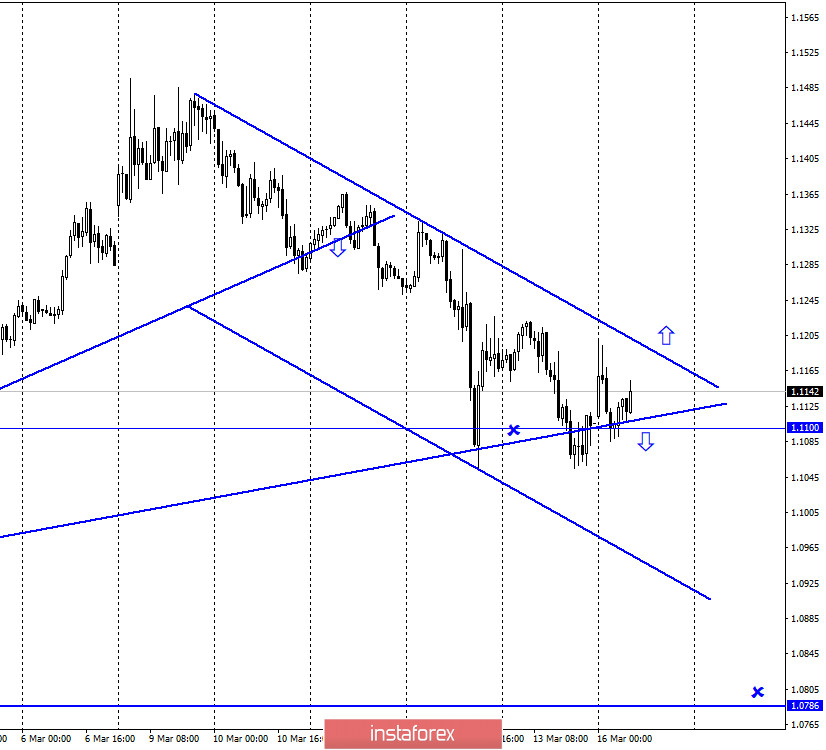

EUR/USD – 1H.

Hello, traders! March 13 was another shocking day for global markets. Stock markets continue to fall, and there is no positive news about the fight against coronavirus. Thus, the fall in quotations continued on Friday. A new downward trend corridor was formed on the hourly chart, which defines the current mood of traders as "bearish". However, the upward trend line remains in effect, around which the euro/dollar pair was trading both on Friday and today. Thus, now I am inclined to the option that the pair will perform a close over the trend corridor, which will serve as a signal to traders to buy and maintain a more global "bullish" mood of traders.

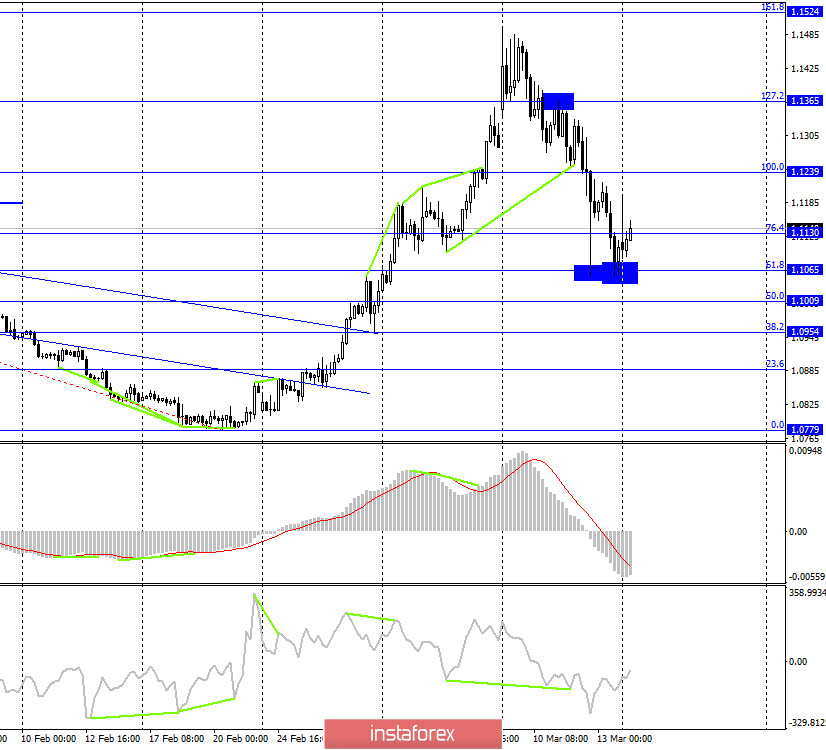

EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed the second fall to the corrective level of 61.8% (1.1065) and the second rebound from this level. Thus, a reversal was made in favor of the EU currency and the growth process began, which can last quite a long time. Although traders remain in a state of shock, certain graphical models still continue to work. I would say that the European currency now has a high chance of returning to the highs of the year. There are no pending divergences in any indicator. The rebound of quotes from the Fibo level of 61.8% is considered as a signal to buy.

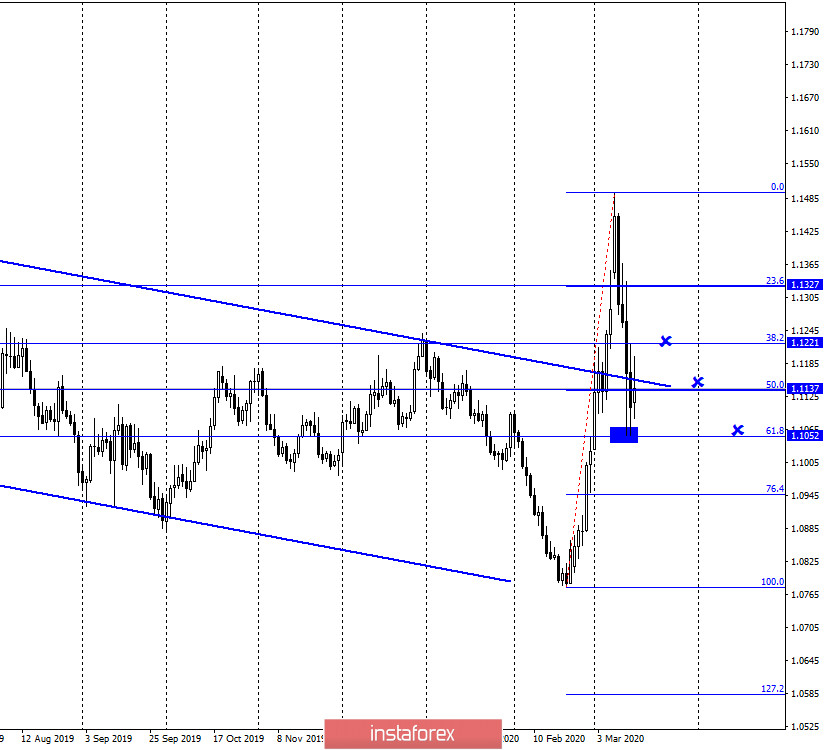

EUR/USD – Daily.

As seen on the daily chart, the euro/dollar pair performed a fall to the corrective level of 61.8% (1.1052) (the same Fibonacci grid as on the 4-hour chart), so the picture here is identical to the younger chart. The same rebound of the pair's quotes and the same high chances of a long-term growth of quotes. The Fed, by the way, by lowering the interest rate by another 1% today, very much increases the probability of a fall in the US currency. And not just in the short term.

EUR/USD – Weekly.

On the weekly chart, the target of 1.1600 (approximate) remains in effect. Thus, if the buy signals on the lower charts are worked out, then the level of 1.1600 will be the final and very realistic goal for bull traders. Of course, the markets as a whole remain in a state of shock, and the actions of the world's central banks, which have regularly lowered rates in the past two weeks, do not add stability and calm. Thus, it is possible that there will be surprises in the pair's movement.

Overview of fundamentals:

On March 13, traders could pay attention to the consumer price index in Germany and the consumer sentiment index in the United States. However, both reports are now of such low significance that it is unlikely that any of the traders even remember that they came out. The market is now quoted events such as the actions of the Central Bank or global changes in stock and commodity markets, and not inflation in Germany...

News calendar for the United States and the European Union:

On March 16, important economic reports and events are not included in the calendar of the European Union and the United States.

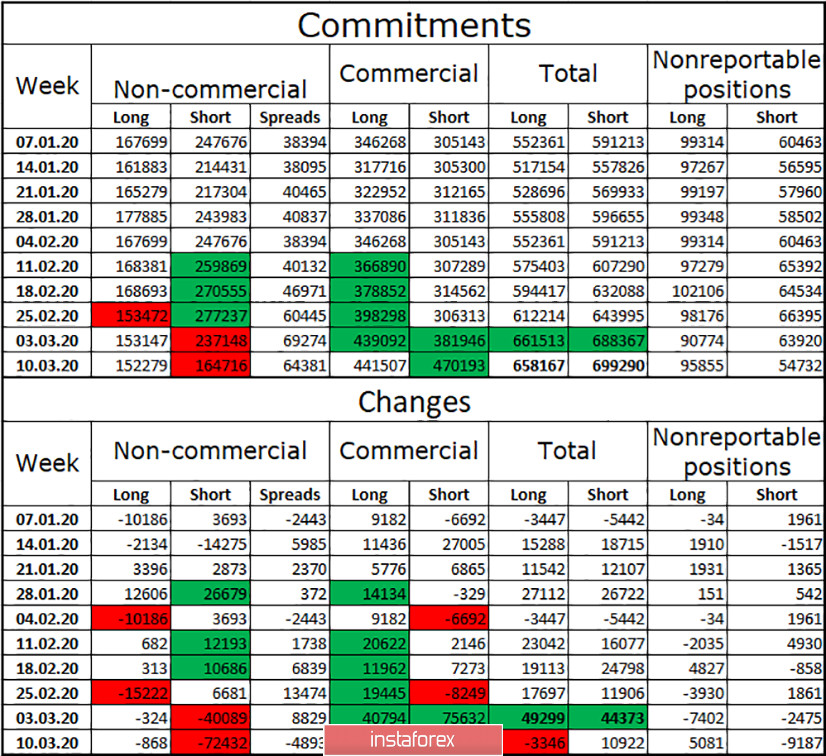

COT report (Commitments of Traders):

The new COT report is out! There is nothing surprising in it. Given that this report comes out three days late, I could already conclude that the total number of Long positions decreased among the major players, and Short positions increased, given the strong fall in the European currency quotes over the past week. However, there are also points that need to be highlighted. First, the total number of contracts continues to grow. That is, the activity of traders does not fall. Second, speculators get rid of Short positions and they are immediately picked up by hedgers. This suggests that market players who specialize in making profits from currency operations do not believe in a further fall in the euro currency. According to our observations, it is speculators who drive the market, and hedgers generally open opposite positions to insure against possible risks. Thus, given the strong reset of Short positions by speculators, I would say that there is a high probability of euro growth in the next week

Forecast for EUR/USD and recommendations for traders:

For the EUR/USD pair, there are now good chances to start a new upward trend. The overall correction from the previous upward trend was 61.8%. Thus, the growth right now highly likely, and several signal-to-purchase is already available. The targets are 1.1365 and 1.1524. Thus, I would now recommend buying the euro currency. Closing on the hourly chart above the descending corridor will significantly increase the probability of further growth.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.