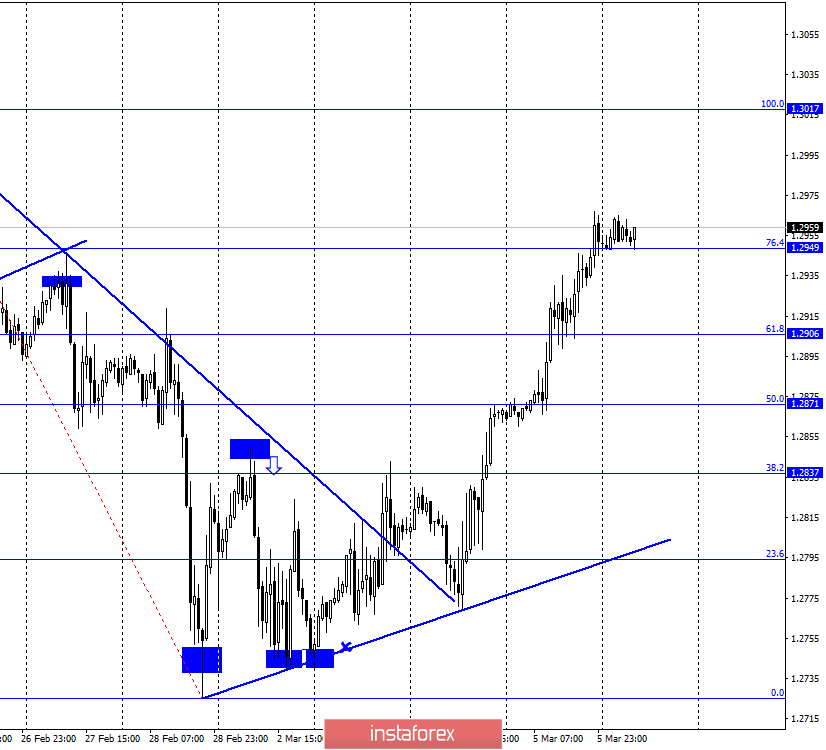

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD pair continues the growth process and performed a consolidation above the corrective level of 76.4% (1.2949). Thus, on March 6, the growth of quotes can be continued in the direction of the next corrective level of 100.0% (1.3017). The new upward trend line continues to maintain the "bullish" mood of traders, however, the pound/dollar pair has moved away from it at a respectful distance. Fixing quotes below the Fibo level of 76.4% will work in favor of the US currency and some fall in the direction of the corrective level of 61.8% (1.2906).

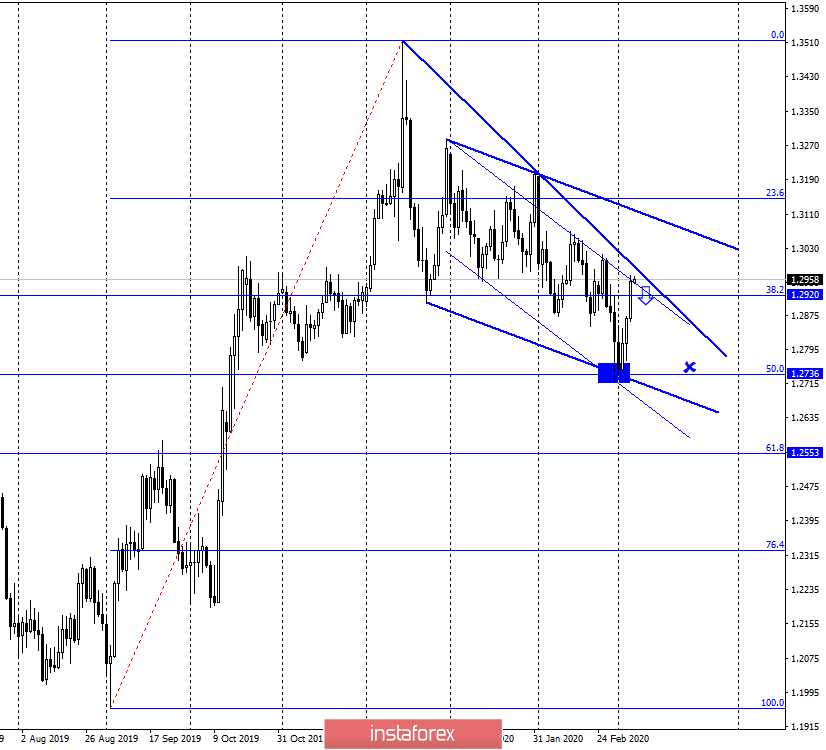

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair closed over the downward trend corridor. Thus, the expected rebound from the upper line of the corridor did not occur, and the mood of traders changed to "bullish". At the same time brewing bearish divergence at the MACD, which allows expecting a reversal in favor of the US dollar and the resumption of fall towards the level low at 1.2641. In general, I would say that the picture now on the lower charts is as ambiguous and confusing as possible. Especially, given the daily chart readings, where three graphical plots at once speak in favor of maintaining a "bearish" mood.

GBP/USD – Daily.

As seen on the daily chart, the graphic picture remains the most interesting. The quotes of the pound/dollar pair performed a consolidation above the corrective level of 38.2% (1.2920). Thus, the chances of continued growth increased. However, two descending trend of the corridor and the descending trend line continue to characterize the market mood as "bearish". Rebound from the upper line of the small trend corridor or trend line may work in favor of the US currency and resume the fall in the direction of the corrective level of 50.0% (1.2736). And in this case, the drop in quotes will resume on the lower charts, and the mood on them will again change to "bearish". Thus, in global terms, bears retain their leadership, so short positions look more attractive now. However, if the quotes close above the trend line, the growth process can continue in the direction of the level of 1.3086 (approximately).

Overview of fundamentals:

On Thursday, March 5, there was no news in the UK, except for information about the completion of the first round of negotiations under the future Brexit agreement. The parties positively noted the atmosphere and results of the negotiations, although they noted that "there is still a lot of work".

The economic calendar for the US and the UK:

USA - unemployment rate (13:30 UTC+00).

USA - change in the number of employees in the non-agricultural sector (Nonfarm Payrolls) (13:30 UTC+00).

USA - change in average hourly earnings (13:30 UTC+00).

On March 6, traders will closely monitor data from America on unemployment, wages and the number of new jobs outside the agricultural sector. No news is expected from the UK.

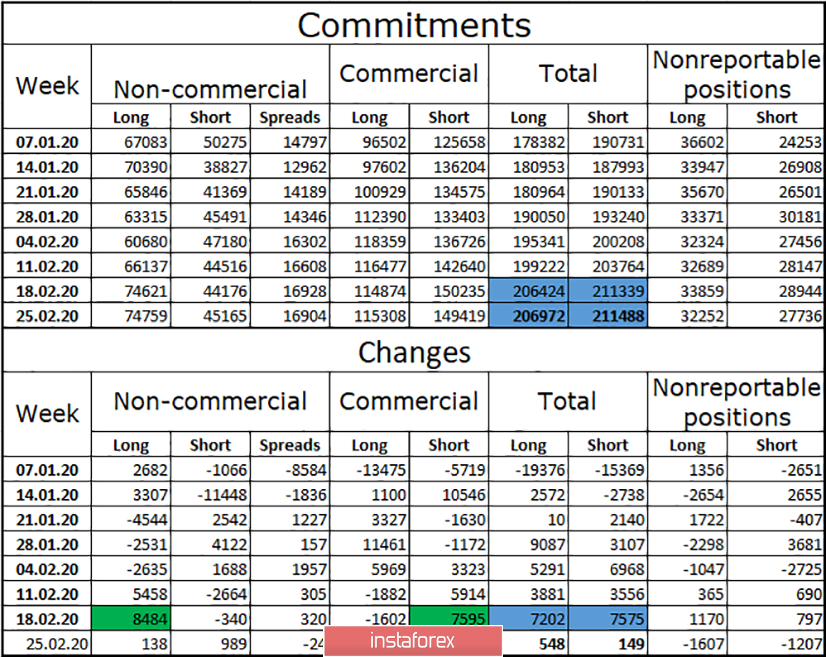

COT survey (Commitments of traders):

The latest report from February 25 shows that equality between major market participants remains. Thus, I still tend to believe that traders should not expect strong exchange rate changes from the GBP/USD pair at this time. Most likely, the auction will continue to be held in the style of "150 points up-200 down-250 up". Today, a new COT report is released, and the main intrigue is whether one or more groups will have a serious increase in long or short positions. The last report showed in principle the minimum changes for the week. Neither hedgers nor speculators had an advantage.

Forecast for GBP/USD and recommendations for traders:

The main trading idea is now waiting for the rebound from the trend line and the upper line of the small corridor on the daily chart. These rebounds will allow you to count on a slight drop in the pair in the direction of 1.2736 and allow traders to sell.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but for current operations or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.