Hello, dear traders!

Yesterday, the European Central Bank (ECB) held a meeting, following which it was decided to keep interest rates at the same levels.

Nevertheless, the incentive measures were taken in the form of reducing the requirements for bank capital. Loans for banks will now be very cheap - minus 0.75%, and asset purchases will increase to 120 billion euros by the end of 2020.

Naturally, Christine Lagarde paid a lot of attention to the coronavirus epidemic at her press conference, calling supply disruptions and reduced domestic and external demand for goods risks for the economy. According to the head of the ECB, economic activity is significantly reduced due to the coronavirus. Despite the COVID-19 epidemic, Christine Lagarde expects economic growth to recover, without specifying the timing of this recovery.

Strange as it may seem, market participants remained unsatisfied with the European Central Bank's interest rates. When was this? Usually, markets are disappointed by a decrease in borrowing (rates), but the outbreak of the coronavirus has changed the attitude of investors to the monetary policy of the world's leading central banks. In the current situation, lowering rates is perceived as a measure to support the economy. In this regard, the ECB's inaction has cost the single European currency dearly, which fell against the US dollar following yesterday's trading results.

The statement of US President Donald Trump, who announced a ban on entry to the United States of America for European citizens for a period of 30 days, did not go unnoticed by the markets. However, this decision will not affect British citizens, and this, in my opinion, has some political implications. Trump also announced financial assistance to infected Americans and those who care for them. Market participants expected the White House administration to take more effective measures to combat the coronavirus epidemic and were disappointed. Now expectations of further Fed rate cuts have become even stronger. But it is unclear whether the expected easing of the Fed's monetary policy will put pressure on the US dollar or support the US currency. Due to the spread of the coronavirus epidemic, the reaction of investors to the easing of monetary policy by leading central banks has changed dramatically. Everyone understands that without the support of national economies, the global financial crisis is not far off.

Yesterday's statistics from the US were actually ignored by market participants. Today, a report on consumer sentiment from the University of Michigan will be released from the United States, as well as an index of import prices.

It's not a big statistic. I believe that even today the topic of coronavirus will prevail on global financial markets, including the Forex currency market.

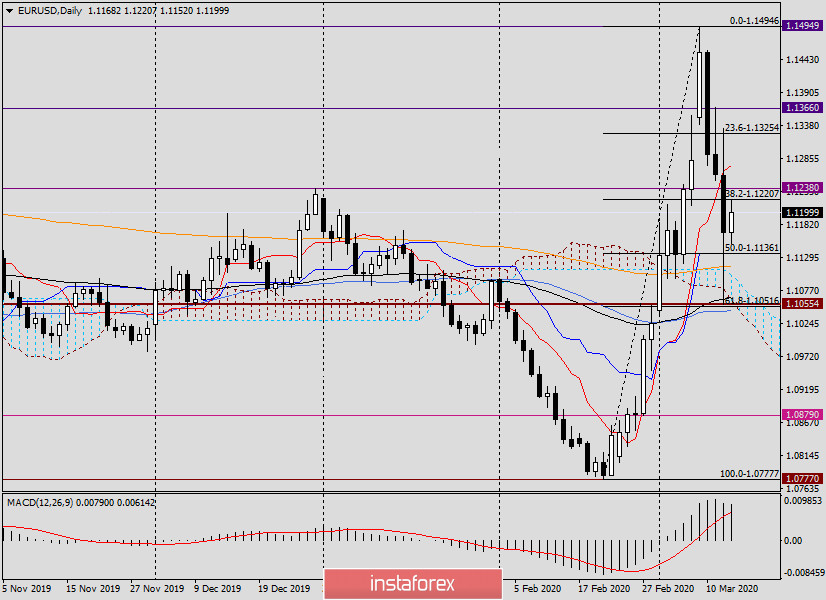

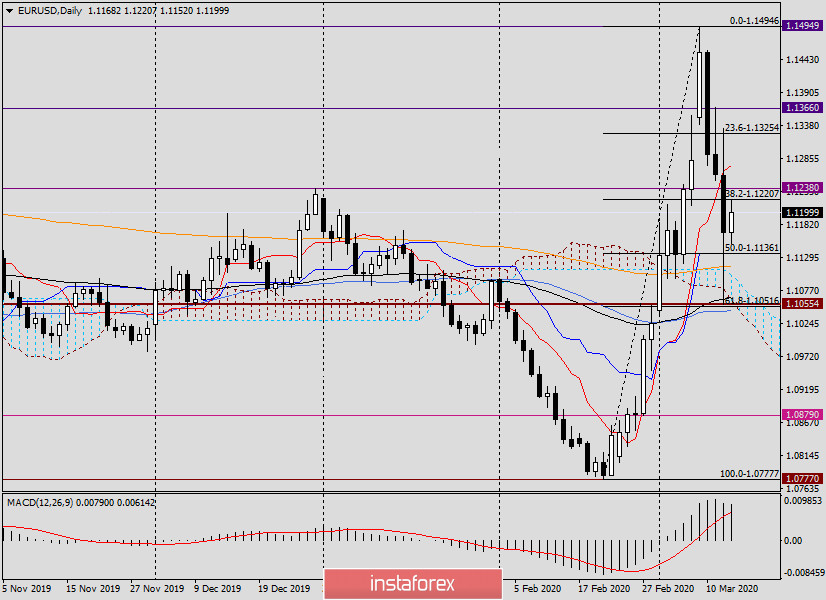

Now for the technical picture, which is observed for the EUR/USD currency pair at the time of writing this article.

Daily

As a result of yesterday's events, trading on the euro/dollar was quite volatile and with a high demand for the US dollar, which again became perceived as a safe haven currency.

The EUR/USD pair fell to 1.1055 but managed to recover and finish trading at 1.1168. However, I do not know how much this will help the single European currency. The weekly candle at this point in time looks pretty creepy. Huge shadows above and below, and no less significant bearish body of the candle indicates its reversal character. Although who knows...

Closing today's trading above 1.1275 will slightly correct the situation in favor of euro bulls. If today's session ends at 1.1134, the bearish sentiment for EUR/USD will become even stronger.

I have almost no doubt that Monday's auction will open with a gap, but it is unclear in which direction. I think everything will depend on the activity of the spread of the coronavirus pandemic over the next weekend. One question remains: which of the currencies will receive support?

Have a nice day!