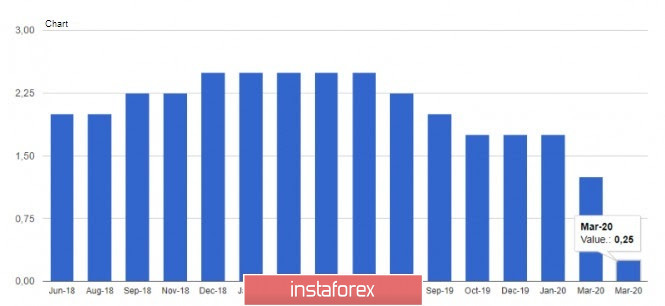

Apparently, the calls of the American leader Donald Trump that interest rates should be lowered to levels comparable to those of competing central banks have had an effect. During an extraordinary meeting this Sunday, the Fed lowered its key rate to almost zero, saying it was starting to buy $700 billion worth of treasury and mortgage bonds. This decision was made in connection with the spread of the coronavirus pandemic. For example, the Federal Reserve has set a range of federal funds interest rates between 0.00% and 0.25%. The Federal Reserve's Open Market Operations Committee voted 9 to 1 for this decision.

The regulator said it would keep rates at a new low level for as long as necessary. It requires the economy to return to growth and stock markets to recover. However, it is difficult to predict what the damage from the coronavirus will be since the pandemic continues to grow, and no antiviral agent has yet been found. During a press conference, Fed chief Jerome Powell said that starting Monday, the central bank will buy Treasury bonds for at least $500 billion and mortgage bonds for at least $200 billion, which should help restore the work of financial markets. Let me remind you that last week, US stock markets continued their largest decline since the global financial crisis.

The Fed statement also called on the country's banks to use their stored capital and not to slow down lending to companies and households suffering from the effects of the spread of the coronavirus.

However, despite the measures taken, many experts and economists say that they are insufficient, which will soon lead a number of developed countries' economies to a large-scale recession. According to surveys, more than 60% of respondents expect a recession in the US and more than 82% in Europe. Although there is no doubt about this, the other question is how quickly the economy will begin to recover. And this is what will indicate the effectiveness of the measures. Let me remind you that the Bank of Canada, the Bank of England and the Reserve Bank of New Zealand also lowered interest rates last week. But the European Central Bank left everything unchanged, only slightly expanding the program of bond repurchases.

Donald Trump on Sunday evening said that the government will work with the private industry to speed up testing for the virus, and about half a million additional tests will be available at the beginning of this week. Another five million tests are also expected to arrive within a month.

As for fundamental statistics, the data released on Friday did not significantly affect the US dollar. According to a report from the US Department of Labor, import prices in February 2020 fell by 0.5% compared to January, while economists expected a fall of 0.8%. Export prices in February fell by 1.1% compared to January.

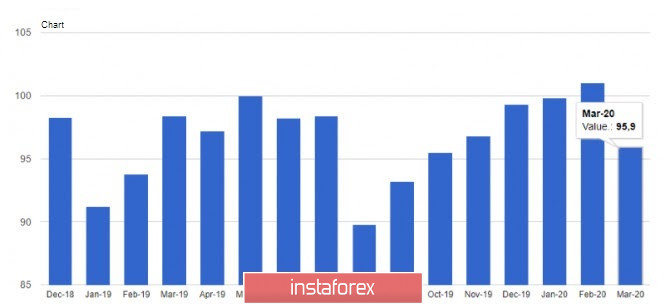

There was also a deterioration in the US economic outlook, as evidenced by the results of a survey by the University of Michigan. According to the data, the preliminary index of consumer sentiment in March fell to 95.9 points from 101.0 points in February, while economists expected the preliminary index in March to be 95.0 points. The index was affected by the spread of coronavirus, which hit consumer confidence.

As for the technical picture of the EURUSD pair, given what is happening in the markets now, I would not bet on the strengthening of risky assets, since the situation is really becoming dangerous. Any signs of a slowdown in the US economy could seriously affect not only the US dollar, but also the general mood of investors, which will further strengthen their faith in the economic crisis, which usually leads to a strengthening of the US dollar.

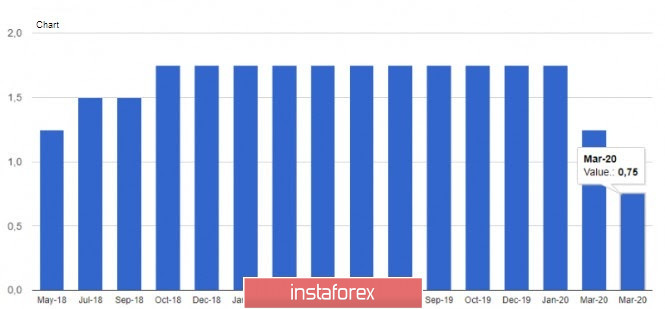

As noted above, the Bank of Canada, following other central banks, lowered its key interest rate to 0.75%, saying that such a decision between meetings was necessary due to the coronavirus pandemic and falling oil prices. According to the regulator, the spread of the coronavirus has serious consequences for the economy, and the recent fall in oil prices only complicates the whole situation, which puts pressure on the growth of the economy. If necessary, the Bank of Canada is ready to further adjust its monetary policy. A more complete assessment of the economy will be presented on April 15.

As for the technical picture of the USDCAD pair, the growth is likely to continue due to the lack of signs of recovery in the oil market. WTI oil continues to gradually return to its annual lows in the area of 27.30 dollars per barrel and is now trading at 30 dollars. The breakout of the 1.2865 resistance in the USDCAD pair by buyers will lead to the repeated growth of the trading instrument in the area of the maximum of 1.3970 and provide a new upward wave to the levels of 1.4070 and 1.4170. When the trading instrument declines, support is seen in the range of 1.3735 and slightly lower, around the larger level of 1.3640.