4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - downward.

CCI: -122.0091

The British pound did not pay any attention to Monday, March 16, to a rather high-profile event - the reduction of key Fed rates. The GBP/USD currency pair just calmly continued its downward movement as if nothing had happened. At the moment, the quotes have fallen to the Murray level of "0/8"-1.2207. There are certain hopes for a rebound from this level. A technical correction has been brewing for several days in a row, but given the panic prevailing in all markets, there are no fundamental or macro-economic movements now. Thus, it is the technical factors that are most effective now. Therefore, it is not recommended to expect a corrective movement until the fastest Heiken Ashi indicator turns up.

On Tuesday, March 17, we do not expect any changes in the currency market. If yesterday, when there were good reasons for the pair to go into an upward correction, nothing happened, today the chances of an upward movement are even less. There is no logic in the movement of the currency market now. Two weeks ago, the euro and the pound were growing. They grew so much that most traders gave up on the US currency. Now both the euro and the pound are declining. And if the European currency is still trying to balance on the edge of the abyss, the pound falls into the abyss non-stop. It is impossible to answer the question of why the British currency is falling. It seems that Britain is not the leader in the number of infected people. The Bank of England, like other central banks, lowered its key rate to support the economy. It seems that traders, selling the pound, immediately remembered all the factors that we have repeatedly listed, calling them "extremely negative" for the pound. There were quite a lot of these factors, they are related to Brexit, the consequences of Brexit for the UK economy, the London-Brussels negotiations on a trade agreement, and so on. And now traders seem to work out all these factors at once, logically believing that it is best to get rid of the currency, from which even if you win over the coronavirus, you do not have to wait for something positive. And it is also impossible to say now how much the pound will fall. Of course, we could expect a certain slowdown in the fall of the pound/dollar pair. For example, if the markets began to calm down. However, why should markets now start to return to normal? Stock markets fell again on Monday, oil resumed its decline, and China's macroeconomic statistics showed the world exactly what kind of reduction is waiting for almost every country "thanks" to the epidemic. At the end of February, industrial production in China fell by 13.5% y/y, and retail sales fell by 20.5%. This is just a huge decline.

Today, the UK will publish data on the unemployment rate, average wages, and applications for unemployment benefits. In normal times, these three reports would definitely provoke a reaction from market participants. However, now, in times of general panic, we believe that there will be no reaction to them. According to experts' forecasts, unemployment in January will remain unchanged - 3.8%, the number of applications for unemployment benefits will be 21,400, and the average wage will grow by 3%. However, it should be borne in mind that all these data relate to January, that is, the time when the coronavirus epidemic has not yet reached the European Union. Thus, the real deterioration of economic indicators should be expected by the end of February or even March.

At the same time, British Prime Minister Boris Johnson urged all residents of the country to avoid social contacts, not to visit clubs, theaters, pubs and any places where people gather unless absolutely necessary. Boris Johnson, in his address to the nation, called for working from home and canceling any trips. According to the Prime Minister, these measures will help reduce the burden on the National Health System, which may experience serious difficulties with equipment and the number of beds in hospitals if the epidemic continues to spread. In the UK, as of March 16, the number of infected people is 1,551.

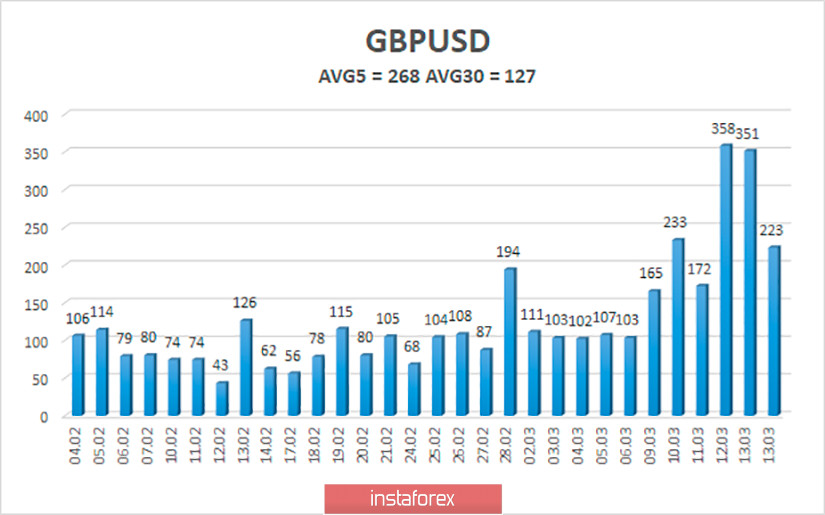

The average volatility of the pound/dollar pair over the past 5 days is 268 points and continues to grow. The penultimate two trading days were absolutely record-breaking for the pound - 350 points were passed for each day. With that in one direction. On Tuesday, March 17, we expect the pair to move within the volatility channel of 1.1996-1.2532. The pair is likely to move towards the lower border again, as the Heiken Ashi indicator is still directed downwards.

Nearest support levels:

S1 - 1.2207

S2 - 1.2085

S3 - 1.1963

Nearest resistance levels:

R1 - 1.2329

R2 - 1.2451

R3 - 1.2573

Trading recommendations:

The GBP/USD pair continues its strong downward movement. Thus, the current sales of the pound remain relevant with the targets of 1.2207 and 1.2085, before the reversal of the Heiken Ashi indicator to the top. It is recommended to return to purchases of the British currency with the target of 1.2817, not before fixing the price above the moving average line, which is not expected in the near future for obvious reasons (the price is too far from the moving average). We remind you that in the current conditions, opening any positions is associated with increased risks.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.