If you ask any investor about the reasons for the rapid growth of gold, then a single word immediately comes to mind – coronavirus. The Chinese epidemic not only leads to a breakdown in supply chains and a slowdown in global GDP but also became the main catalyst for the most rapid correction of US stock indices from levels of record highs in history. The S&P 500 was about to burst sooner or later, and the pandemic forced it to do so in late February. However, many people forget that in the modern world, the precious metal is a hedging tool against the monetary expansion of central banks.

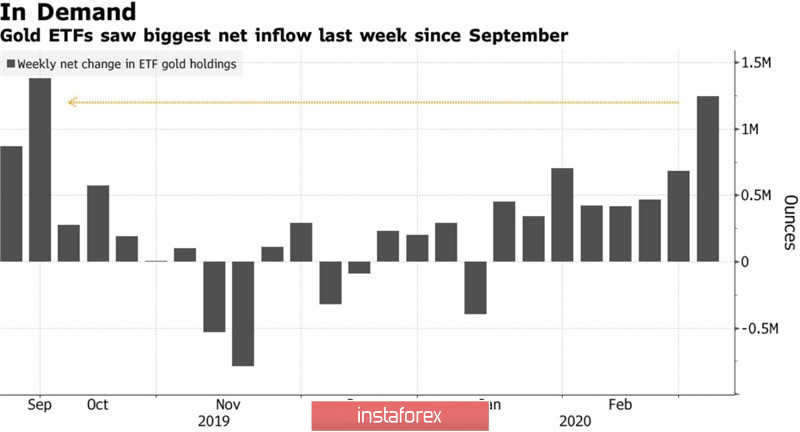

The success of the "bulls" on XAU/USD, which inflated the quotes to the highest levels since December 2012, would not have been so bright if it had not been for the reduction of the federal funds rate at an extraordinary FOMC meeting by 50 bps and the expectation of its fall to zero before the end of 2020. Donald Trump never tires of criticizing the Fed for its slowness, demanding a reduction in borrowing costs to levels that have major US competitors. The Federal Reserve was followed by the Reserve Bank of Australia and the Bank of Canada. The ECB, as well as regulators from Japan and England, say they are ready to ease monetary policy. Monetary expansion is a "bearish" driver for any currency, while the weakness of the latter contributes to the growth of demand for gold. Isn't that why ETF stocks rose at the fastest pace since September in the first week of March?

Dynamics of gold ETF stocks

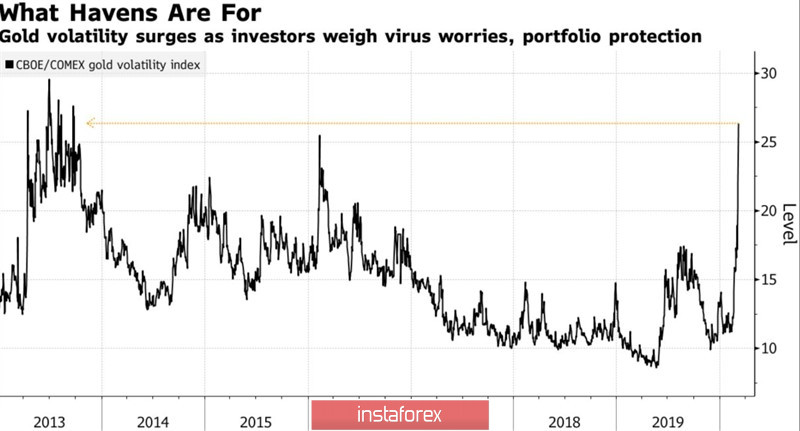

Interest in gold is fueled by significant turmoil in the financial markets. In this regard, the collapse of the S&P 500 by 10% for 6 days, more than 7% sagging stock index at the auction on March 9, as well as the fastest peak in oil since the crisis in the Persian Gulf in 1991 could not leave the "bulls" on XAU/USD indifferent. The rise in the volatility of various assets, including precious metals, contributes to the growth of quotes of safe-haven assets, which once again proved gold.

Dynamics of gold volatility

Despite the fact that major banks are predicting the continuation of the northern hike XAU/USD, I would not be so confident in their targets. UBS expects the precious metal to jump to $1,800 an ounce in the next few weeks, while Citigroup forecasts it to strengthen to $2,000 by the end of 2021. In my opinion, the market situation is beginning to change, which increases the risks of correction and consolidation.

First, the White House and the Fed will most likely be able to stabilize the stock market with fiscal and monetary stimulus, which will return interest in the US dollar. Second, China is gradually defeating the coronavirus, which allows us to count on a V-shaped recovery of its economy in the second quarter.

Technically, the formation of the "Three Indians" subsidiary and parent model on the daily chart of the precious metal at the target level of 224% on the AB=CD pattern increases the risks of correction to $1630 and $1600 per ounce. However, until the quotes fall below the trend line of the initial stage of the "surge and reversal with acceleration" model, the situation will continue to be controlled by the "bulls" and pullbacks will be used for purchases.

Gold, the daily chart