The euro was able to recover its positions slightly, but the pound, along with other commodity currencies, continued to decline against the US dollar. G7 leaders held a meeting, which resulted to an agreement of using all available fiscal and monetary policy tools to fight against the coronavirus pandemic. They also touched on the creation of the vaccine, as well as on providing assistance to companies affected by the COVID-19 pandemic.

In his speech yesterday, Donald Trump said that the government is ready to do whatever it takes, expressing hope for a better outcome. He also expects that the coronavirus outbreak will end in July-August this year, but much will still depend on the development of a vaccine, which, as of now, has not been created yet.

Meanwhile, the Eurozone also held a meeting yesterday, which focused on the fight against the coronavirus. It established that EU finance ministers must do whatever it takes to restore confidence and maintain rapid growth, but this requires ambitious and coordinated measures. Overall fiscal support for the economy should be very tangible, and the amount of aid should be increased in the future.

Unfortunately, neither the G7 meeting, Trump's statements, nor the Eurozone meeting managed to calm the markets. Both the indices and commodity markets continue their collapse, as monetary stimulus alone will not be enough to ease the financial crisis. Now, a lot depends on the changes that will be adopted in the fiscal policy, as well as on the actions of virologists. The sooner a vaccine is found, the faster the markets will recover and return to the path of recovery. For now though, the situation will only get worse, as the peak of the spread of the virus has not yet arrived.

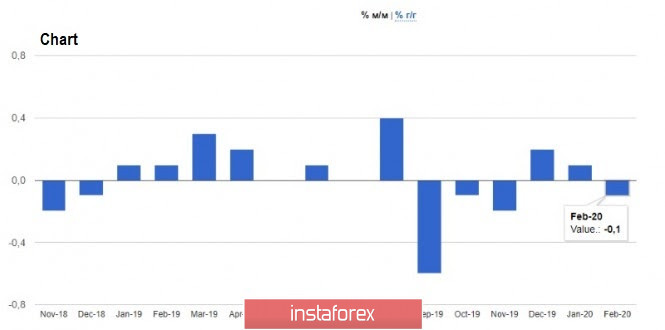

Although yesterday's fundamental data indicated a deterioration in the economy, it did not significantly affect the markets. Istat reported that consumer prices in Italy decreased by 0.1% in February 2020, as compared to the index' result in January. The drop was due to a slight decline in prices for transport services and energy. If compared though to the same period of the previous year, the index actually increased by 0.3%. Nevertheless, EU's inflation fell by 0.5% as compared to January, and increased by only 0.2% as compared to February of the previous year.

The industrial activity in the area of the Federal Reserve Bank of New York's responsibility declined sharply due to the spread of the coronavirus. According to the preliminary data, the manufacturing index fell from 12.9 points in February, to -21.5 points in March. Economists expected the index to fall to only -5.1 points.

At the same time, the New York Fed also announced an unscheduled $ 500 billion REPO operation, saying that this measure is aimed at supporting short-term financing markets.

As for the current technical picture of the EUR/USD pair, most likely, weak reports on the Eurozone and US economies will be used by investors as a reason to buy safe haven assets. Unfortunately though, the US dollar may follow gold's path of being unpopular at this situation, even though it is one of the safe haven assets. Meanwhile, in the short term, a return to the support level of 1.1155 will lead to a repeated decrease of risk assets to the low of 1.1060, where the breakout of which will increase the pressure on the pair, opening a direct path to the support area of 1.0990 and 1.0910.

GBP/USD

The pound remains under pressure amid the spread of the coronavirus. As a result, the Bank of England will most likely follow the example of the US Federal Reserve, and reduce its key rate to zero. It may also launch a quantitative easing program, which will not support the pound, but will instead lead to even more pressure on the GBP/USD pair. It may return the trading instrument to the lows of last year and will most likely collapse the currency (the pound) even lower.

Since the Bank of England and the European Central Bank have almost no space left to ease the monetary policy, serious fiscal policy interventions are required to stimulate growth. These measures include a reduction in value-added tax, and a broader program to support companies facing a sharp decline in their revenue.

As for the technical picture, so far, there is no gap for correction nor recovery of the GBP/USD pair. A break in the support of 1.2195 will only increase the pressure, leading to an update of the lows of 1.2150, 1.2060 and 1.2015. In the scenario of an upward correction, buyers' problems will begin in the resistance area of 1.2400 and 1.2515.