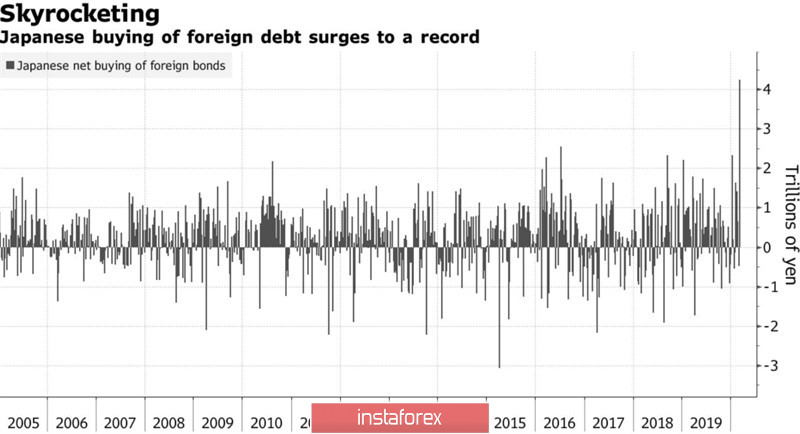

If the "bears" on USD/JPY are not able to stop any aggressive monetary expansion of the Fed, the rumors about the weakening of the monetary policy of the Bank of Japan at the March meeting, or the threat of a recession in the economy of the Land of the Rising Sun in the second quarter, currency intervention should be used. By the end of the week to March 6, Japanese investors registered record purchases of foreign bonds of £4.24 trillion ($41 billion), significantly exceeding the previous maximum of £2.5 trillion, which took place in July 2016. This is the 10th excess of the weekly average for 2019. Although the names of the buyers were not disclosed, there are rumors on the market about the participation in the $1.6 trillion Japanese State Pension Fund. The largest in the world.

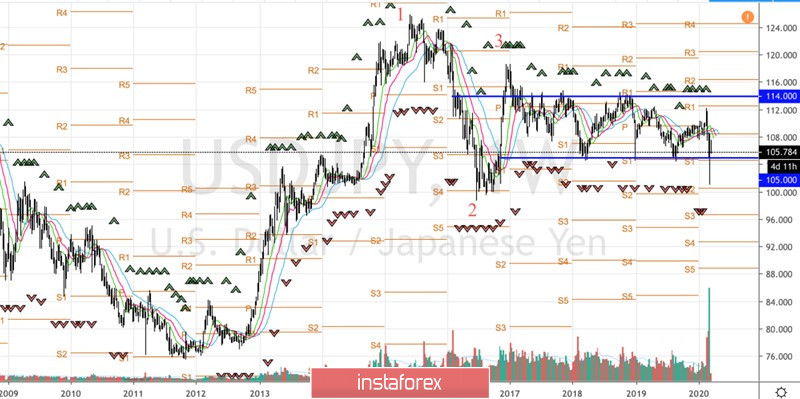

Dynamics of purchases of foreign bonds by Japanese investors

Formally, the principle of "buy what is cheap, sell what is expensive" could be implemented. The fall of USD/JPY to the lowest level since the fall of 2016 clearly did not suit either the BoJ or the government. The Central Bank is already unable to cope with inflation, and then the revaluation of the yen puts a stick in its wheels. On the eve of the March meeting of the Bank of Japan, Minister of Finance Taro Aso said that investors should not worry about an excessively high yen. A dollar at £105 is quite normal.

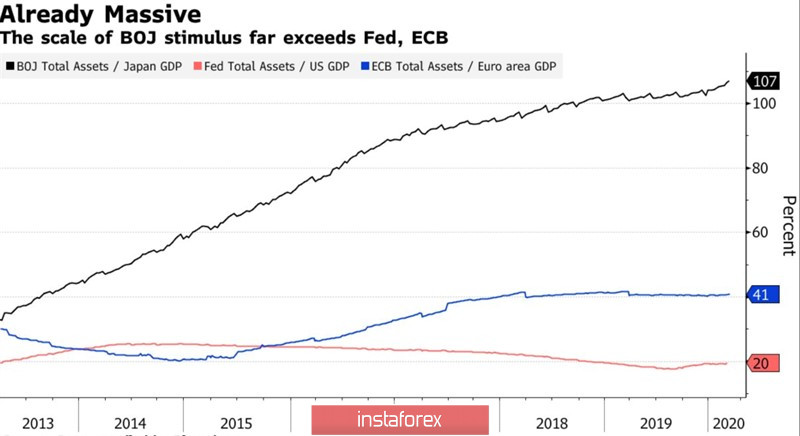

The currency of the Land of the Rising Sun rightfully claims to be the most interesting currency of the week by March 20 at Forex. First, the market turmoil is not over yet, and second, the BoJ meeting risks being very interesting. According to 90% of 41 Bloomberg experts, we should expect the Central Bank to ease monetary policy. First of all, we are talking about increasing purchases of market-oriented ETFs from the current £6 trillion ($58 billion) to a much more serious figure. Purchases of other assets and cheap credit programs for companies affected by coronavirus are also possible.

Dynamics of asset purchases by the world's leading central banks

In my opinion, Haruhiko Kuroda and his colleagues are not able to stop the fall of the TOPIX and Nikkei 225. These indices react to the behavior of their American counterparts, and if the Fed failed to put the bears in their place with the help of unexpected and aggressive monetary expansion, it is unlikely that the BoJ will succeed, whose potential is limited. On the other hand, if the Federal Reserve and the White House work together to stabilize the S&P 500, the USD/JPY bulls will have a great opportunity to continue their rally.

Technically, on the weekly chart of the analyzed pair, there was a false breakdown of the lower limit of the long-term consolidation range of 105-114. The bears' inability to implement the "surge and shelf" pattern on a 1-2-3 basis indicates their weakness. To continue the upward movement, buyers must take control of the levels of 108.5 and 109.6.

USD/JPY, weekly chart