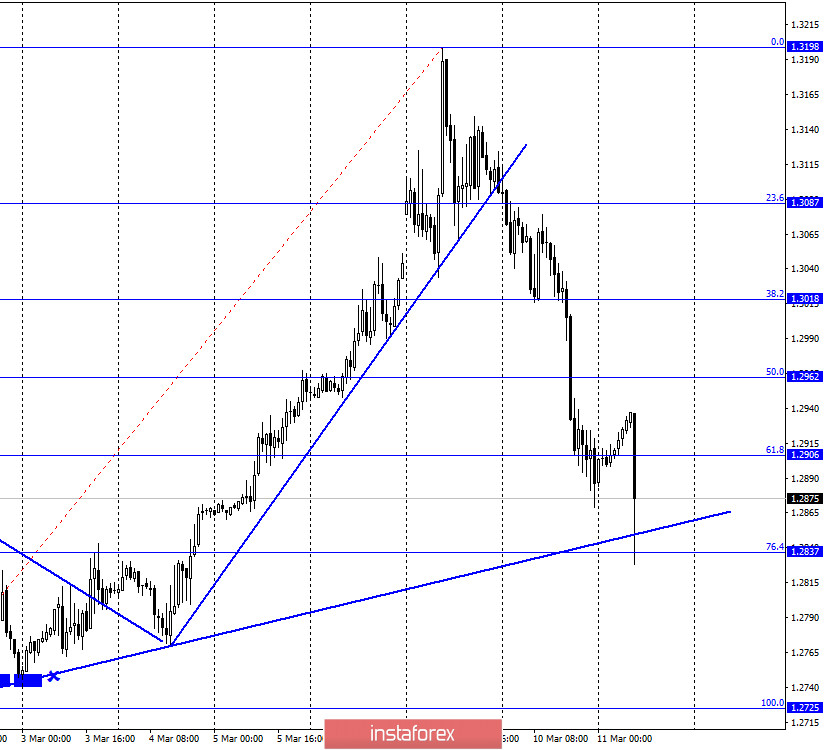

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the GBP/USD quotes performed a fall to the corrective level of 61.8% (1.2906), and this morning the uncontrolled fall of the pound resumed and the pair performed a fall to the Fibo level of 76.4% (1.2837) in 15 minutes. Thus, all three goals for the sales signal that I announced yesterday have been fulfilled. Now the question: what awaits the British in the future? As we all see, there are no signs of a decrease in the activity of traders. Thus, we can conclude that the panic in the markets remains, which is fraught with new strong movements of the pair's rate in any direction.

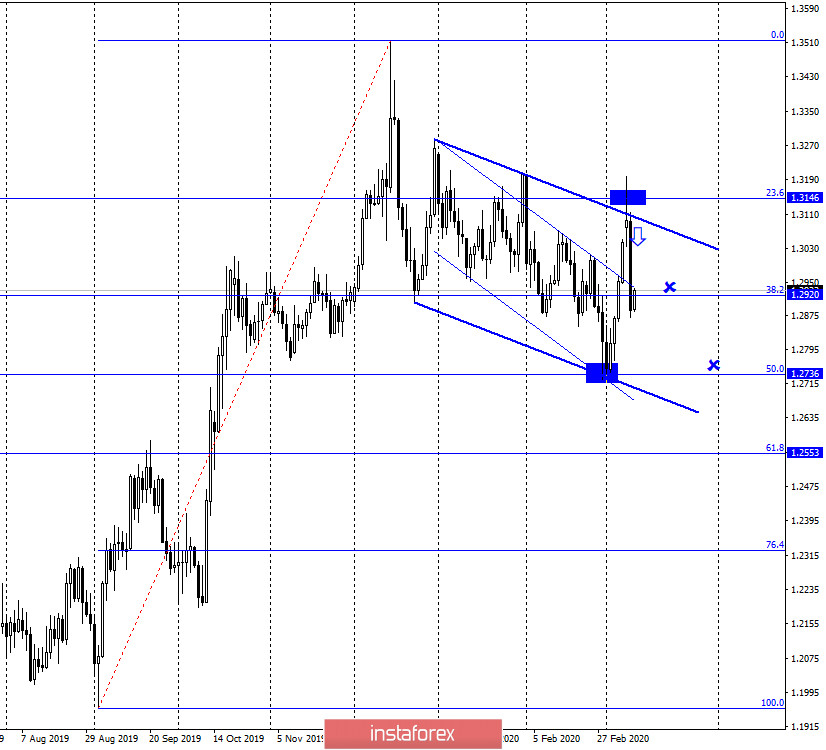

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair also performed a strong fall. First to the corrective level of 38.2% (1.2909) and then to the level of 23.6% (1.2840). The rebound of the pair's quotes from the latter may work in favor of the British currency and resume growth in the direction of the Fibo levels of 76.4% (1.3094) and 100.0% (1.3207). However, I once again remind traders that it is quite risky to work both ways now. Today, the pair's quotes began to collapse in the morning, although there was no real news on the currency market. For example, the euro currency is trading quite calmly. But these are the current realities of the Forex market. The coronavirus continues to strike fear into all large, medium and small investors and traders.

GBP/USD – Daily.

According to the daily chart, the graphic picture remains the most interesting. After rebounding quotes from the Fibo level of 23.6% (1.3146), as well as the upper line of the downward trend corridor, the pound/dollar pair performed a reversal in favor of the US dollar and fell to the corrective level of 38.2% (1.2920). Thus, another target level, which I mentioned yesterday, has been fulfilled. Today, based on this chart and the graphic picture formed on it, I expect the fall to continue in the direction of the second goal – the corrective level of 50.0% (1.2736). The Briton is quite capable of working it out today.

Overview of fundamentals:

On Tuesday, March 10, there was not a single report or news that deserves the attention of traders.

The economic calendar for the US and the UK:

UK - change in GDP (09:30 UTC+00).

UK - change in industrial production (09:30 UTC+00).

USA - consumer price index (12:30 UTC+00).

USA - consumer price index excluding food and energy prices (12:30 UTC+00).

On March 11, important economic reports will be released in both Britain and the US. Unfortunately, traders still do not show any desire to trade in accordance with the information background. In addition, no reports were released in both countries during the first two days of the week. Thus, traders may not pay attention to these reports but may work them out with a vengeance.

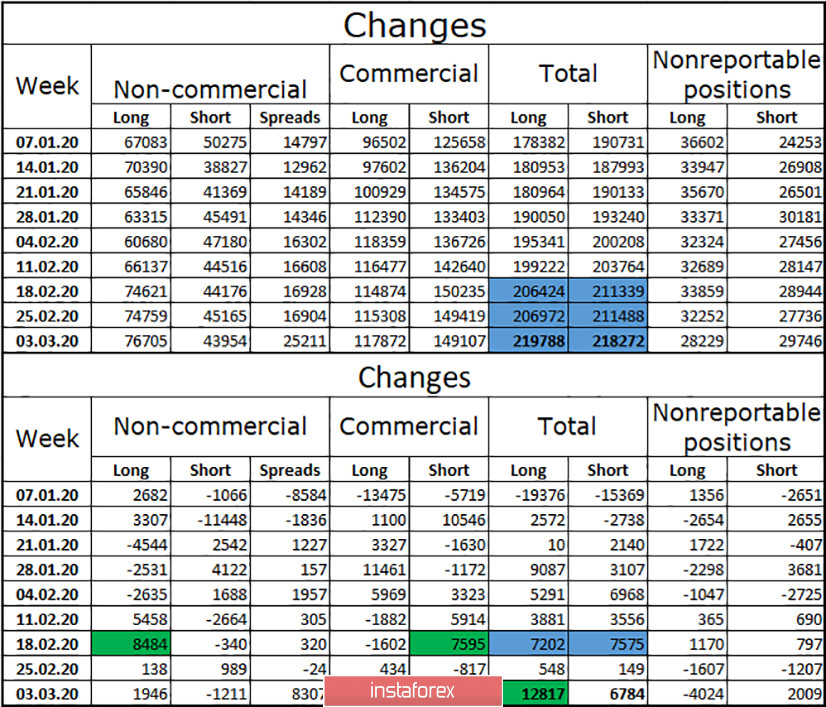

COT report (Commitments of traders):

The new COT report for the week of March 3 showed the same lack of changes between the total volumes of Short positions and Long positions. Thus, nothing has changed compared to the previous report. The markets now remain in a state of panic, so the overall numbers of all contracts for all groups of major players may already be very different from those presented in the report. Nevertheless, the almost complete equality of Short and Long positions suggests that neither bears nor bulls currently have an advantage.

Forecast for GBP/USD and recommendations for traders:

I believe that in the current conditions, opening any deals is associated with high risks, since the market remains in a state of panic and can move in any direction with renewed vigor. However, on the daily chart, there is a strong signal for sales with targets of 1.2920 and 1.2736, the first of which has already been worked out. At the same time, the trend line on the hourly chart can protect the British from further decline.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but for current operations or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.