Panic continues to dominate the markets. Oil again plunged under the 30-dollar mark, and Wall Street again suspended trading today: the Dow Jones index almost immediately after opening had slumped by 9.7% (the largest daily fall since 1987), the S&P 500 – by 8.1%, NASDAQ – by 6.1%. This is the third time that trading has been suspended in the past six days.

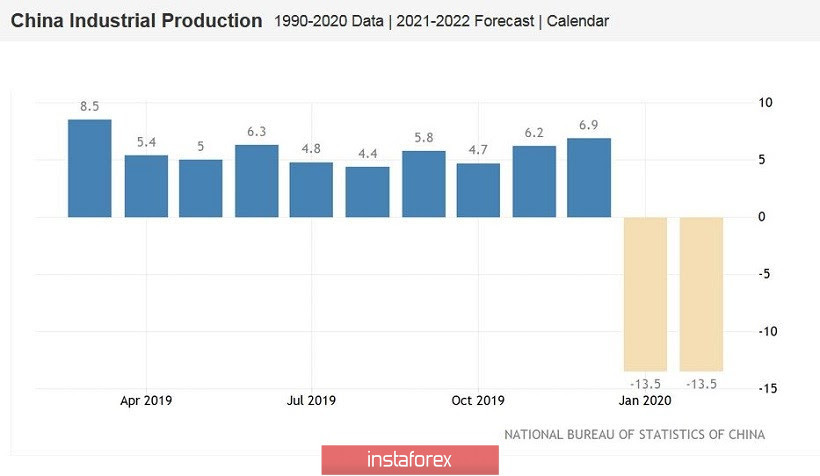

The market is quite sensitive to recent events related to the spread of coronavirus. The negative consequences of the epidemic are gradually reflected in key macroeconomic reports. For example, today it became known that industrial production in China collapsed by 13.5%. This is a historical anti-record: since January 1990, that is, since the beginning of observations, this indicator has not fallen or even approached the designated mark. For comparison, as recently as last December, the indicator grew by 6.9%, reaching an 8-month high. It is noteworthy that in February, experts expected a weak, but still growth (by one and a half percent), so today's result literally stunned market participants. In addition, other indicators also disappointed. Investment in fixed assets fell by almost 25% (in annual terms), and retail sales fell immediately by 20.5%, with growth forecast to reach 0.8%.

The decline in consumer activity is obvious – in February, the Chinese avoided (in some cases – forcibly) sites with a large crowd of people, so they stopped visiting shopping centers, restaurants and cinemas. The epidemic also triggered unemployment, which rose from the December level of 5.2% to the February value of 6.2%. According to experts, the recovery of the Chinese economy will take months, while the spread of COVID-19 around the world could trigger a global recession, which, in turn, will lead to a decrease in demand for Chinese goods.

Air carriers are also sounding the alarm. The CAPA aviation center, which is based in Sydney, Australia, published a report yesterday that the coronavirus pandemic will lead to the bankruptcy of most airlines around the world. According to their calculations, this will happen before the end of May, if they do not receive support from their state. According to specialized experts, many airlines have already faced technical bankruptcy or are experiencing problems with paying debts. Cash reserves of airlines are rapidly losing weight due to flight cancellations and a sharp drop in demand for air travel.

This fundamental background supports the degree of heat in the currency market. The number of cases and deaths is growing worldwide, while scientists promise to develop a vaccine against COVID-19 no earlier than 2021. Many states of the world are imposing strict restrictive measures, and some of them have already introduced a state of emergency. European Commission chief Ursula von der Leyen today announced that Brussels will impose a 30-day ban on entering the European Union without a valid reason. The iron curtain was lowered in America – where the number of infected reached almost four thousand.

Central banks of the world's leading countries keep their finger on the pulse of events: on Sunday, the Federal Reserve lowered the interest rate by one hundred basis points, while simultaneously deciding to resume the quantitative easing program. Following the Fed, the Reserve Bank of New Zealand made a similar decision. At the end of last week, the Bank of Canada unexpectedly cut the rate by 50 points, while the Bank of Japan only announced an increase in stimulus measures.

It is worth noting that, despite the continued growth of anti-risk sentiment, the dollar froze in place. For example, the EUR/USD pair today shows increased volatility – if the low of the day was at 1.1085, then the daily high was indicated by buyers at 1.1237. After the Fed cut the rate by 100 points at once, traders cannot crystallize their attitude to the US currency. During the previous week, the greenback was used by the market as a defensive asset, due to which it swept away everything in its path, updating multi-week, multi-month, and in some cases (as in the case of NZD/USD) and multi-year highs. But today, the market was again in favor of the yen, which looks most attractive amid the half measures taken by the Japanese regulator. That is why the USD/JPY pair fell by more than 200 points today, continuing to show a bearish mood.

Meanwhile, the EUR/USD pair froze in the middle of the intraday range, as if waiting for another information push in one direction or another. In the near future, one of two possible scenarios will be implemented – either the dollar will regain its status as a defensive instrument, or it will again be under powerful pressure, when panic moods will be interpreted not in its favor, but vice versa. If the first option is implemented, EUR/USD bears will test the support level of 1.1050 again. Otherwise, we expect a large-scale price correction, which may lead buyers of the pair to the level of 1.1275 (the Tenkan-sen line on the daily chart).