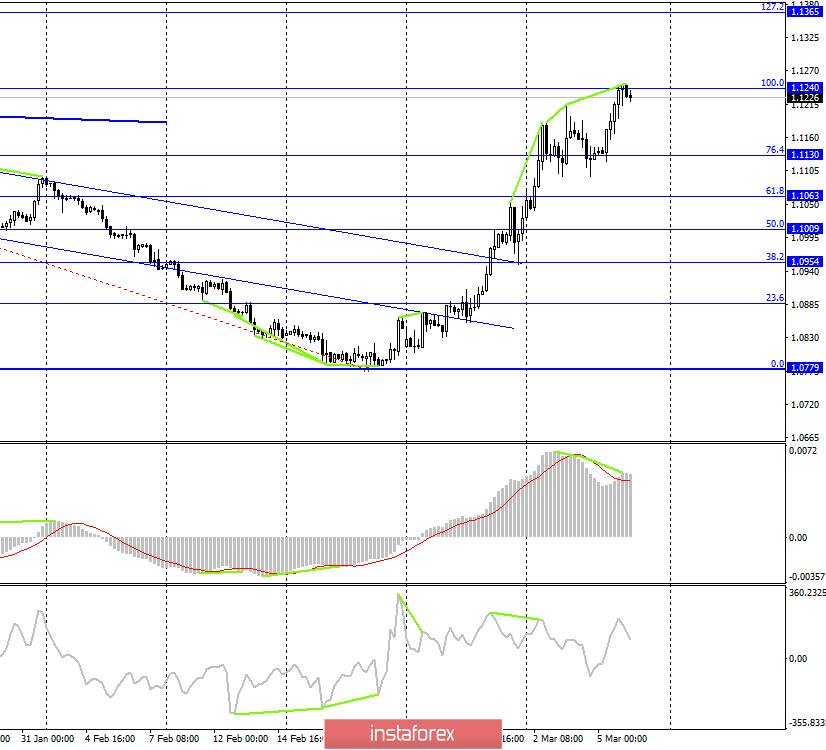

EUR/USD – 1H.

Hello, traders! The EUR/USD pair continues the growth process on the hourly chart. After performing a fall to the upward trend line, the pair's quotes performed a reversal in favor of the European currency and resumed growth. The second trend line continues to define the current mood of traders as "bullish". Closing the pair's rate below this line will work in favor of the US currency and some fall in the direction of the first upward trend line.

EUR/USD – 4H.

As seen on the 4-hour chart, quotes of the euro/dollar pair performed a reversal in favor of the euro after a release from the corrective level of 76.4% (1.1130) and renewed growth process, having worked out the Fibo level of 100.0% (1.1240) by the end of the day. The bearish divergence of the MACD indicator (the third in a row) again warns of a reversal of the pair in favor of the US dollar and some drop in quotes towards the level of 76.4%. Rebound of the pair from the level of 100.0% will similarly work in favor of the beginning of the fall. Closing the pair above the 100.0% Fibo level and passing the divergence peak will significantly increase the probability of continuing growth towards the next corrective level of 127.2% (1.1365).

EUR/USD – Daily.

As seen on the daily chart, the euro/dollar pair performed a consolidation over the downward trend corridor. Thus, the global mood of traders has changed to "bullish". In the long term, we can now expect growth, and in this case, the daily and weekly charts are the same. However, on the hourly and 4-hour charts, sales signals may be formed in the near future, which also does not contradict the general picture of things, since traders need to start correcting the pair.

EUR/USD – Weekly.

The weekly chart indicates that the potential for growth of the European currency is available, and quite strong, up to about the level of 1.1600. However, this is a weekly chart, meaning that goals can be worked on for months. The lower charts are in favor of a pullback of quotes down, after which it is quite possible to resume a more global growth of the euro.

Overview of fundamentals:

On March 5, one economic report was released in the US - changes in production orders, which showed a decrease of 0.5% in January. Thus, although traders had no particular reason to increase demand for the dollar, further strong growth of the euro was also not expected. Nevertheless, the pair continued to grow, despite the almost empty calendar.

News calendar for the United States and the European Union:

USA - unemployment rate (13:30 UTC+00).

USA - change in the number of employees in the non-agricultural sector (Nonfarm Payrolls) (13:30 UTC+00).

USA - change in average hourly earnings (13:30 UTC+00).

Today, all the news will come from America. The most interesting report will be Nonfarm Payrolls, which predicts new jobs of 175,000. Thus, this report in the second half of the day will be the "engine" of the pair's growth or fall.

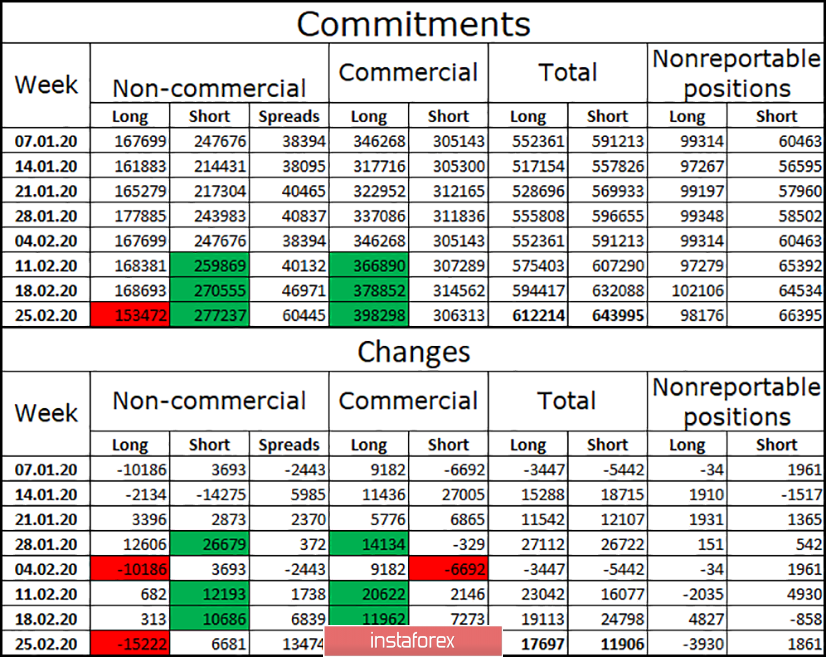

COT survey (Commitments of traders):

The latest COT report for the week of February 25 showed that long positions are being built up by major market players. At the same time, speculators prefer to get rid of long positions and hedgers – on the contrary, to increase them. I still conclude that the downward trend is complete. Thus, in the future, we can expect growth to 1.1600, as the weekly chart predicts. A new COT report will be released today, in which we are likely to see a new increase in long positions. At the same time, this report, combined with the background information, can help determine when to expect a correction.

Forecast for EUR/USD and recommendations for traders:

In this situation, even taking into account the closing of quotes above the descending corridor on the daily chart, I recommend considering closing long positions and not considering new purchases. From my point of view, this is dangerous. At the same time, the mood of traders is already "bullish", and any sales will be "against the trend". However, closing below the trend line on the hourly chart and rebounding from the level of 100.0% (1.1240) with a bearish divergence on the 4-hour chart will allow traders to expect some fall and work out these signals for sales.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but for current operations or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.