To open long positions on GBPUSD, you need:

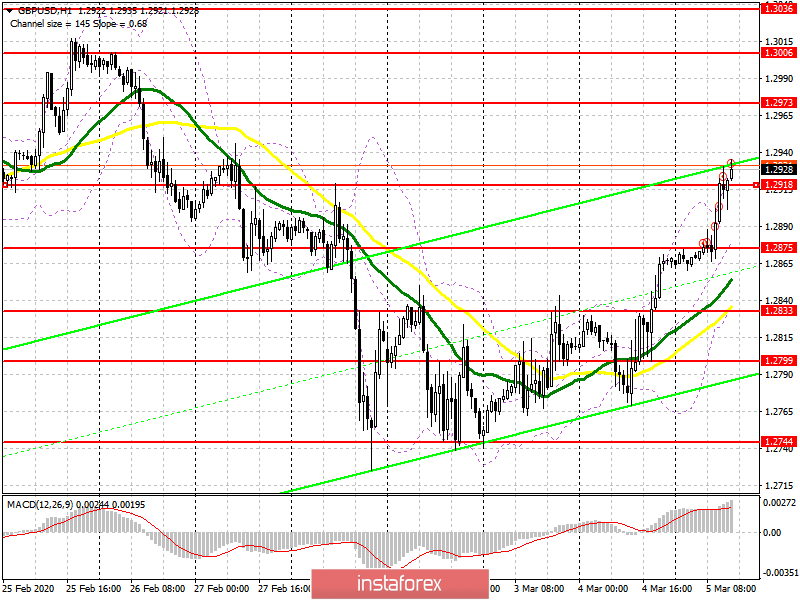

Buyers of the pound climbed above the resistance of 1.2875 today, ignoring the statements of the future Governor of the Bank of England, Andrew Bailey, who will take office on March 16 and replace Mark Carney. Bailey mostly talked about the high probability of interest rate cuts in the near future. At the moment, the pair has hit the resistance of 1.2918 and is still experiencing some problems with continuing growth above this level. Only bad data on the US and today's speech by Mark Carney will allow GBP/USD to strengthen to new highs in the area of 1.2973 and 1.3006, where I recommend taking the profits. In the scenario of the pair's decline in the second half of the day, the area of 1.2875 will be a good level for purchases, but it is best to open long positions from it only after a false breakdown is formed. I recommend making purchases for the rebound only from the minimum of 1.2833.

To open short positions on GBPUSD, you need:

Sellers are still standing on the sidelines and are counting on a reduction in interest rates by the Bank of England or at least on direct statements on this topic by the current Governor, Mark Carney. His presentation today will take place in the second half of the day. It is best to consider short positions after updating the maximum of 1.2973 or sell the pound on a rebound from the resistance of 1.3006. The formation of a false breakdown and consolidation below the area of 1.2918 will quickly push GBP/USD to the support of 1.2875, and in the case of lower interest rates, the pound may return to the lows of 1.2833 and 1.2799, where I recommend fixing the profits. A larger fall in the pair will not occur, since the scenario with monetary policy easing has already been partially taken into account by the market.

Signals of indicators:

Moving averages

Trading is conducted around the 30 and 50 daily averages, which indicates a possible continuation of the pound's growth.

Bollinger Bands

If the pair declines in the second half of the day, the lower border of the indicator around 1.2875 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20