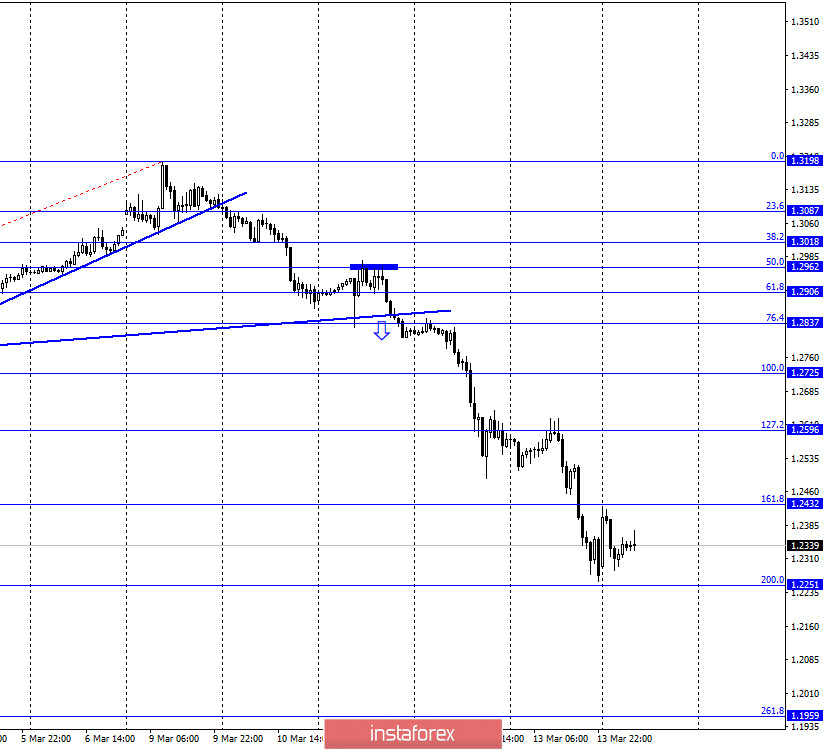

GBP/USD – 1H.

Hello, traders! Unfortunately, all global markets are now driven solely by news about the spread of the coronavirus, as well as news related to measures taken by the Central Bank and governments to stop the spread of the epidemic and mitigate its consequences. For the second time, the Federal Reserve did not wait for a scheduled meeting and again lowered the rate in an emergency mode - this time by 100 points. Thus, now the UK and the US have the same base rate - 0.25%. At the same time, Boris Johnson in the UK suggests isolating all people over the age of 70 at home. According to the hourly chart, the quotes of the pound/dollar pair performed a fall to the Fibo level of 200.0% (1.2251). Despite the important decision of the Fed this night, bull traders are not in a hurry to buy the British pound yet. Fixing the pair's exchange rate below the Fibo level of 200.0% will increase the probability of a further fall in the direction of the next corrective level of 261.8% (1.1959).

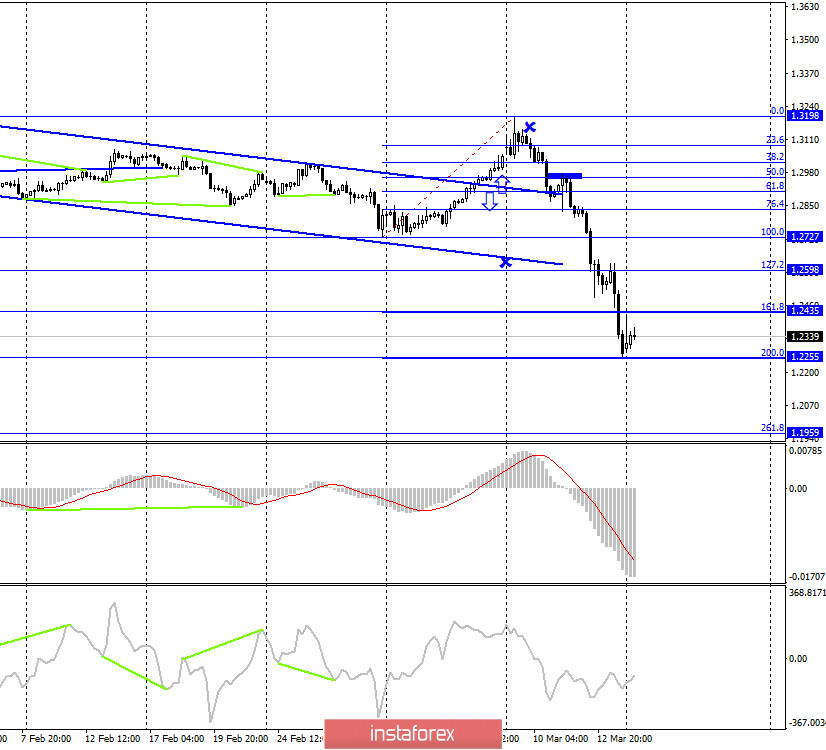

GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a fall to the same corrective level of 200.0% (1.2255). The rebound of quotes (inaccurate) from this Fibo level worked in favor of the British, but so far the growth of quotes is very sluggish and weak. Thus, the readings of the two lower charts coincide and imply further growth if bear traders fail to close below the Fibo level of 200.0%. Today, the divergence is not observed in any indicator.

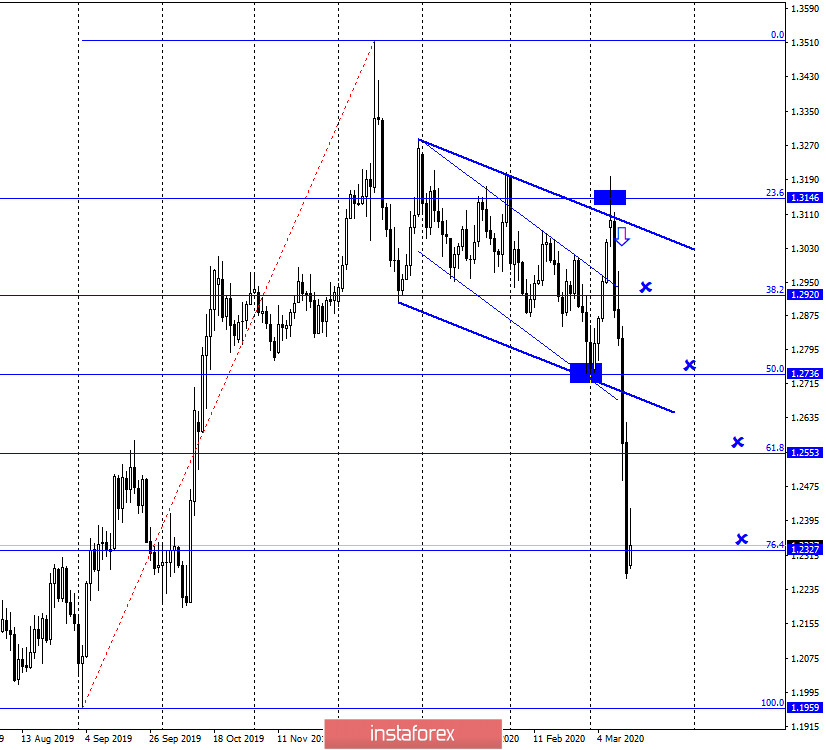

GBP/USD – Daily.

On the daily chart, the graphic picture remains the most interesting and impressive. All the previous target levels, which I gave on the signal about the rebound from the corrective level of 23.6% (1.3146), have been fulfilled. The collapse has now stopped near the corrective level of 76.4% (1.2327). However, if the quotes close below this level, the probability of a new fall with the goal of the Fibo level of 100.0% (1.1959) will increase many times. There are no new graphical constructions at the moment.

Overview of fundamentals:

on Friday, there was no important news from the US and the UK. Both countries continue to fight the infection, closing borders, air traffic, and taking internal measures to stop the spread of infection. Tonight, the Fed decided to cut the interest rate by another 100 points. However, as we can see, traders are not particularly impressed with this decision and demand for the US dollar remains. The COVID-19 virus continues to spread, and it is not yet clear when the authorities will be able to defeat the disease. Thus, all currency, stock, and commodity markets remain in a state of shock and danger. Surprises and unexpected movements are possible and highly possible.

The economic calendar for the US and the UK:

On March 16, important economic reports and events are not included in the calendar of the UK and the US.

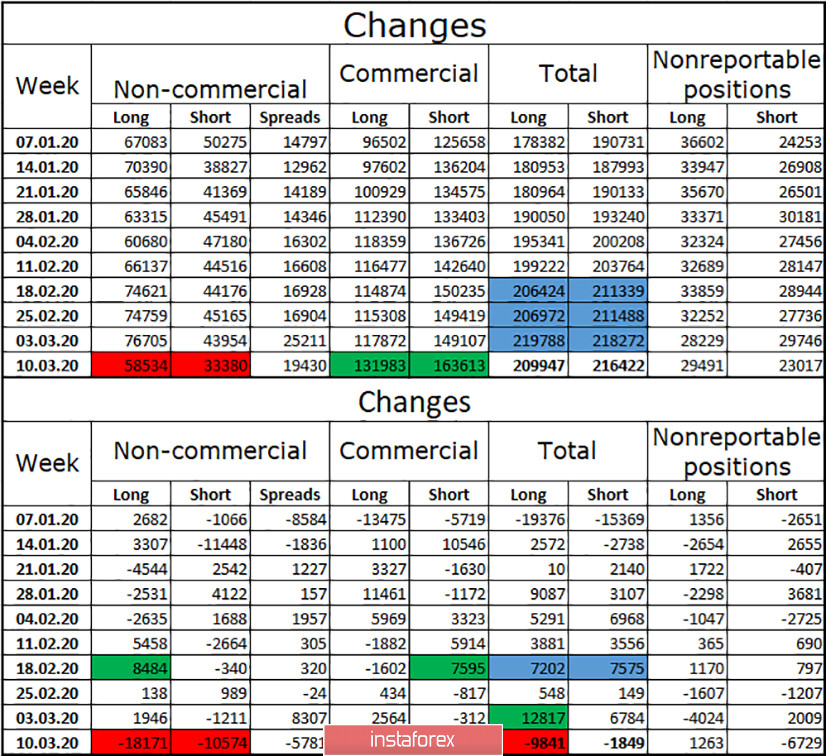

COT report (Commitments of Traders):

A new report from Commitments of Traders showed that the growth rate of Long and Short positions among speculators has decreased. But they have increased for hedgers. Thus, the total number of contracts for buying and selling among major players has again remained almost unchanged, only slightly decreased. First of all, due to Long positions, which is not surprising, given the strong collapse of the British dollar's quotes. Given the fact that speculators were particularly eager to reduce their Long positions, we can assume that the "bearish" mood will continue. However, almost complete equality in the total number of Long and Short can cause a pullback of quotes up, in other words, the new growth of the pound/dollar pair. The situation is now confusing, and graphical analysis does not give clear signals to buy or sell.

Forecast for GBP/USD and recommendations to traders:

I believe that in the current conditions, opening any transactions is still associated with high risks, as the market remains in a state of shock. In my opinion, for new sales of the British dollar, you need to wait for the consolidation of quotes under the Fibo level of 200.0% (1.2251) on the hourly chart. Purchases look more promising, but there are no specific signals right now.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.