The scale of yesterday's loss of the single European currency and the pound, to say the least, is impressive especially the pound. The decline itself, both of the single European currency and the pound, is due to the simple fact of the restoration of American stock indices, which descend very much before that, especially against the backdrop of the panic in the oil market. In addition, the growth of the dollar was enhanced by its primary oversold, caused by its largely unjustified weakening over the previous days. However, correction and recovery of markets were inevitable, but still, the speed and scale of the rebound are impressive. The truth here was not without the coronavirus, which is already starting to scare even children. We can say that it was the coronavirus that buried the pound yesterday. After all, the reports that the Deputy Minister of Health of Great Britain turned out to be among the infected clearly contribute to the idea that that the money should be hidden away from Misty Albion. To be honest, reports from Italy, which is already almost all ready to put in quarantine, are also not encouraging.

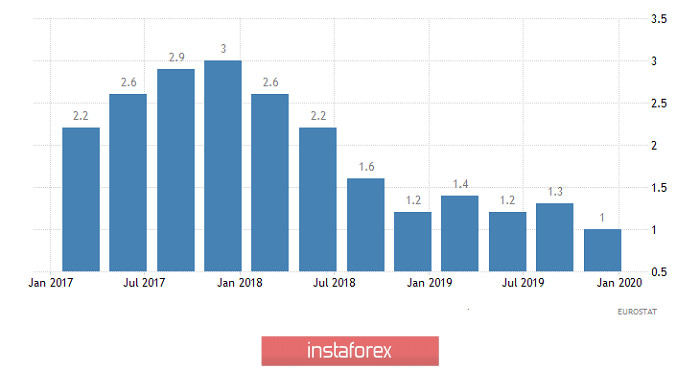

At the same time, it must be recognized that European statistics were more positive in nature, and with other conditions remaining the same, it could more likely help even strengthen the single European currency. But the general background in the market clearly did not favor this. The most important news can be considered the latest estimate of the GDP of the euro area for the fourth quarter, which showed a slowdown in economic growth from 1.2% to 1.0%. The good thing about this news is that the two previous estimates spoke of a slowdown to 0.9%. So, although we have to talk about a slowdown in economic growth, it's still not the same as it was supposed a couple of days ago. In addition, the decline in industrial production in France slowed down from -3.0% to -2.8%. In Italy, in general, the decline in industrial production slowed down from -4.4% to -0.1%, but general happiness was prevented by the announcement of quarantine throughout the country. It is also noteworthy that in Spain, the yield on 3-month government bills increased from -0.503% to -0.462%. And yes, we are still talking about negative returns, but for a long time, the dynamics were purely opposite, and the yield only decreased. So the positive symptoms start to show but at least hope isn't dead yet.

GDP growth rate (Europe):

On the other hand, the yield on 10-year bonds of the UK government declined from 0.512% to 0.307%, which is rather a reflection of the negative factors that were discussed at the very beginning.

Another thing is that a similar trend can be seen in American debt securities. In particular, the yield on 3-year US bonds declined from 1.394% to 0.563%. In this case, this is a combination of two factors at once. First, markets are waiting for the Federal Reserve to cut another refinancing rate. Secondly, amid what is happening in Europe and Asia, capital is actively flowing into the United States, and some of these funds are in the debt market, increasing demand for government securities. Thus, this only explains such a rapid decline in government debt yields.

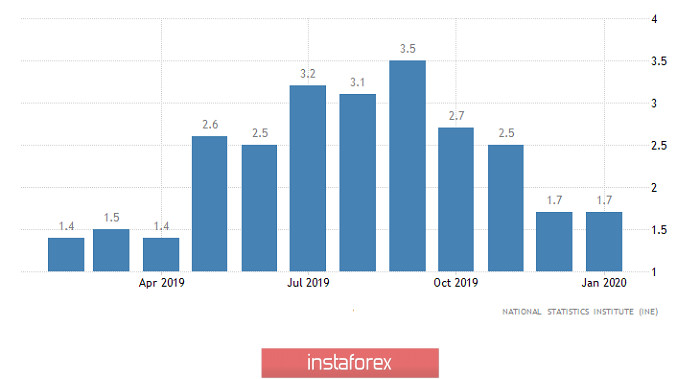

The scale of yesterday's strengthening of the dollar led to the opposite situation, and the dollar is now not oversold, but overbought, and we are now seeing uncertain attempts to reverse the rebound. And for the single European currency, this happens against the background of the constant growth in retail sales in Spain, which is rather negative news, as growth rates were forecast to accelerate from 1.7% to 2.0%. In Italy, they expect a slowdown in the decline in producer prices from -2.1% to -1.8%. The data is not so significant, so they can not have a serious impact on the market which is in contrast to the ongoing news about the coronavirus. Nevertheless, the single European currency is much more waiting for today's inflation data in the United States.

Retail Sales (Spain):

However, a considerable amount of quite significant macroeconomic data will be published in the UK today. Thus, the final GDP data for the fourth quarter should show a slowdown in economic growth from 1.2% to 0.8%, which indicates the ever-increasing risks of a slide into recession. The decline in industrial production may accelerate from -1.8% to -2.7%, which further confirms such concerns. Well, things should come in order with the trade balance, which was surplus for two consecutive months, and it amounted to 7.7 billion pounds in December. Therefore, according to the results of January, there should be a familiar deficit again of -3.7 billion pounds. This is not strange, but it is precisely these data that can trigger a further weakening of the pound, which, surprisingly, ignored the morning, and emergency, decision of the Bank of England, reduce the refinancing rate from 0.75% to 0.25%. Thus, the Bank of England in one decline approached the lower bar, previously designated by Andrew Bailey. Let me remind you that the new head of the Bank of England announced just last week that the rate cut is inevitable, but it does not decline below the level of 0.1%. So, this decision was expected; however, not on an emergency basis, but during a scheduled meeting.

Bank of England Refinancing Rate (UK):

In many respects, the indecision of the market is still connected with the expectation that the Federal Reserve System will not stop there and will lower its refinancing rate again during the upcoming meeting. An indirect confirmation of this will be today's inflation data, which should decrease from 2.5% to 2.3%. Indeed, the slowdown in inflation becomes an unambiguous marker of what central banks will do next, in the conditions of information panic, as well as emergency measures by the monetary authorities.

Inflation (United States):

The expectation of weak inflation data in the United States will contribute to a small rebound, so that the single European currency could increase to the level of 1.1400.

The pound will be pushed by weak macroeconomic data and a sudden decision by the Bank of England to lower the refinancing rate. However, inflation data in the United States will counterbalance them. Thus, the pound will move from the range of 1.2900 to 1.3000 then head towards the level of 1.2950.