Good day!

I decided to show you the euro/pound cross-rate, which is quite a curious picture. But first, let's briefly talk about macroeconomic indicators.

No statistics are expected from Europe today, and reports on the Halifax house price index will be published from the UK at 09:30 (London time). The main event of the day, which will have an impact on all currency pairs of the Forex market, will be data on the US labor market. The publication of American labor reports for the month of February is scheduled for 14:30 (London time).

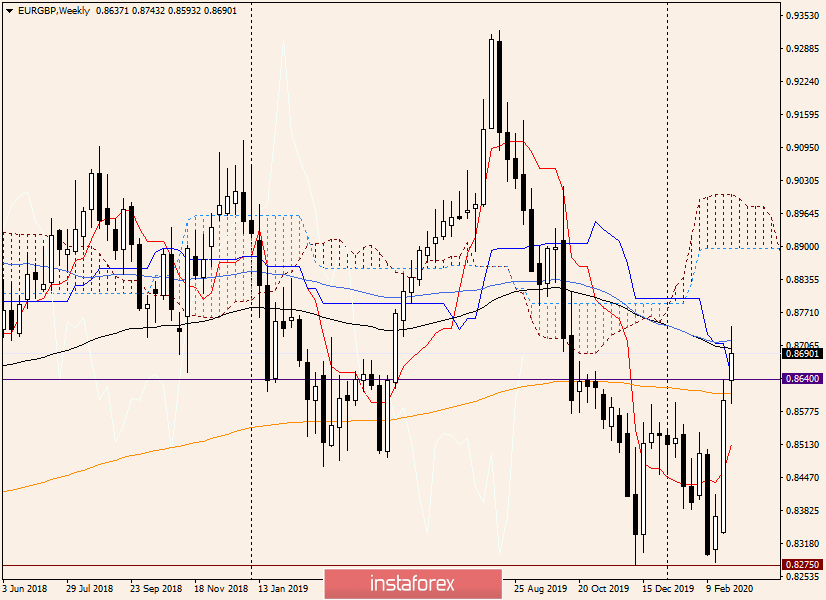

Weekly

Having risen to 0.8743, the euro/pound cross-rate encountered very serious resistance. This was facilitated by the simple and 89 exponential moving averages located slightly below 50, as well as the Kijun line of the Ichimoku indicator.

All the growth gained by the excessive labor of players to increase melts before our eyes. There is a long shadow at the top and the bull's body is rapidly decreasing.

At the moment, the situation is such that a reversal bearish candle may be formed following the results of weekly trading. This will become real if the trades of the current five-day period close below the resistance level of 0.8640. In this scenario, you will have to state a false breakdown of this mark, and this very often leads to a change in the trend.

If the week ends under the 200 exponential moving average, which runs at 0.8612, there will be little doubt about the reversal. However, it is unknown how EUR/GBP will behave after the release of American labor statistics. It is likely that the euro bulls will be able to compensate for the losses incurred from the level of 0.8743. Here, much will depend on the price dynamics of the majors: EUR/USD and GBP/USD.

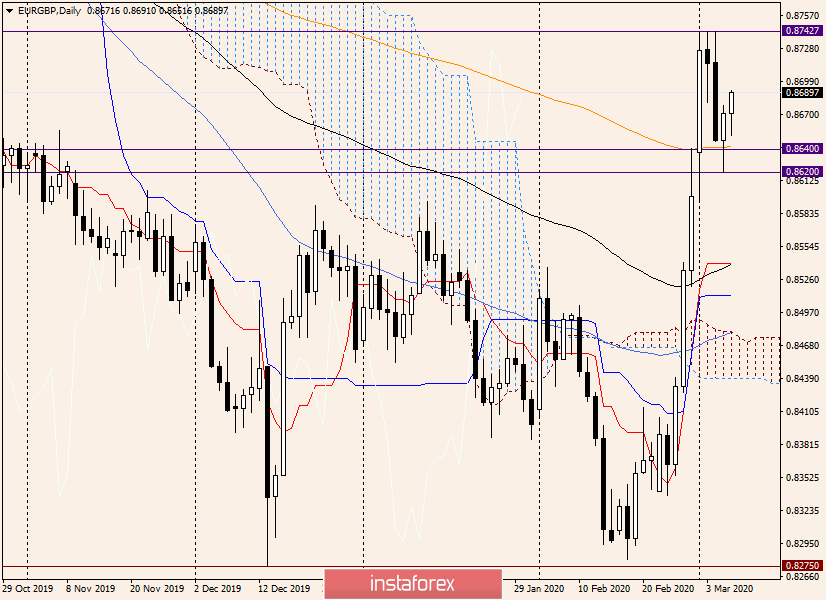

Daily

A bearish candle appeared on the daily chart following the results of trading on February 3, followed by a decrease in the cross to the area of 0.8620. As you can see, the 200 exponential and the breakdown resistance level of 0.8640 are slightly higher, which contributed to the support.

Today's attempts by the bears to resume pressure on the pair were limited to the level of 0.8651, where the pair found support and is recovering. If the pair manages to rise to the opening price of today's trading 0.8671, most likely, the quote will move to positive territory. That is, it will start to grow, forming a bullish body of today's daily candle.

If the support level of 0.8620 breaks, a bearish scenario for further trading on EUR/GBP will be indicated. A breakout means the closing of today's session below 0.8620.

It is unlikely that the bulls on the instrument will be able to raise the quote to the resistance level of 0.8743, although who knows. Nothing is impossible in the market.

In my opinion, closing today and the entire week above the strong and significant technical level of 0.8700 will already be a success for players to increase and a signal to retest the resistance of sellers at 0.8743.

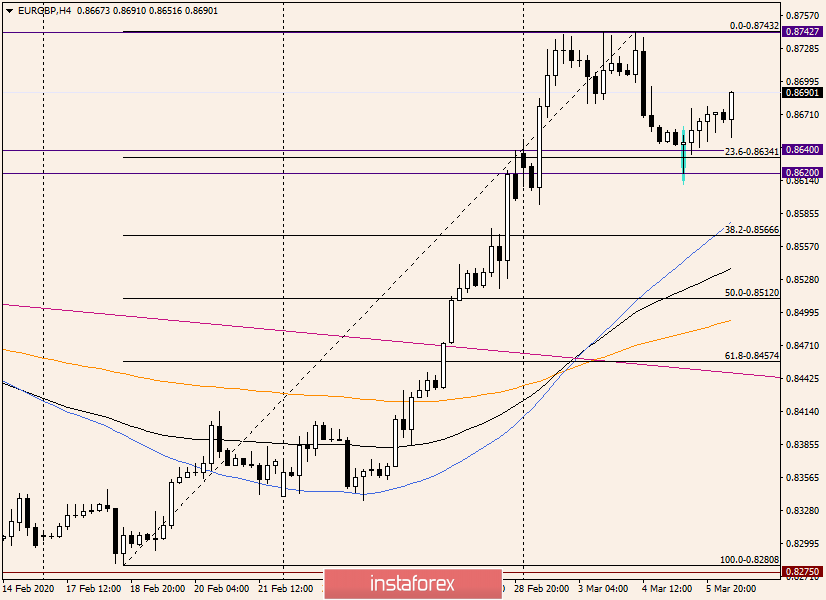

H4

After the bullish candlestick reversal pattern appeared on this chart, the euro/pound shows a tendency to strengthen. At the end of this article, the local resistance breaks through at 0.8677. If above this level it will be possible to gain a foothold, we are waiting for the continuation of the upward dynamics to the nearest targets at 0.8700, 0.8737, and 0.8743. In my opinion, further prospects for the price movement of the euro/pound will depend on the breakdown of the last mark.

Given the current upward trend, the main trading idea for this tool is to make purchases that are better and safer to open after corrective rollbacks to 0.8677 and 0.8666. However, today is not the best day for opening new positions, but it is up to each of you, of course.

Have a nice weekend!