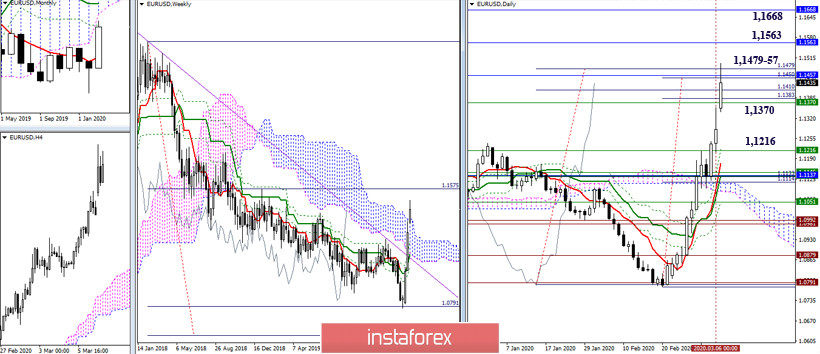

EUR / USD

Today is just the case when the conversation about upward prospects, postponed from Friday to Monday, was a bit late in time, because the nearest benchmarks have turned so far from perspectives into reality. Today, the players to increase fulfilled two daily goals at once - the target for the breakdown of the Ichimoku cloud (1.1450) and the target for the breakdown of the Chinkou line price chart (1.1479), and also tested the resistance of the upper boundary of the weekly cloud and the monthly Fibo Kijun (1.1457). As a result, the strength of the resistance encountered can contribute to the slowdown in the near future. Nevertheless, you can pre-identify the following upward benchmarks given the current activity and the effectiveness of the players to increase.

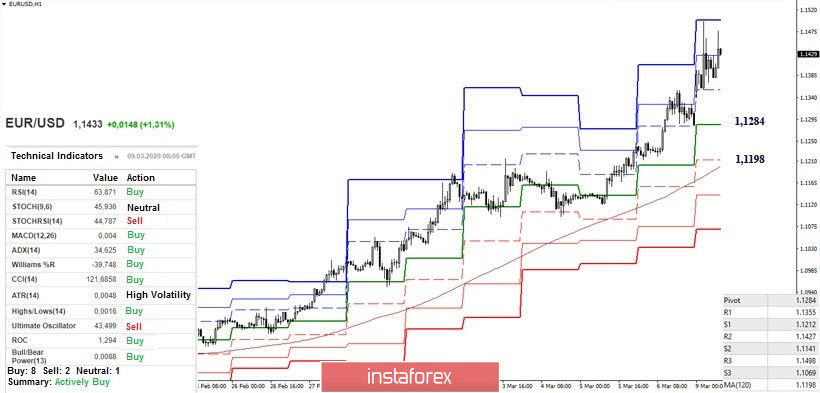

At the moment, the players are actively dominating the market for an increase, which already rose to the maximum resistance of the classic Pivot levels for the current day (1.1498) in the first hours, after the opening of new working days and weeks. At present, we observe correction and braking in the lower halves. Today's support can be noted at 1.1355 (R1) - 1.1284 (central Pivot level) - 1.1212-1.1198 (weekly long-term trend + S1).

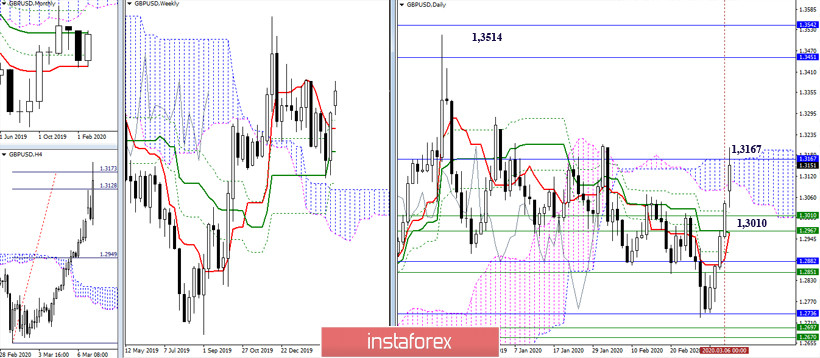

GBP / USD

Having formed a successful rebound from the met support (1.2736), the players to increase by the current moment not only returned to the area of the previous consolidation, but also attempted to actively break its upper boundaries. The upper boundaries still combine the daily cloud (1.3168) and the monthly Kijun (1.3167). Overcoming the encountered resistance will form a new upward target for the breakdown of the daily Ichimoku cloud. In addition, the result of interaction with the monthly levels in the area of 1.3451-1.3542 (Fibo Kijun + the lower boundary of the cloud), as well as consolidation above the maximum (1.3514), will be important for further bullish conquests. Now, support can be noted at 1.3105 (the lower boundary of the daily cloud) and 1.2967-1.30010 (daily cross + weekly levels).

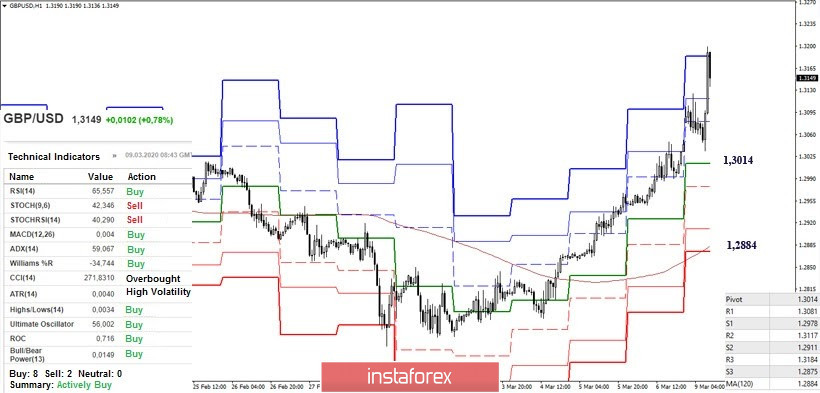

At the moment, the resistance R3 of the classic Pivot levels (1.3184) in the lower halves is being tested. When overcoming the benchmark, it is better to follow the trend, since R3 is the maximum line offered by the Pivot levels for the current day. The following benchmarks will be formed tomorrow. Among the most important supports, the central Pivot level (1.3014) and the weekly long-term trend (1.2884), 1.3117 (R2) - 1.3081 (R1) - 1.2978 (S1 ) - 1.2911 (S2) should be noted today.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)