The Bank of Canada followed in the footsteps of the Fed.

Good day!

At yesterday's meeting, the Bank of Canada made changes to its monetary policy and decided to reduce the main interest rate from 1.75% to 1.25%.

Thus, the Canadian regulator followed in the footsteps of the Fed and lowered the main rate by 50 basis points at once. If we recall that the Reserve Bank of Australia (RBA) also lowered the rate, however, by 25 bps, we can conclude that the world's leading central banks have moved to the trend of ultra-soft monetary policy and lower interest rates. The main reason for the decline in borrowing costs is the spread of the coronavirus epidemic almost all over the world.

Fears of the beginning of another financial and economic crisis and the maintenance of their own economy were the reason for taking appropriate measures. At the same time, the Canadian central bank said that if necessary, it is ready to go for further easing of monetary policy.

Just like the Federal Reserve, the Bank of Canada lowered its main interest rate by 50 basis points for the first time since the last global crisis of 2008-2009.

Now let's look at the reaction of the USD/CAD currency pair after the central banks of both neighboring countries made decisions to reduce the rate by 0.50% at once.

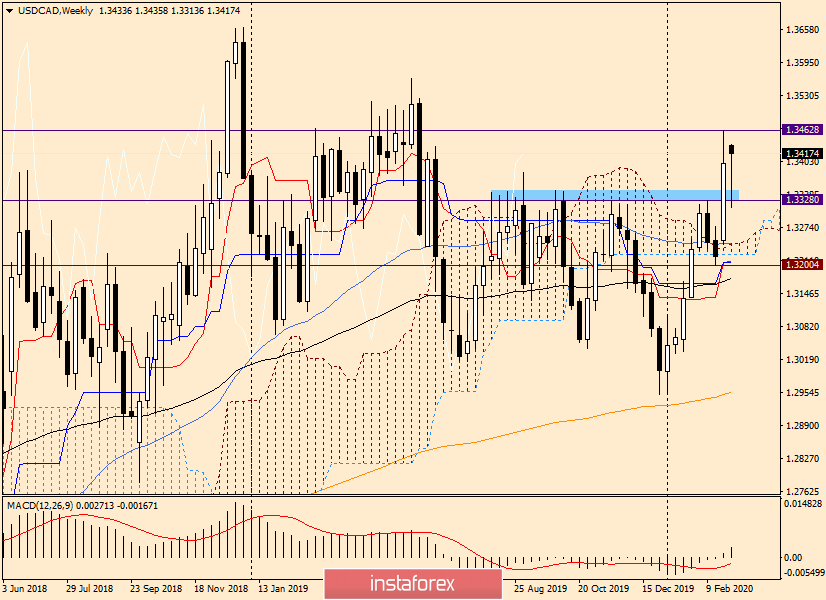

Weekly

Last week, the USD/CAD currency pair strengthened significantly and broke through the difficult resistance zone of 1.3328-1.3381. The maximum trading values of the last five days were shown at 1.3463, and the closing price was 1.3398.

In the course of trading this week, the pair managed to pull back to 1.3313, after which it began to strengthen, and at the moment of writing the review, it rises to the opening price of 1.3433. If the upward movement continues, USD/CAD will re-test the seller's resistance of 1.3463 for a breakdown. If this level is broken, the quote will rise to a significant psychological level of 1.3500, which will determine the pair's future prospects.

Let's see what the situation is on lower timeframes and whether there are interesting points for opening positions.

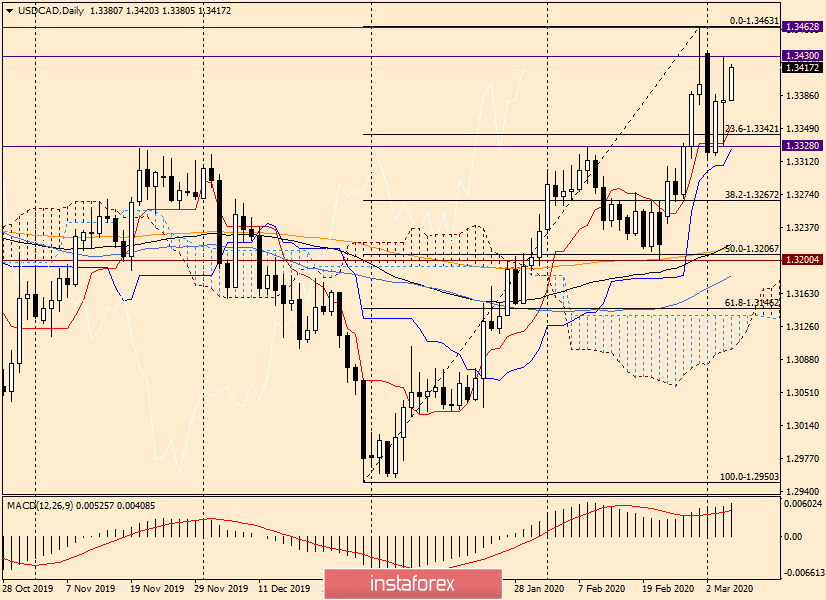

Daily

Yesterday's candle on the daily chart shows the market participants' moods as well as possible after both central banks lowered the main interest rate by 0.50%.

At the end of this article, the pair is strengthening. If growth continues, the nearest target will be yesterday's highs at 1.3430. If this level is broken, the USD/CAD will head to the maximum trading values on February 28 - at 1.3463. Judging by the intensity of the upward trend, the US dollar is in high demand, which is probably due to players' concerns about the continuing growth of the coronavirus epidemic.

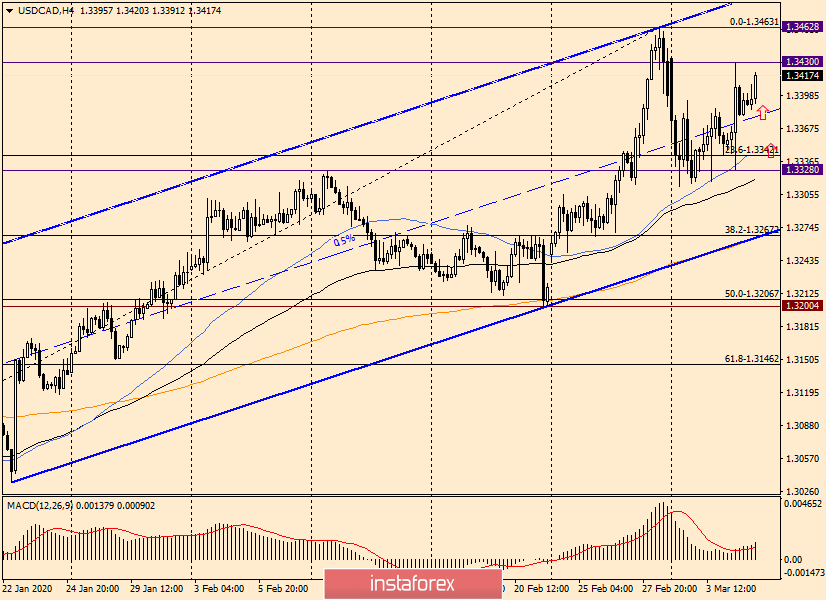

H4

On this timeframe, the pair is trading in an ascending channel, in case of a decrease to the middle line of which you can count on the support and plan purchases.

You should look for more favorable prices for opening long positions when the price drops to the area of 1.3345-1.3320. First, this is a strong technical area. Second, there are 50 MA and 89 EMA, which can support the price to return the pair to growth.

At the moment, it is recommended to plan purchases after rollbacks to the indicated prices. Since the pair is trading near the resistance of 1.3430, I consider it risky to buy here and now, despite the bullish market mood.

Do not forget that tomorrow at 14:30 (London time), data on the US labor market and labor statistics from Canada will be published. Volatility will be high, and price movements will be sharp and strong, possibly in each direction. Be careful and attentive!

Good luck!