The euro fell against the dollar yesterday, after the data on Eurozone's GDP was released. Moreover, the significant changes that may happen in the monetary policy at the upcoming ECB meeting added to the situation as well.

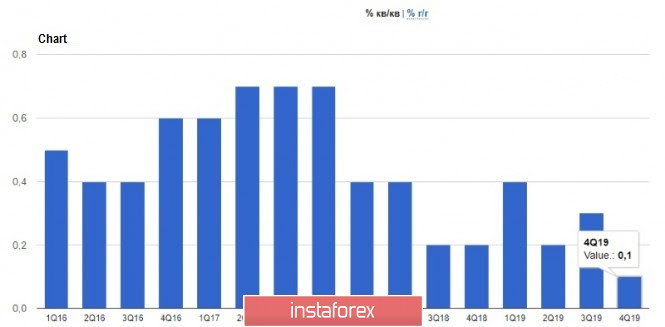

Yesterday's report showed that the Eurozone's GDP grew by only 0.1% in the 4th quarter of 2019, which, by the way, is the slowest growth rate it recorded in the recent years. The data did not even take into account the serious spread of the coronavirus. Exports is the only one that increased, although just slightly, while the trade and domestic demand slowed.

Meanwhile, we can expect a decline in the Eurozone economy in the 1st quarter of this year

Italy has already introduced a quarantine across the country, which will last until April 3 of this year. It will likely lead to an economic downturn, as GDP is expected to decline in the 1st and 2nd quarters of this year. For 2020 as a whole, GDP may decline by 2%. If the quarantine lasts even longer, a larger drop in the economy (up to 4.5%) may happen.

While traders are waiting for the ECB's decision regarding the economic assistance program and changes in the monetary policy, US President Donald Trump once again called on the Federal Reserve to lower rates up to the levels of competing countries, primarily focusing on the Eurozone, where rates are at zero, saying that the Fed should be a leader, not a lagging follower.

Meanwhile, the reports on retail sales from Redbook and The Retail Economist were ignored by the market, even though it indicated a decrease of 0.1% in the first week of March, if compared to February. If compared to the same period in 2019, they increased by 6.0%. On year-on-year, US retail sales for the week of March 1 to March 7 increased by 6.0%.

US retail sales index, on the other hand, as reported by The Retail Economist and Goldman Sachs, remained unchanged for the week of March 1 to 7. For year-on-year, it grew by 0.9%.

In general, the measures that the ECB may take tomorrow may put pressure on the euro. Many experts expect that the regulator will expand the asset purchase program, but maintain the key interest rate. Only the deposit rate will be reduced by 10 bps. The asset repurchase program may be doubled, from 20 billion euros per month to 40 billion euros, and the terms of the targeted longer-term refinancing operations (TLTRO) may also be significantly relaxed.

As for the current technical picture of the EUR/USD pair, the upward correction observed since the beginning of the Asian session may be limited to the resistance level of 1.1390, while support is seen in the area of 1.1280. If the pair does not break the level of 1.1390, an upper limit will form in the downward channel, which will maintain the pressure on risky assets before tomorrow's ECB meeting. Because of this, I do not expect any serious strengthening from the euro, as growth can only resume if there is news of a more serious spread of the coronavirus in the United States.

GBP/USD

The pound lost all its positions against the dollar, after the report that the UK Treasury may seriously reconsider its plans to increase investment, which will lead to a review of the state budget. This is due to the measures that will be used to contain the effects of the coronavirus, which includes the protection of the economy and the bond market. However, a change in fiscal policy alone is not enough to stop the economy from falling in the long run. More coordinated measures are certainly needed, along with the Central Bank, which may resort to changes in the monetary policy.

As for the technical picture of the GBP/USD pair, large support levels are seen in the area of 1.2870 and 1.2800. The resistance levels for the upward correction are 1.2950 and 1.3000.