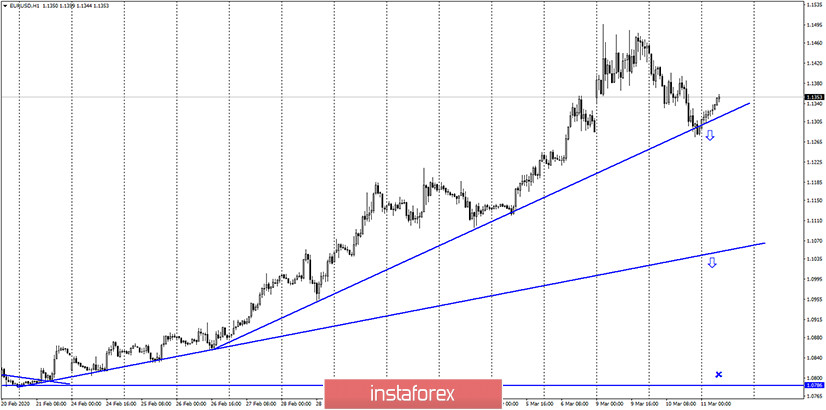

EUR/USD – 1H.

Hello, traders! The EUR/USD pair maintained its upward trend on March 10, despite the fall. The pair's quotes performed a fall to the second uptrend line, even performed a close just below it, but just an hour later they performed a reversal in favor of the European currency and resumed the growth process. Thus, no sales signals were received on the hourly chart. The euro/dollar pair may continue to grow in the direction of new peaks. More precise target levels are defined on the higher charts.

EUR/USD – 4H.

According to the 4-hour chart, the quotes of the euro/dollar pair also performed a small drop, after a reversal in favor of the EU currency and closing under the Fibo level of 127.2% (1.1365). However, at the moment, a reversal was made in favor of the euro and the process of returning to the corrective level of 127.2% has begun. The rebound of the pair from this level will work in favor of the US currency and the resumption of the fall in the direction of the corrective level of 100.0% (1.1240). Closing quotes above the level of 127.2% will increase the probability of continuing growth towards the next corrective level of 161.8% (1.1524). Today, the divergence is not observed in any indicator.

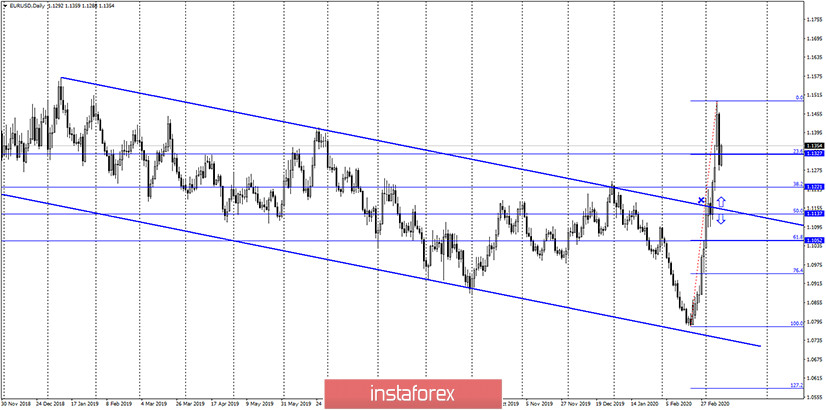

EUR/USD – Daily.

As seen on the daily chart, the euro/dollar pair, after a rapid growth to the level of 1.1496, can finally start falling. I assume that it has already started and built a Fibonacci grid that predicts a fall in quotes in the direction of the Fibo levels of 38.2% (1.1221) and 50.0% (1.1137). However, I am also aware that a strong upward trend can be resumed at any time. The activity of traders does not decrease, but, on the contrary, increases every day. Panic may return to the markets, as the main cause, the coronavirus, continues to rage and instill fear in citizens, governments and central banks of any country. Thus, the trading idea with a fall in the area of 1.1137-1.1221 is just a hypothesis.

EUR/USD – Weekly.

The weekly chart indicates that the potential for growth for the European currency remains and is limited to the level of 1.1600 (approximately) or the upper line of the tapering triangle. So far, bull traders have decided to take a pause (it is not known for how long), so the goal remains relevant, but its development may be delayed.

Overview of fundamentals:

On March 10, the calendar included only one report – the change in GDP for the fourth quarter in the European Union. As it turned out, the numbers were slightly better than the traders' expectations. The European economy accelerated over the specified period by 1% y/y, although traders were waiting for a value of 0.9% y/y. However, the euro still fell all day, and today it is growing since the night. Thus, the information background now has a weak impact on the market.

News calendar for the United States and the European Union:

USA - consumer price index (12:30 GMT+00).

USA - consumer price index excluding food and energy prices (12:30 GMT+00).

Today, both reports of the day will come from America, and both will relate to inflation in the United States. Core inflation is expected to fall to 2.2% y/y, while inflation excluding food and energy will remain unchanged at 2.3% y/y.

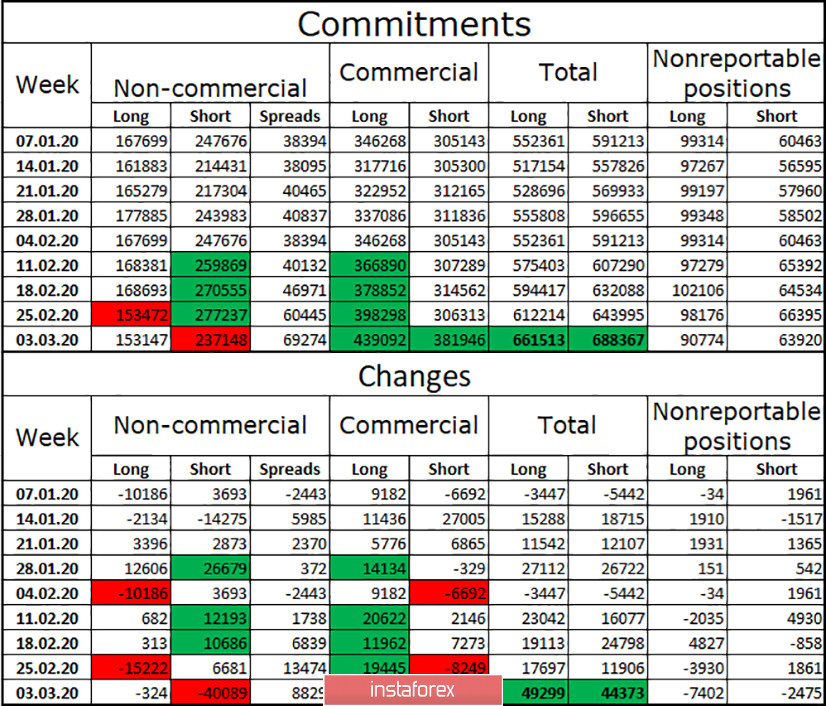

COT report (Commitments of traders):

A new report by Commitments of traders for the week of March 3 showed a sharp decrease in the number of Short positions among the "Non-commercial" group, a sharp increase in both Long and Short positions among the "Commercial" group, and a noticeable increase in the total number of both Long and Short positions. Market activity is growing, and we can see this in terms of general volatility even now, after the report. The total number of purchases from major players is increasing, and hedgers are now insured against the future growth of the euro currency and its fall. The "Changes" part of the table shows even better that the number of sales contracts among speculators has decreased by 40,000. But the number of Short positions among hedgers increased by 80,000. Thus, I conclude that the high activity of traders of all calibers remains.

Forecast for EUR/USD and recommendations for traders:

The overall picture of the EUR/USD pair remains unchanged. Purchases, from my point of view, are still dangerous, although the growth of quotes may resume. Thus, each trader still decides on the appropriateness of purchases, possibly at the end of the upward trend. At the same time, any sales remain counter-trend, so they are also dangerous. So I think the best option now is to stay out of the market. Traders can now expect a pullback to the area of 1.1137-1.1221, but there is still no signal for sales.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, and companies that buy currency not for speculative profit, but for current operations or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.