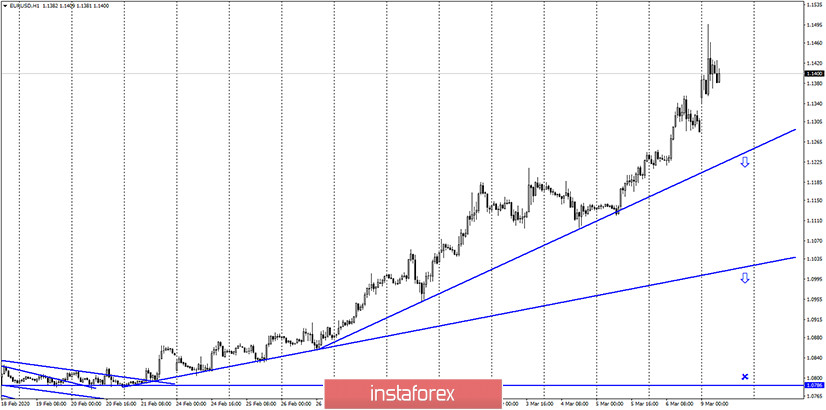

EUR/USD – 1H.

Hello, traders! The EUR/USD pair continues the growth process on the hourly chart. The last rebound of quotes from the second upward trend line worked again in favor of the EU currency. All goals are determined on the higher charts. Thus, on the hourly chart, I simply state that a strong "bullish" mood persists. The COT report, which will be discussed below, confirms a sharp change in priorities among major market players.

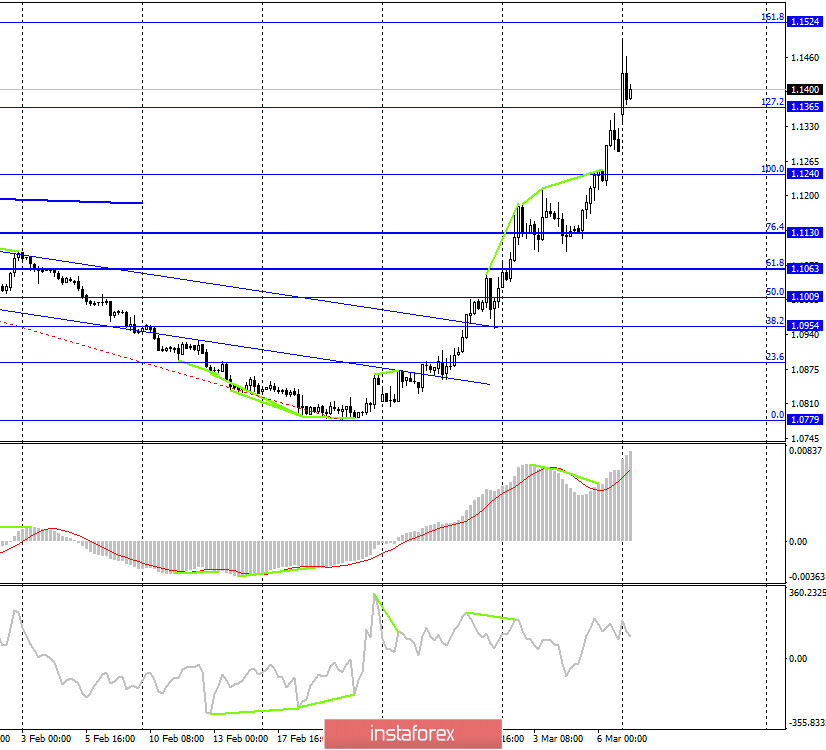

EUR/USD – 4H.

According to the 4-hour chart, the euro/dollar pair continued to rise on Friday, despite three bearish divergences formed earlier. At the moment, the pair has been closing above the resistance levels to 127.2% (1.1365). Thus, the growth process can be continued today in the direction of the next corrective level of 161.8% (1.1524). There are no new emerging divergences in any indicator today. But in any case, they are not currently working in favor of the US currency. The rebound of quotes from the Fibo level of 161.8% will again give the chances of a reversal in favor of the dollar and some fall.

EUR/USD – Daily.

As seen on the daily chart, the euro/dollar pair performed a consolidation over the downward trend corridor. Thus, the growth continues on the older charts and has no obstacles in its way. The global mood of traders has changed to "bullish", but how long will it remain so unambiguous that even there is no correction?

EUR/USD – Weekly.

The weekly chart indicates that the European currency has the potential for growth and is limited to the level of 1.1600 (approximately) or the upper line of the tapering triangle. I said earlier that it can take several weeks to several months to reach the target of 1.1600. In practice, traders have already worked out this level. This is the specifics of the market at this time. The activity of traders is very high, which allows the pair to move very quickly.

Overview of fundamentals:

On March 6, the most interesting news came out in America. And no help was given to the US dollar. Although they were very strong and any trader could count on the strong growth of the dollar at any other time. The unemployment rate in February fell to the lowest level in 50 years - 3.5%. The change in the number of people employed in the non-agricultural sector was 273,000, and wages increased by 3%. Traders' expectations were much more modest, but the US currency still continued to fall.

News calendar for the United States and the European Union:

Germany - change in industrial output (07:00 UTC+00).

Today, the only report of the day is industrial production in Germany. However, in principle, it is easy to predict that traders will not pay any attention to it. The week and day have just started, and the pair has already increased by 140 points, decreased by 120 and again increased by 70. In such circumstances, traders clearly do not need economic reports to conduct active trading.

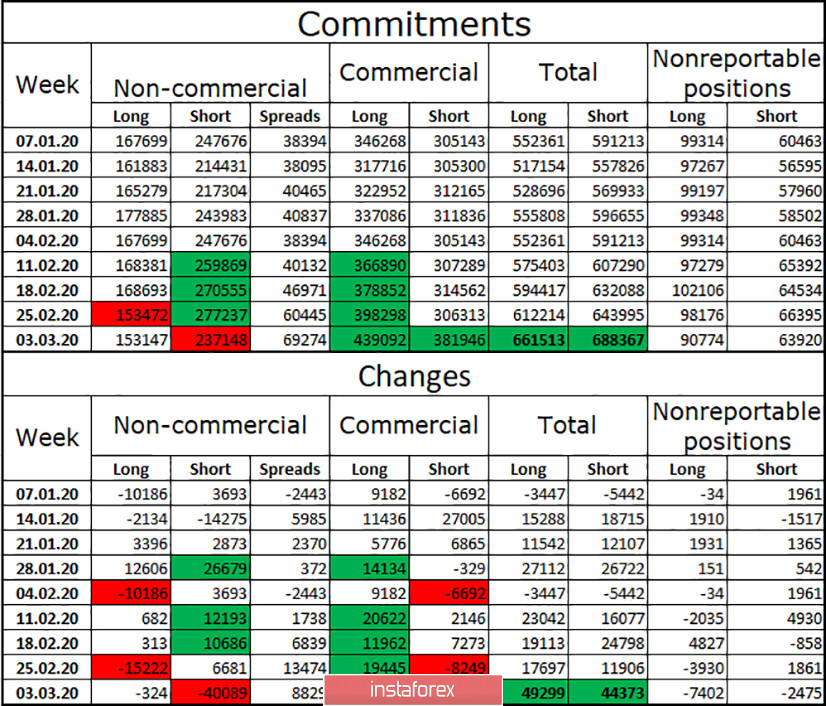

COT survey (Commitments of traders):

A new report by Commitments of traders for the week of March 3 showed a sharp reduction in the number of short positions among the "Non-commercial" group. Second, a sharp increase in both long and short positions among the "Commercial" group. Third, the total number of both long and short positions has increased significantly. This suggests that market activity has increased significantly in the last week, the total number of purchases from major players has increased, and hedgers are now insured against future growth of the euro and its fall. The "Changes" part of the table shows even better that the number of sales contracts among speculators has decreased by 40,000. But the number of short among hedgers has increased by 80,000. Thus, I conclude that the high activity of traders of all calibers will remain for the time being. At the same time, the euro may well continue to grow. Graphic factors remain very important.

Forecast for EUR/USD and recommendations for traders:

The overall picture of the EUR/USD pair remains unchanged. Purchases are still dangerous, although the growth of quotes is very strong. Thus, traders must decide for themselves whether they want to buy the euro, perhaps at the very end of the movement? At the same time, any sales remain counter-trend, so they are also dangerous. So I think the best option now is to stay out of the market. None of the sales signals were worked out in the last week. Only bull traders who are already in purchases can continue to keep them open with a target of 1.1524.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but for current operations or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.