Hello, traders!

The spread of coronavirus on our planet continues and has already covered about 100 countries. Against this background, the Swiss franc as a safe-haven currency has been in high demand over the past few weeks and has strengthened significantly against the US dollar.

However, the US President's promises to present a plan to support the world's leading economy somewhat reassured market participants. In this regard, the US currency began to win back the losses suffered earlier, which must be recognized as very significant.

Today, data on consumer prices in the United States will be published, but it is unknown whether they will have an impact on the price dynamics of the "American". Now investors have the topic of coronavirus in the foreground. One by one, the world's leading central banks are switching to ultra-soft monetary policy and urgently reducing their main interest rates. It is expected that at its March meeting, the Federal Reserve will again reduce the refinancing rate, but by 0.25%.

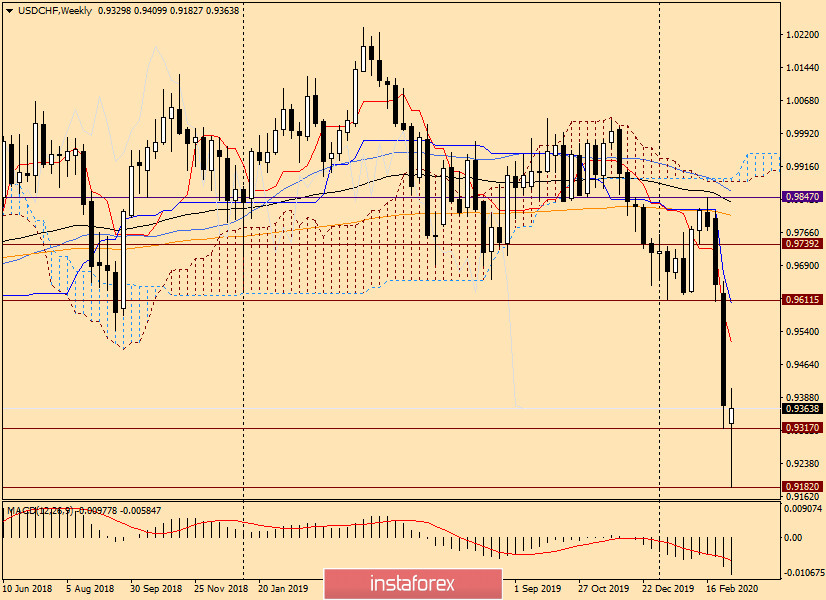

Weekly

After a large-scale fall during the previous two weeks at the current five-day trading session, the bears tried to continue to put pressure on the pair. However, at 0.9183, the pair found strong support and started an active recovery. The White House's plan to save the national economy supports the demand for the US dollar.

At the time of writing, the dollar/franc is trading above the minimum values of last week (0.9317) and has chances to continue the rise. However, much of the price dynamics of all dollar pairs will depend on news from the US about what real measures will be taken to combat the coronavirus.

Technically, if USD/CHF continues to rise, its nearest target may be the Tenkan line of the Ichimoku indicator, which is located at 0.9515.

Given the important psychological level of 0.9500, the pair may face serious resistance in this area. Naturally, this will only be possible if the bulls manage to raise the price to the area of 0.9500.

At the moment, the current candle is definitely a reversal, but there is still enough time to change the picture before the end of the weekly trading.

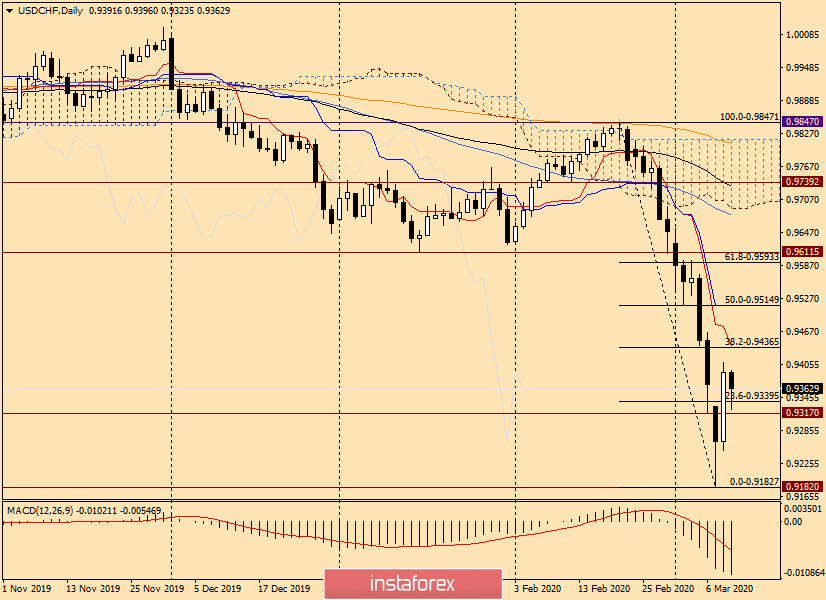

Daily

On the daily chart, I stretched the Fibonacci tool's grid by a drop of 0.9847-0.9183. As you can see, the pair has already passed the first pullback level of 23.6 and is ready to move to 38.2 and 50.0.

It should be noted here that the Tenkan and Kijun lines are located directly on the indicated corrective Fibo levels, respectively. Thus, we can expect that after the rises to 0.9436 and 0.9515, the pair will meet strong resistance and be ready to return to the main downward dynamics.

During today's trading, the bears tried to return the price to 23.6 Fibo, but at the end of the review, the pair rebounded from 0.9323 and is trading above the level of 23.6 near 0.9366.

Judging by the picture that is observed on the daily timeframe, the main trading idea for USD/CHF is sales near the prices highlighted above.

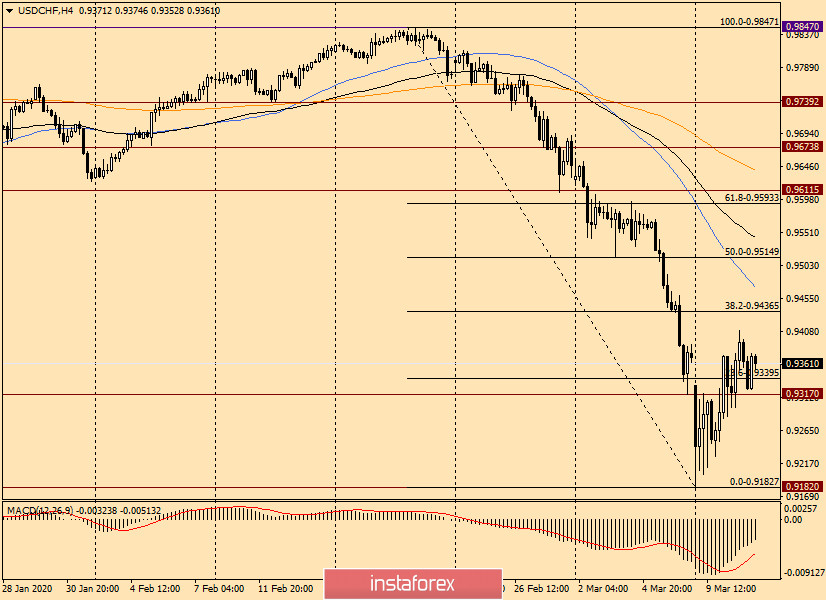

H4

The situation on the 4-hour chart, in principle, confirms the assumption of opening sales, only taking into account the finding of 50 simple and 89 exponential moving averages. The prices for opening short positions should be slightly adjusted.

The next sales can be considered after the rise in the price area of 0.9436-0.9472. More attractive prices for opening short positions on USD/CHF should be looked for after the growth in the area of 0.9515-0.9547.

I would like to draw your attention to the fact that it is better to wait for the confirmation signals of Japanese candles before opening positions. With this coronavirus, you don't know what to expect, and a dramatic change in the situation shouldn't surprise you. It is quite possible.

Good luck!