Today, all attention was focused on the decision of the European Central Bank, which slightly surprised traders, which led to a temporary purchase of risky assets, which then resulted in a larger sale, as it became clear to everyone that now it is definitely not a joke and the risk of a new financial crisis does not seem so unrealistic. Futures on US stock indices, in particular on the S&P500, collapsed, breaking through the mark of 2600 points, and gold reached support at 1576 per ounce. Rates on US bonds have crept down again.

Apparently, the European regulator is not very concerned about these nuances, although during the speech, the president of the bank, Christine Lagarde, mentioned the problems that the eurozone economy may face against the background of the spread of the coronavirus. Either the ECB really does not want to act ahead of the curve, since there are not many tools left in its asset that can affect the sharp contraction of the economy and the fall in inflation. Or the Central Bank will actually take action only after it is too late, as it was in 2008 during the global financial crisis.

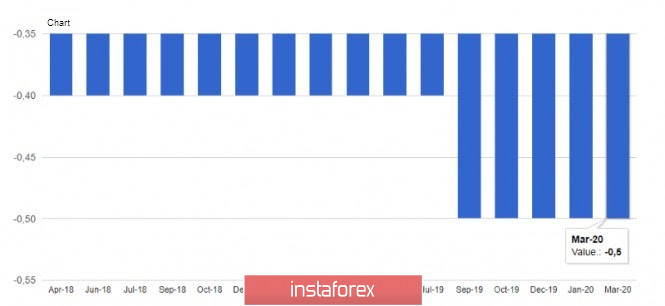

But let's return to the results of the meeting. Today, the European Central Bank left the deposit rate at -0.5% and the refinancing rate unchanged at 0.0%, while stating that rates will remain at current levels or lower until inflation confidently reaches the target level. What target level of inflation can we talk about if even Lagarde herself expects it to fall sharply in the coming months?

The ECB also noted that bond purchases will continue for as long as necessary, and will end only shortly before the start of raising key interest rates. The regulator also said that it will temporarily expand bond purchases under the program, which amounts to 2.6 trillion euros. The program, which currently amounts to 20 billion euros per month, will be increased by just 120 billion euros by the end of the year. Against this background, the euro fell to new intraday lows in the area of 1.1130.

Also, following the meeting, it was announced that new long-term loans for banks, interest rates on which were lowered, would be granted. So, now the European Central Bank is ready to lend to European banks at a rate of -0.75%. However, at the same time, the ECB does not see any noticeable signs of tension in the money markets.

As for the speech of ECB President Christine Lagarde, during her press conference, the statements were even more vague. Lagarde believes that the coronavirus represents a major shock to growth prospects, and governments should take timely measures to mitigate the economic consequences. In this regard, coordinated fiscal changes are required, which will be aimed at supporting liquidity, financing households and banks. At the end of the speech, Lagarde said that she was ready to adjust all the tools if necessary.

The market reaction to these statements was appropriate. Without getting any specifics, traders continued to get rid of risky assets, completely ignoring a good report on the growth of industrial production in the eurozone in January this year, since, in fact, it did not matter, since the spread of the coronavirus began in February this year. According to the data, industrial production increased by 2.3% in January compared to December and fell by 1.9% compared to January 2019. It was expected to grow by 1.3% and fall by 3.1%, respectively.

But the actions of American President Donald Trump are the complete opposite of the decisions of the European Central Bank. Today, Trump said that the Federal government and the private sector are making every effort to fight the coronavirus, and once again called on the US Congress to allocate an additional $50 billion to provide loans to businesses. Let me remind you that a decision was already made to allocate $30 billion to fight the coronavirus. Trump also continues to push for a reduction in the payroll tax, which will undoubtedly help him in the future election race for president. However, his initiative has faced opposition from representatives of both US parties and is not yet being seriously considered.

The US President also announced that entry to the US from Europe will be closed for 30 days, but this does not apply to trade relations. The EU has already criticized such measures, saying that the coronavirus is not limited to any continent, it requires cooperation, not unilateral actions, not approving the fact that the decision to ban entry to the United States was taken unilaterally, without consultation.

As for the current technical picture of the EURUSD pair, most likely, the pressure on the euro will continue, since there are no active purchases after the collapse of the trading instrument in the area of 1.1130. The nearest support levels are seen in the area of the 11th figure, a breakthrough of which will quickly push the euro to the lows of 1.1040 and 1.0990. The upward correction will be limited by the resistance of 1.1240, which the bulls failed to return today. Just above is another large level of 1.1330.