EUR/USD bears made another attempt to storm the 12th figure late last night, against the background of the overall recovery of the dollar. Meanwhile, sellers reached a local low of 1.1275, but they failed to gain a foothold in the area. During the Asian session on Wednesday, the pair returned to the 13th figure, demonstrating the vulnerability of the dollar.

The corrective pullback of EUR/USD began after Trump promised to stimulate the US economy, which began to feel the negative consequences of the coronavirus. According to him, the White House is preparing a package of stimulus measures, which will particularly affect the income tax and the loans for small businesses. As a result, the dollar rose, as the currency's bulls perceived this initiative positively. However, further developments have made it doubtful that the stated measures will be taken in full or will be taken in principle, because as it turns out, the Republican congressmen and the White House see different scenarios in stimulating the national economy.

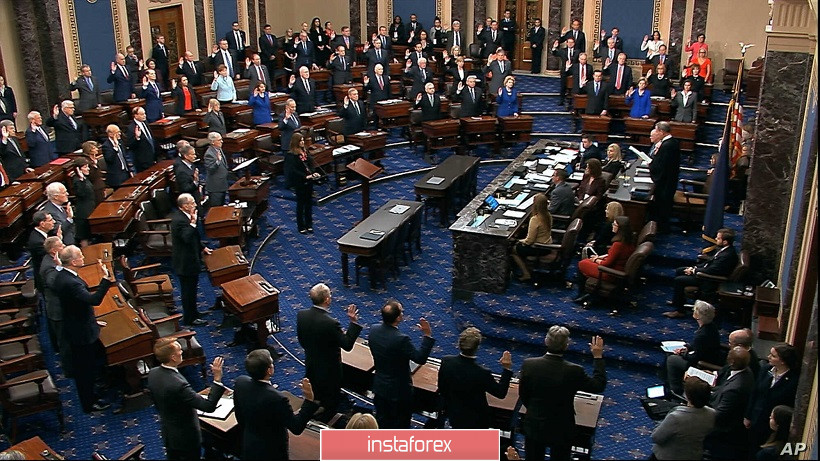

According to The Washington Post, yesterday, Trump told Republican senators that he wants to either sharply reduce the payroll tax permanently, or cancel it at least until the end of the year. However, the members of the Senate were skeptical of the idea. The Democrats took it "with hostility", while some have accused Trump of using such proposals to earn "political points" for the presidential election that will be held in November.

Nevertheless, none of the senators deny the fact that the coronavirus has a negative impact on the country's economy, so some measures still need to be taken. One possible action is granting paid sick leave to those Americans who are forced out of work due to quarantine or other circumstances related to the spread of COVID-19. Democrats have supported this initiative yesterday. Meanwhile, House Speaker Nancy Pelosi and Senate minority leader Chuck Schumer told reporters that any tax relief should only be taken against those who have somehow suffered from the virus.

In any case, the parties have not reached a compromise yet, as according to The Wall Street Journal, Donald Trump's advisers continue to insist on the abolition of the payroll tax – if not before the end of the year, then at least for the next three months. The White House also insists on providing state assistance to the companies in the tourism industry, as well as to oil and gas companies who have been affected by the recent events in the oil market. Administration officials also plan to delay the deadline for filling out tax returns (as of now, the deadline is on April 15).

According to Trump's opponents, the proposed initiatives are too extravagant, as according to preliminary calculations, the abolition of the payroll tax will reduce the level of tax revenues by $ 400 billion. Tax cuts will obviously be covered by an increase in the budget deficit (by about 40%), which has already reached a historic high and exceeded a trillion dollars. As a result, the Democrats proposed to adopt a targeted program that will provide targeted assistance.

Because of the obvious disagreement between the Congress and Trump's administration, the dollar has gone under pressure, turning around once again and falling to the 95th figure. In addition. the yield of 10-year treasuries also started to fall (now, this indicator is at the level of 0.657%).

Meanwhile, the coronavirus continues to spread. To date, 118,745 cases of infection have been registered, including 4,284 deaths. More than a thousand people have contracted the virus in the United States, and among the countries of the European Union, the most cases of COVID-19 infection were registered in Italy – 10,149. The next countries with high number of cases are France, Spain and Germany.

All in all, the virus has already been identified in more than 100 countries around the world.

This further increase in coronavirus cases puts strong pressure on risk currencies. At the same time, the dollar was also under pressure, due to the disappointment of traders regarding the proposed stimulus measures (which are still subject to political controversy). Moreover, the market has once again increased the Fed's likelihood of easing the monetary policy (a decrease of 50 or 75 points at the meeting on March).

Nevertheless, it is worth noting that as soon as the American politicians finalize the economic stimulus program, the dollar will once again receive some support. However, even in this case, short positions on the EUR/USD pair will still look risky, since the US currency will remain vulnerable in the medium term and long term (primarily against the background of the euro). The goal of the upward movement remains the 1.1450 mark, which is the upper line of the Bollinger Bands indicator on the daily chart. Meanwhile, the nearest support level is at 1.1220, which is the Tenkan-sen line on the same timeframe.