Hello, traders!

The situation with the spread of the coronavirus epidemic forces the central banks of the leading economic powers to take necessary and urgent measures to protect the economy of their states.

So, on Sunday, unexpectedly and again in an emergency, the Federal Reserve System (FRS) lowered the main interest rate to 0%-0.25% and announced an increase in its balance sheet by $700 billion.

There is little doubt that the rest of the world's leading central banks will follow the Fed's example. What to expect from the main currency pairs in this situation is absolutely unclear.

We can only assume that there will be virtually no appetite for risk, and the Japanese yen, Swiss franc and the same US dollar will be in greatest demand. As we can see, the situation is unusual and the rate cut is perceived as a measure to support or save the economy, so these measures do not lead to a strong and stable fall in currencies, in particular, the US dollar.

In this case, we can rely on technical analysis, which will most likely indicate the further direction of the quote.

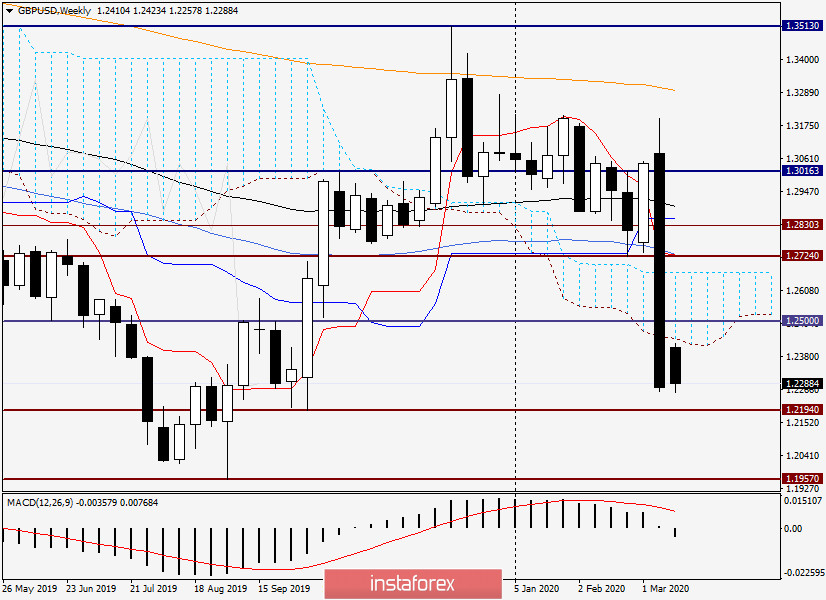

Weekly

Last week, the pair not only declined, but it also collapsed! During the fall, the 89 exponential moving average, Tenkan and Kijun lines of the Ichimoku indicator were broken, after which the pair entered and exited the Ichimoku cloud, closing trading on March 9-13 under its lower border.

A clear bearish scenario, which was not changed even by the unexpected decision of the Fed on Sunday to lower the refinancing rate again. If the collapse of the British currency continues, the pound/dollar pair will go to support at 1.2194, in order to test it for a breakdown. If this mission is successfully completed, the pound bears will lower the quote to the landmark psychological and technical level of 1.1000, the breakdown of which will finally indicate the bearish prospects for sterling.

However, the pound is still that figure! The slightest positive and change in market sentiment can lead to a sharp and strong growth of the "British". This has happened many times in my memory.

In the meantime, at the time of writing, the pair is rewriting the previous lows at 1.2261. The exchange rate has already fallen lower and visited 1.2258, but at the time of writing, there is a rebound and GBP/USD is trading near 1.2300. It is a difficult situation when there was almost no correction after a strong fall, and it is dangerous and risky to sell at the minimum values.

Let's see what the picture is on the lower timeframes.

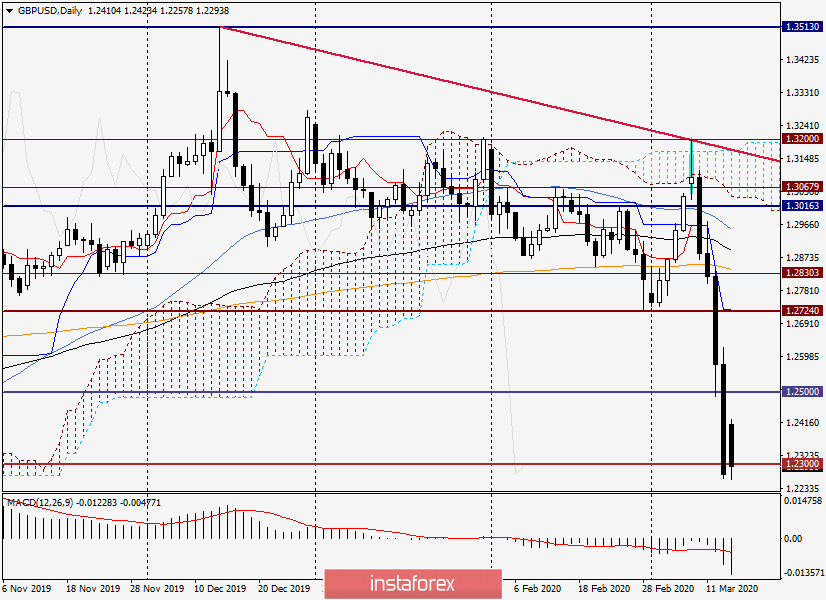

Daily

Judging by the picture on the daily chart, the mark of 1.2300 is the level that the pair is trying to cling to. If today's trading on GBP/USD ends above 1.2300, and the candle is formed in the form of a reversal, we can expect an adjustment of the exchange rate to 1.2430 and 1.2500. Returning and fixing above the important technical and psychological level of 1.2500 will open the way to higher correction goals, among which it is worth highlighting 1.2580, 1.2620 and 1.2700.

The continuation of the bearish scenario is signaled by the closing of daily trading below the previous lows of 1.2261. However, trading is so volatile and unpredictable that any news and/or comment about coronavirus can significantly change the situation on the market. Based on this probability, we must be prepared for everything and consider both scenarios. Although it is clear that in the current situation, the pound is under very strong pressure and the chances of a further decline in the GBP/USD are high. However, I do not recommend selling near the minimum values. In the case of a strong rebound or correction of the exchange rate, you can fall under a significant drawdown. And this is at least.

If you go back to the monetary policy of the world's leading central banks, there is little doubt that in the very near future, the Bank of England will follow the example of the Fed and once again reduce the main rate, especially since such hints have already been made.

By trading ideas. Naturally, the main one remains sales, which are better to open after corrective pullbacks to the levels of 1.2480 and 1.2515.

In the case of a more significant exchange rate adjustment, you can look at the opening of short positions after the price rises to the area of 1.2580-1.2620.

Purchases are too risky, and there are no corresponding signals for opening long positions yet.

Success!