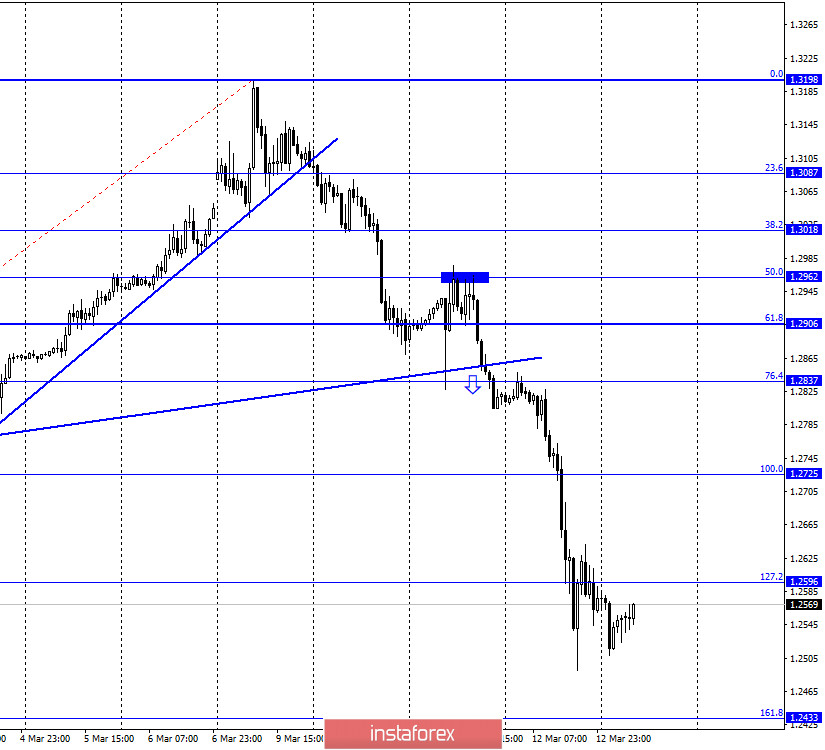

GBP/USD – 1H.

Hello, traders! To my great regret, all global markets are now driven solely by news about the spread of the coronavirus, as well as news related to measures taken by the Central Bank and governments to stop the spread of the epidemic and mitigate its consequences. A week ago, the euro and the pound were growing by leaps and bounds, and now they are falling down day after day. Thus, movements in the foreign exchange market remain shocking. Yesterday, March 12, the quotes of the GBP/USD pair closed on the hourly chart below the trend line. This moment served as a signal for new sales. However, instead of "simple" working off the nearest correction level, the pair fell below the Fibo level of 127.2% (1.2596). Thus, while maintaining a high probability of a further fall in the direction of the next corrective level of 161.8% (1.2433).

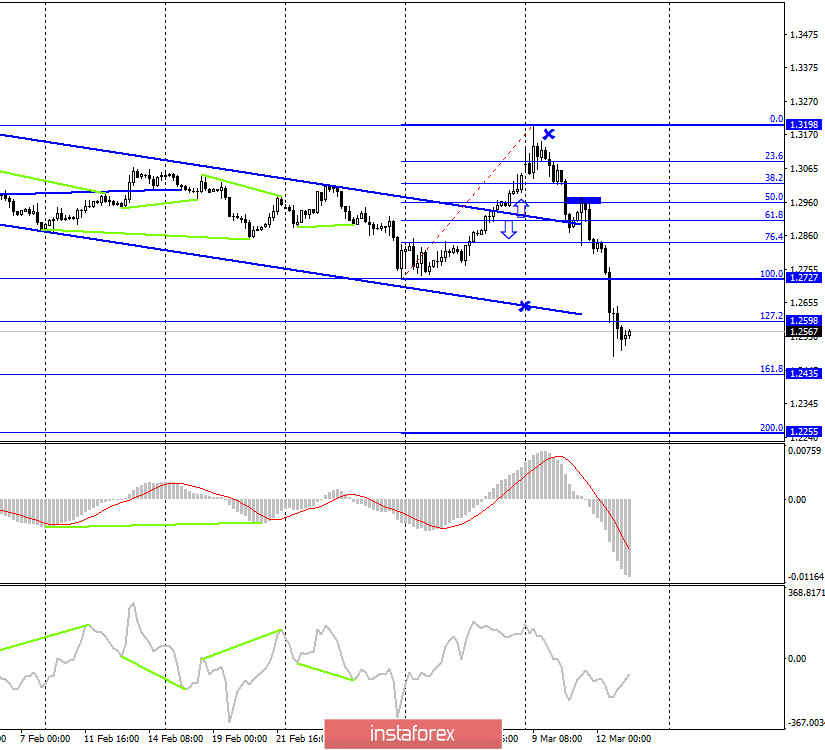

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair rebounded from the Fibo level of 50.0% and resumed the process of falling, and so strongly that the entire Fibonacci grid had to be built anew. At the moment, the grids match on the two smallest charts. There are no trend corridors, divergences or rebounds on the 4-hour chart at the moment. The data is identical to the hourly chart.

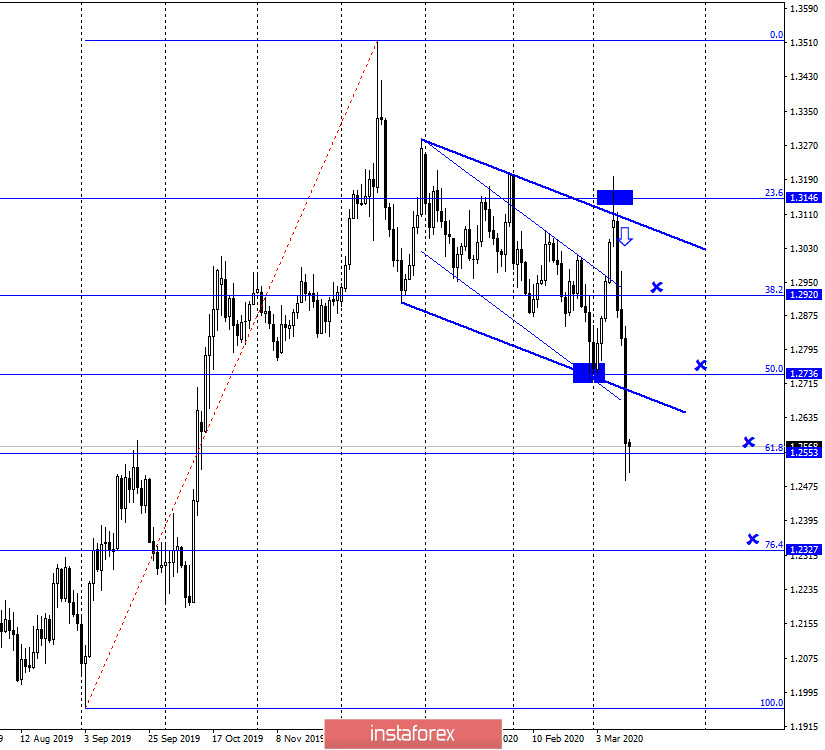

GBP/USD – Daily.

According to the daily chart, the graphic picture remains the most interesting. Yesterday, I also gave goals for this time period, but the British exceeded the goals and instead of falling to the corrective level of 50.0% (1.2736), it made a "peak" immediately to the Fibo level of 61.8% (1.2553). Thus, all the target levels that I gave as part of the signal about the rejection of the 23.6% level and the upper line of the downward trend corridor have been fulfilled. Moreover, the quotes of the pound/dollar pair performed closing under the trend corridor itself. The rebound of the pair's exchange rate from the Fibo level of 61.8% will work in favor of the English currency and some growth in the direction of the corrective level of 50.0% (1.2736). Fixing quotes below the Fibo level of 61.8% will increase the chances of a further fall in the direction of the next corrective level of 76.4% (1.2327).

Overview of fundamentals:

On Thursday, March 12, there were no important marks on the UK and US news calendar. However, the constant stream of news concerning the coronavirus continues to excite the currency market, leaving it in a state of shock and panic. Yesterday, we received reports from the UK that the number of infected people may already be 5-10 thousand, and among the infected is the country's deputy health minister. The danger of the virus is that before it is identified, the infected person does not have symptoms for some time, but at the same time is the carrier of the infection. Thus, the virus will continue to spread almost 100% across the UK.

The economic calendar for the US and the UK:

USA - consumer sentiment index from the University of Michigan (14:00 UTC+00).

There is not much news in the calendar on the 13th day. Nevertheless, news feeds will continue to be full of new reports about the COVID-19 virus.

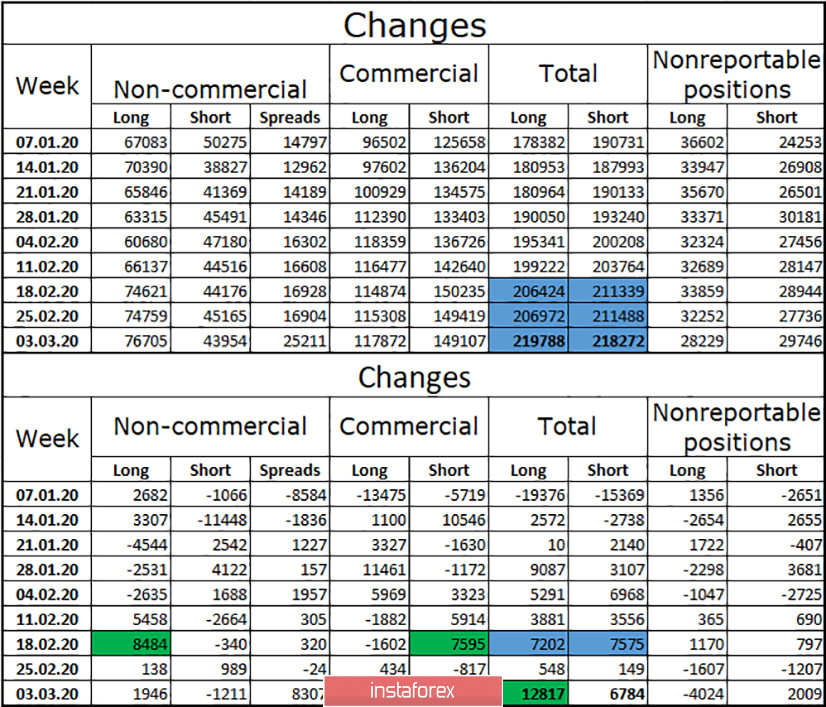

COT report (Commitments of traders):

Today, a new COT report will be released for the pound/dollar pair. More precisely, for the British pound. The key question remains: will the full balance between Short and Long positions of major market players be disrupted? All recent reports have shown that the number of these positions is almost equal. Only the activity of major players is growing, and even then not at a very high rate. Given the strong movements in the last 2 weeks, the COT report should show major changes that will help determine the future mood of speculators and hedgers.

Forecast for GBP/USD and recommendations to traders:

I believe that in the current conditions, opening any transactions is still associated with high risks, as the market remains in a state of shock. In my opinion, for new sales of the British pound, you need to wait for the consolidation of quotes under the Fibo level of 61.8% (1.2553) on the daily chart. Otherwise, the pair will begin to grow.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.