EUR/USD – 1H.

Hello, traders! March 12 was another shocking day for global markets. Although, we, traders, are primarily interested in the currency market. After the EUR/USD pair secured under the second upward trend line, the quotes continued to fall and the first trend line was worked out, as I expected yesterday. The rebound from this line worked in favor of the European currency and the beginning of growth. Fixing the pair's exchange rate under the first trend line will again work in favor of the US dollar and resume falling towards the level of 1.0786, although it is better to determine the goals on older charts.

EUR/USD – 4H.

According to the 4-hour chart, the quotes of the euro/dollar pair performed a reversal in favor of the US currency yesterday and resumed the process of falling, eventually working out the corrective level of 61.8% (1.1063). Thus, first of all, all the goals that I gave yesterday were fulfilled, and secondly, the condition under which it was recommended to sell the pair was met - closing under the Fibo level of 100.0% (1.1240). The rebound of quotes from the corrective level of 61.8% (1.1063) worked in favor of the European currency and the beginning of growth in the direction of the corrective level of 100.0%. The rebound of the pair's exchange rate on March 13 from this level will work again in favor of the US currency and resume falling towards the level of 61.8%. Today, the divergence is not observed in any indicator.

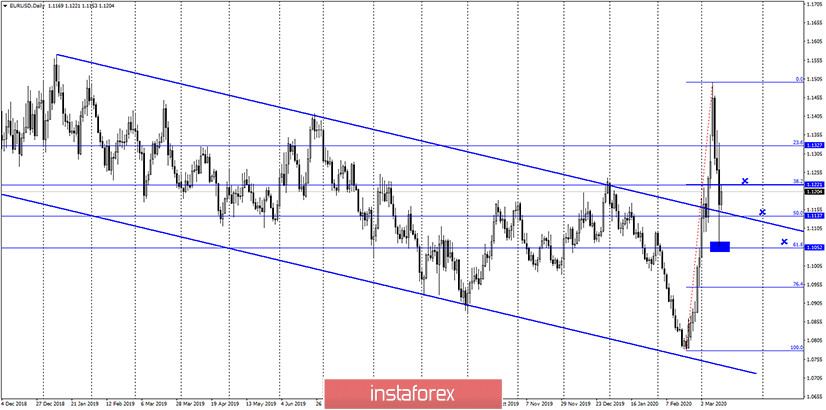

EUR/USD – Daily.

As seen on the daily chart, the euro/dollar pair worked out all three target levels during the past day, which I indicated in yesterday's article. The fall of quotes ended near the Fibo level of 61.8% (1.1052). The pair's rebound from this level worked in favor of the EU currency and the beginning of growth. At the moment, the quotes have returned to the Fibo level of 38.2% (1.1221). There are no new signals for sales or purchases on this chart. The pair successfully corrected by 61.8% after strong growth.

EUR/USD – Weekly.

Nothing changes on the weekly chart. Changes over such large periods are extremely rare. The pair still has the potential to grow towards the upper line of the tapering triangle (approximately 1.1600 level). However, the markets continue to be in a state of shock. Trading activity is very high, and movements are often unpredictable.

Overview of fundamentals:

On March 12, traders closely followed the results of the European Central Bank meeting. In some ways, the ECB was disappointed, as it did not lower rates. However, the quantitative easing program was expanded, which can also be considered as stimulus measures. Industrial production in the EU, although it turned out to be better than traders' expectations, still declined.

News calendar for the United States and the European Union:

Germany - consumer price index (07:00 GMT+00).

USA - consumer sentiment index from the University of Michigan (14:00 GMT+00).

Today, the information background will be relatively weak. However, in times of raging coronavirus, when every day there are reports of new quarantines, diseases among the "top officials" and the isolation of entire countries, at any moment information can arrive that will "throw" the markets up.

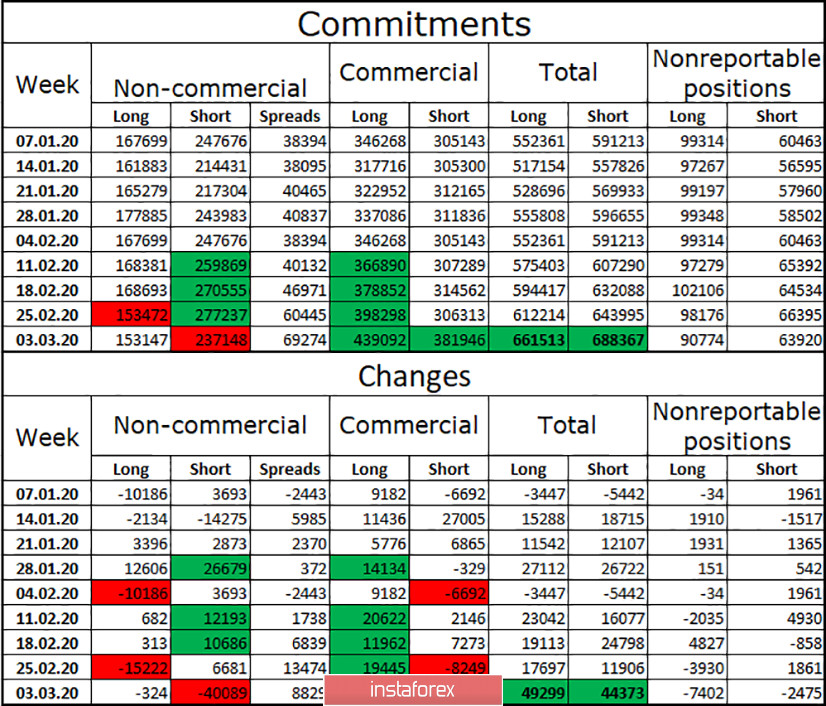

COT report (Commitments of Traders):

This afternoon, a new COT report will be released. I am most interested in how the ratio of total Long and Short positions has changed, as well as what changes have been made in the last reporting week. As usual, this report will help determine the long-term mood of major market players. Since all markets have been in a state of shock for the past two weeks, the figures in the new report can be very interesting and "fun". In any case, graphical analysis remains in the first place, and the COT report only helps to determine the dynamics.

Forecast for EUR/USD and recommendations for traders:

For the EUR/USD pair, the upward trend turned into a downward trend. After yesterday's testing of all target levels, there are no new sales signals. However, fixing the pair's rate under the first trend line on the hourly chart will again allow traders to sell the pair with goals up to the level of 1.0800. On the 4-hour chart, the rebound of quotes from the Fibo level of 100.0% (1.1240) can allow you to sell the euro.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.