Hello, traders!

Yesterday, the Bank of England urgently decided to reduce the main interest rate immediately by 50 basis points, to 0.25%. In principle, market participants expected the British Central Bank to reduce the rate, and it was already included in the price of the pound.

The spread of the coronavirus epidemic has forced the Bank of England not to delay the decision to ease monetary policy, but to act faster and more decisively.

Bank of England Governor Mark Carney, although he called the consequences of COVID-19 temporary, but the negative impact of the coronavirus on the economy of the United Kingdom was designated as uncertain. Carney also said that the Bank of England is ready for a further rate cut, which may be slightly higher than zero.

Monetary policy easing measures are being implemented to protect the UK economy and banking sector. In this situation, even the topic of Brexit has taken a back seat, since the main task of the world's leading central banks is to protect and support their own economies from the consequences of the coronavirus epidemic.

Well, let's look at the reaction of the pound/dollar currency pair and the technical picture that is observed for this trading instrument.

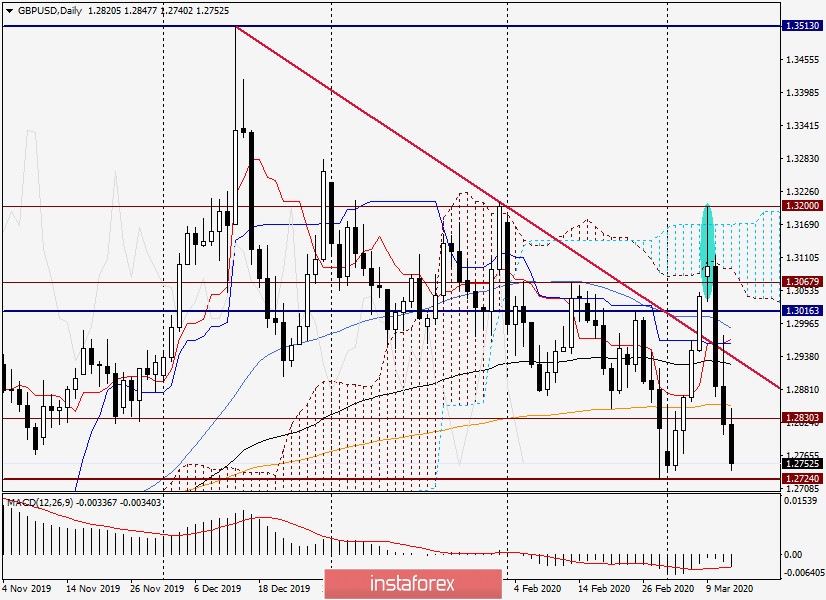

Daily

After the candle that appeared on the daily chart on March 9, further bearish prospects for GBP/USD became clearly visible. This is exactly what happens. The pair shows a serious decline for the third day in a row. I guess that's not the limit.

If the support level of 1.2724 is broken and trading closes below this level, the chances of continuing the bearish scenario for this currency pair will increase significantly. In this case, the road to the levels of 1.2580 and 1.2515 will open. If the quote falls and is fixed below the iconic technical and psychological level of 1.2500, the bears will fully gain control of the market.

Despite the fact that investors are somewhat disappointed by the lack of a clear plan for the Trump administration to support the US economy from the coronavirus epidemic, the dollar feels quite confident and is strengthening across a wide range of the market.

At the very least, the pound/dollar currency pair clearly demonstrates a tendency to a bearish scenario. As noted above, the candle for March 9 and the false break of the red resistance line 1.3513-1.3207 are clear confirmation of this.

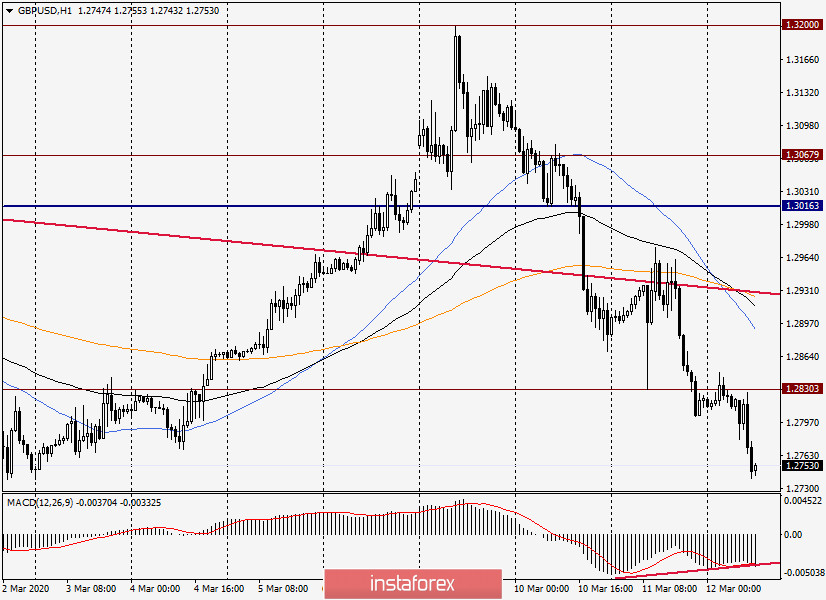

H1

Despite the presence of bullish divergence of the MACD indicator, the hourly chart is clearly bearish. There is a high probability that the downward trend will continue, and the main trading idea in this situation looks like selling the British currency.

The main task now is to find acceptable points for opening short positions. In my opinion, selling near the support zone of 1.2738-1.2724 is technically incorrect and quite risky. Despite strong bearish pressure, the probability of a corrective pullback remains.

With this development, we can consider selling the GBP/USD pair after rising to a strong technical zone of 1.2800-1.2830. More attractive prices for opening short positions can be found after the growth in the area of 1.2880-1.2920. However, given the current strong pressure, this option seems less likely.

Another idea for opening sales is to roll back to the broken support zone of 1.2724-1.2738. With this positioning, it is better to enlist the support of the corresponding candle signals, which will indicate that the pair is ready to return to the downward dynamics.

Now any comments on measures to counter the coronavirus from high-ranking officials, especially from the White House, can significantly change the situation in international financial markets. Be vigilant!