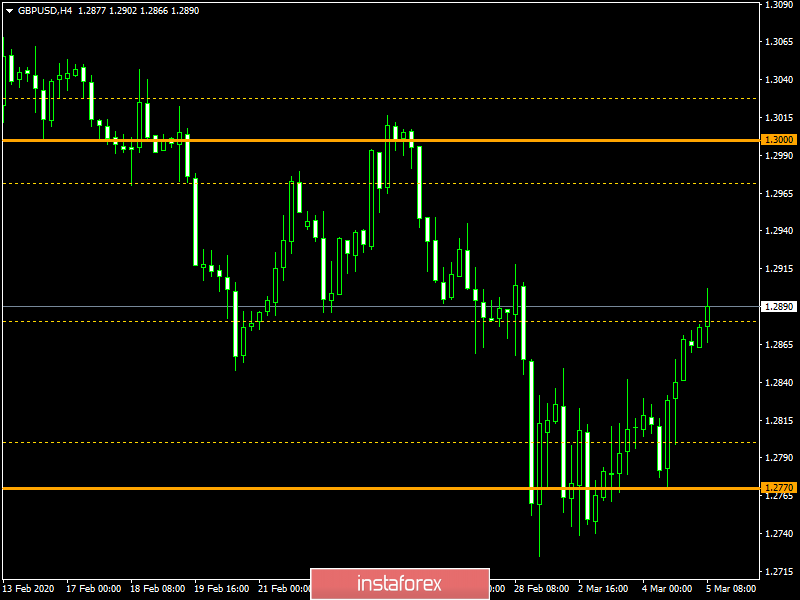

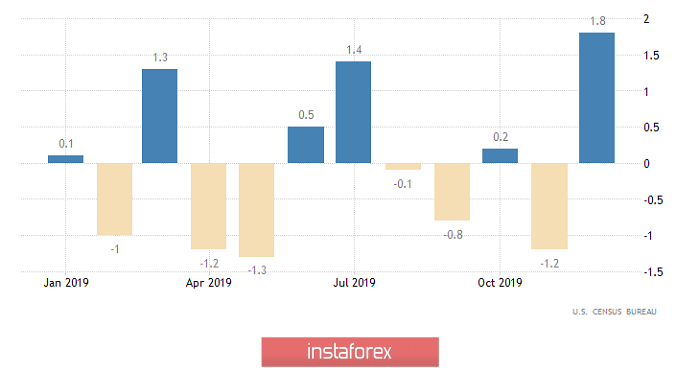

Thus, the euro is preparing for the reduction of the interest rates. The ECB policymakers are confused since they do not know what to expect after the FED's urgent measures. As a result, it is not clear what to expect from the ECB as no decision has yet been made. Anyway, uncertainty about the future of interest rates puts pressure on investors. It is not surprising that the market did not pay attention to the positive macroeconomic statistics. Thus, the Services Business Activity Index increased to 52.6 from 52.5. The composite PMI grew to 51.6 from 51.3. However, retail sales were steady as a result of the previous revision to 1.7% from 1.3%. According to preliminary estimates, retail sales were expected to increase to 1.4% from 1.3%. The data considerably improved compared to the forecast. However, investors were concerned about possible interest rate cuts by the European Central Bank.

Retail sales (the EU):

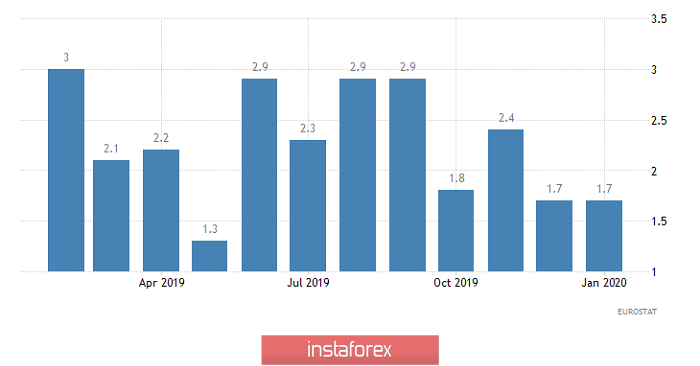

As for the British pound, the situation is completely different. The pound was rising despite the negative macroeconomic statistics. Thus, the Services Business Activity Index dropped to 53.2 from 53.9 which was slightly weaker than forecast. The composite PMI shrinked to 53.0 from 53.3. The pound was growing despite soft business activity data. The fact is that Andrew Bailey, the new Governor of the Bank of England, removed all the uncertainty as to the future of interest rates. Bailey said that the bank's benchmark rate could be lowered to about 0.1%. As a result, further actions of the BoE are pretty much evident compared to the ECB. Today, it is better to be prepared for a bad scenario rather than no scenario at all. As we can see, the pound is rising only because the Bank of England's decision on interest rates is known. Moreover, the effect of Brexit on the economy still remains the main problem.

Composite Services PMI (the UK):

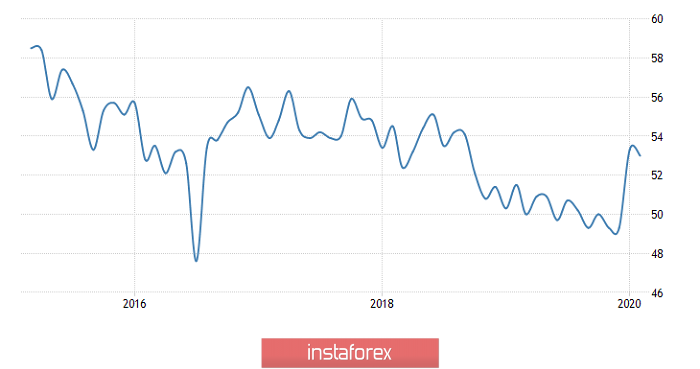

The market did not pay attention to the negative statistics in the US as well. First of all, the business activity index dropped below the 50-point mark separating growth from contraction. Thus, the Services PMI fell to 49.4 from 53.4. The Composite Business Activity Index shrinked to 49.6 from 53.3. Second, according to ADP, employment increased by 183,000 from 209,000. Consequently, the employment rate is decreasing suggesting that the situation in the labour market is deteriorating.

Employment data from ADP (the US):

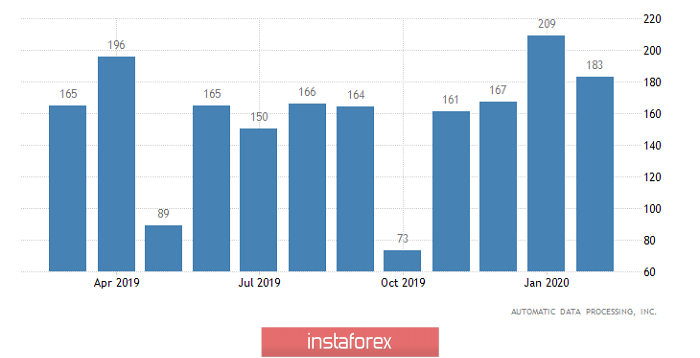

Today, only the United States publishes at least some macroeconomic data. However, these forecasts are rather weak. The total number of jobless claims is expected to increase by 5 thousand. Initial jobless claims are likely to grow by 1 thousand while secondary unemployment claims - to increase by 0.3%. Tomorrow, the US Labour Department is set to release a report. There are suggestions that this jobs report could disappoint. Moreover, factory orders are likely to be reduced by 0.3%. In other words, all forecasts without exception indicate that the situation can become worse. The market expects the ECB and the Bank of England to cut interest rates. At the same time, when everything is clear with the euro, the situation with the pound is far more interesting as the impact of Brexit on the British economy remains unpredictable.

Volume of factory orders (the US):

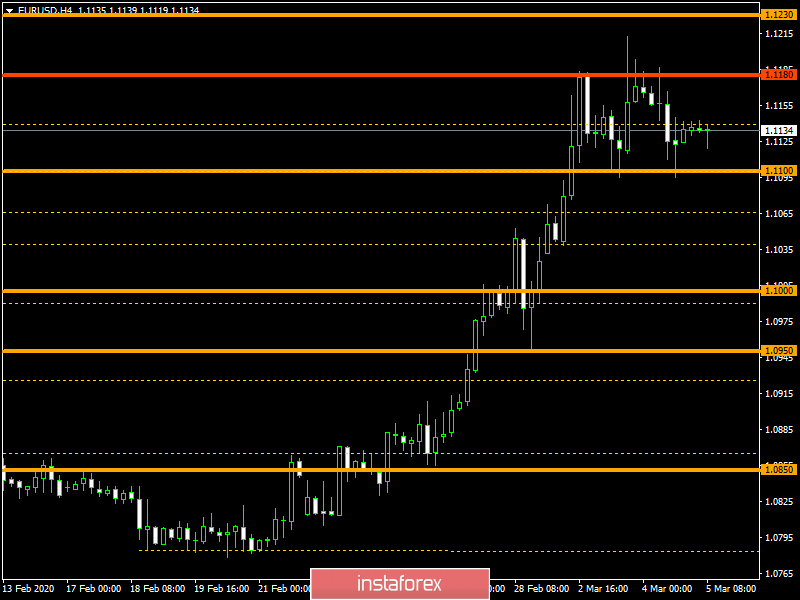

The euro-dollar pair was neither risingr declining for some time. Later, it fell and formed a flat near the levels of 1.1100-1.1180. It is likely to assume that the movement within the established framework continues and overbought remains. However, a corrective move is expected if the price consolidates lower the level of 1.1100.

The GBP/USD pair once again reached the level of 1.2770, forming a corrective move of more than 100 pips. The upward trend is seen as a temporary phenomenon. The price is likely to return to the level of 1.2770 in the coming days.