4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

CCI: -122.0091

The British pound continues to fall against the US currency. If just a week ago there were hopes for the formation of a new upward trend, since the upward movement was very strong and recoilless, then after the last four days we can say that the downward trend was resumed. The currency market continues to panic and, as we said in the article on EUR/USD, there are no specific reasons for the collapse of the British pound in the last week. We cannot say that the US dollar is growing because of the US stock market, or because exactly four days ago, most market participants at once considered that the best reserve currency is the US currency. The current movements in the currency pair are not related to the actions of the central banks of the United Kingdom and the United States. The reason for all that is happening now in the market can be only one - panic because of the "coronavirus". And until it ends, ordinary traders do not even need to dream about any logical and reasonable movements. However, there is also good news: almost all the movements of the last two weeks are recoilless and are well visualized by technical indicators. That is, if you trade carefully and are guided only by technical factors, you can earn good money, although we continue to warn traders about the increased risks of trading at this time.

"Coronavirus" reached the Foggy Albion in full. All competitions are canceled, including the most important for the British population - the Football Championship of England and all international competitions under the auspices of UEFA. Several of England's leading athletes became infected and their clubs were quarantined. It is suspected that the number of infected people is currently more than 10,000, although official data indicate no more than a thousand infected. The problem is that the incubation period of the virus is quite long, so a person can be infected and transmit the infection to other people, not knowing at this time that he is sick himself. At this time, Prime Minister Boris Johnson made a resonant statement: "The coronavirus continues and will continue to spread around the world and across our country over the next few months. We have done what we can to contain this disease, but now it is a global pandemic. The number of cases will increase dramatically, and the true number of cases is much higher than the number of cases officially confirmed by tests. This (virus) will spread further, and I have to be honest with you, with the British public: many more families will lose their loved ones before their time." To be honest, Boris Johnson has rarely made statements that caused confusion about the public, but now, when the epidemic is gaining momentum, it is necessary to say publicly that many will lose their loved ones... instead of calming the population...

At the same time, Johnson's American counterpart is preparing to introduce a "state of emergency" in his country. It is reported that in this case, special powers will be available to Donald Trump, and much more resources will be allocated to fight the "coronavirus". The US leader has already blocked communication with Europe (not Britain), which immediately caused a flurry of criticism of European colleagues. However, the most important thing is that Donald Trump himself may be infected with the pneumonia virus. Just the other day, the US President was surrounded by the press secretary of the President of Brazil, who was diagnosed with the virus yesterday. An even more interesting fact is that Boris Johnson could also have fallen ill since the British government has already officially confirmed a case of the disease.

Thus, as long as the Heiken Ashi indicator is directed downward, the downward movement will continue. To date, there are no significant macroeconomic publications planned in the UK or the States, but this does not matter now. The only important thing now is to stop the spread of the pandemic as quickly as possible. Without this, the world economy, the American economy, and the British economy will only continue to slow down and shrink, no matter how central banks stimulate them. Both the Fed and the Bank of England can now only mitigate the negative impact of the disease on the economy, no more.

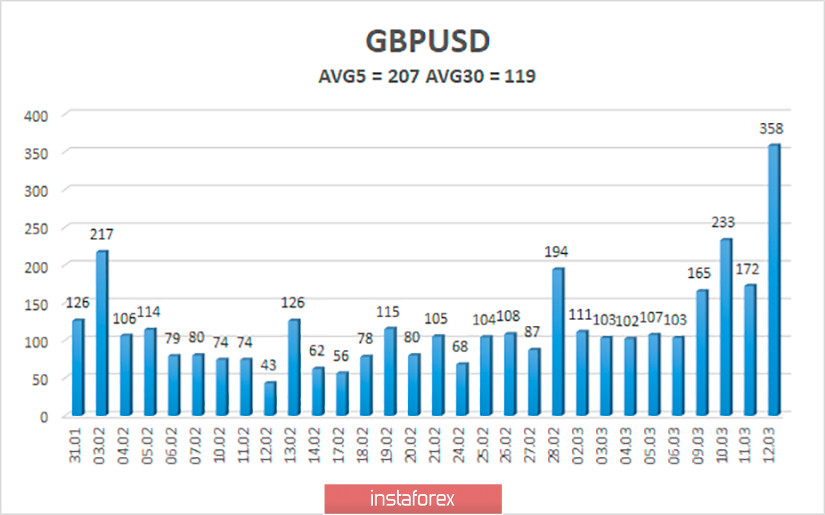

The average volatility of the pound/dollar pair over the past 5 days is 207 points and continues to grow. Yesterday was an absolutely record day for the pound - more than 350 points were passed during the trading day. On Friday, March 13, we expect the pair to move within the volatility channel of 1.2417-1.2831. This pair is likely to move back to the lower border.

Nearest support levels:

S1 - 1.2451

Nearest resistance levels:

R1 - 1.2573

R2 - 1.2695

R3 - 1.2817

Trading recommendations:

The GBP/USD pair continues its strong downward movement. Thus, the current sales of the pound remain relevant with the targets of the Murray level of "-2/8"-1.2451 and the volatility level of 1.2417, before the reversal of the Heiken Ashi indicator to the top. It is recommended to return to purchases of the British currency with the target of 1.2939, not before fixing the price above the moving average line. We remind you that in the current conditions, opening any positions is associated with increased risks.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.