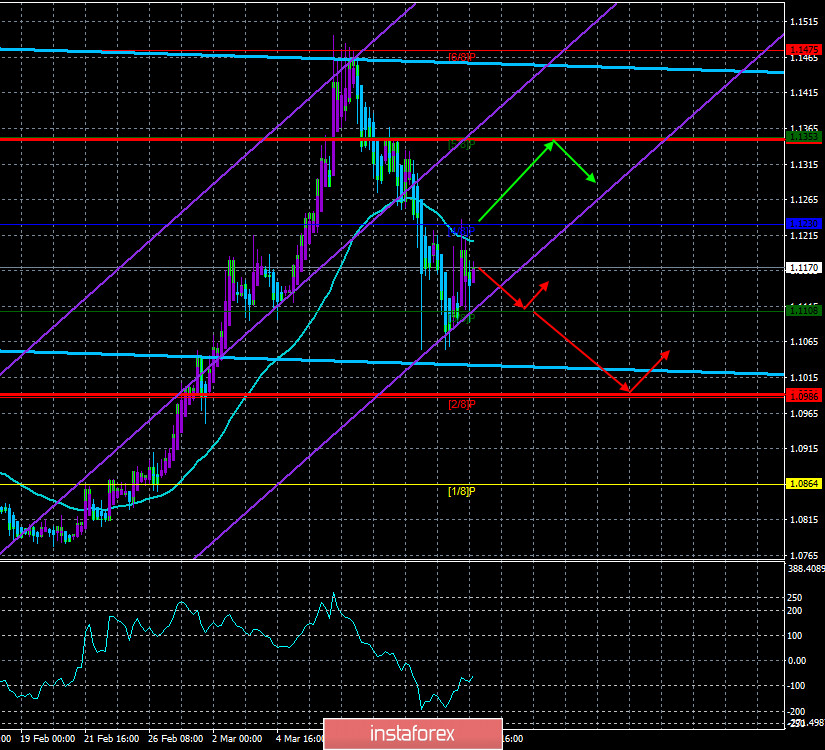

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - downward.

CCI: -58.2580

The currency pair on Monday, March 16, successfully corrected to the moving average line. A rebound from the moving average may trigger a resumption of the downward trend, but the pair failed to gain a foothold below the Murray level of "3/8". The currency market remains in a state of panic, although yesterday was clearly calmer than the previous day. However, this does not mean that the situation is beginning to stabilize. American stock markets continue to fall down, "black gold" - cheaper, and the currency market remains in chaos.

As we have already said, there was no special reaction to the Fed's decision to lower the key rate by 100 basis points at once. Traders simply ignored this information, only formally correcting the euro/dollar pair. However, we all understand that the correction would have been almost in any case, and 100 points of growth in the current conditions are just a "weak movement". Thus, we can even say that the unscheduled meeting of the Fed was left without the attention of traders. Unfortunately, it is the coronavirus that is now the number 1 topic in the world. Over the weekend, we recorded 160,000-165,000 cases worldwide. On Monday, March 16, the figure is already 175,000. Thus, the coronavirus continues to spread, throwing more and more market participants into a panic. However, despite the completely unoptimistic statements of Boris Johnson and the data from secret documents of the British Ministry of Health, we believe that we will be able to defeat the epidemic. Thus, sooner or later everything will return to normal, the only question is when it will happen... According to the latest data, the number of infected people in Italy has increased to 25,000, in Spain - to almost 10,000, in Germany - to 7,000, in France - to 5,500. Thus, the largest EU economies will now face serious difficulties. We have already written about Italy several times. The country is essentially isolated from the outside world. However, it is not only Italy that suffers, but, in principle, any country where at least a few dozen cases of coronavirus have been recorded.

In the current environment, macroeconomic statistics remain a completely unimportant factor. However, it should not be completely ignored. Sooner or later, everything will get better, and then it will be necessary to re-analyze the economic indicators of the European Union and the United States. We are also waiting for the first indicators for March, which should show how much the epidemic affects the economies of the EU and the US? To date, the EU planned to publish the current economic conditions in Germany (decrease from -15.7 to -30 is forecasted), the index of business sentiment in Germany (decrease from 8.7 to -26.4 is forecasted) and the European economic sentiment with an unexpected forecast of 35.4 in March with the February value of 10.4. These indicators from the ZEW Institute reflect the mood of investors. They are not important or significant.

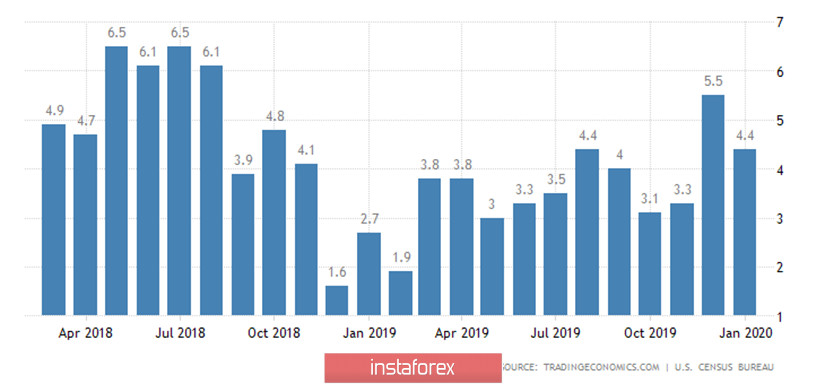

But the February retail sales figure in the US is a more important report. According to experts, in February, an increase of 0.2% m/m will be recorded. The retail control group should show an increase of 0.4% and retail sales excluding cars - 0.2%.

In addition to retail sales, the most important report will be published. Since any crisis primarily affects industrial production, it is this indicator that causes the greatest interest. Especially since it has been steadily declining in the States over the past year and a half. Now that the full-scale crisis has begun, the rate of production growth may collapse. However, this will most likely happen at the end of March. In February, it is expected to increase by 0.4% on a monthly basis and declined by 0.3% on an annual basis.

Unfortunately, these publications are likely to be a mere formality, and there will be no market reaction to them. We would like to draw the attention of traders to one very important fact. Over the past 2 years, we have repeatedly said that the US economy looks much stronger than the European one. The Fed's monetary policy is much stronger than the ECB. Accordingly, it was in the United States that investor money was poured all this time, it was the US dollar that was bought on currency exchanges in large volumes for conducting transactions in America. Now the Fed has lowered rates to almost zero and thus equaled (almost) the European Central Bank. A small gap, of course, remains, but now it is insignificant. Thus, both American companies and the US currency are not so attractive for investment. Accordingly, the long-term dollar trend can be completed. Of course, you need to make allowances for the epidemic. Because we don't know when it will end or how it will end. Thus, the balance of power between the euro and the dollar, between the EU and the US may still change repeatedly. But at the moment, the situation is as follows.

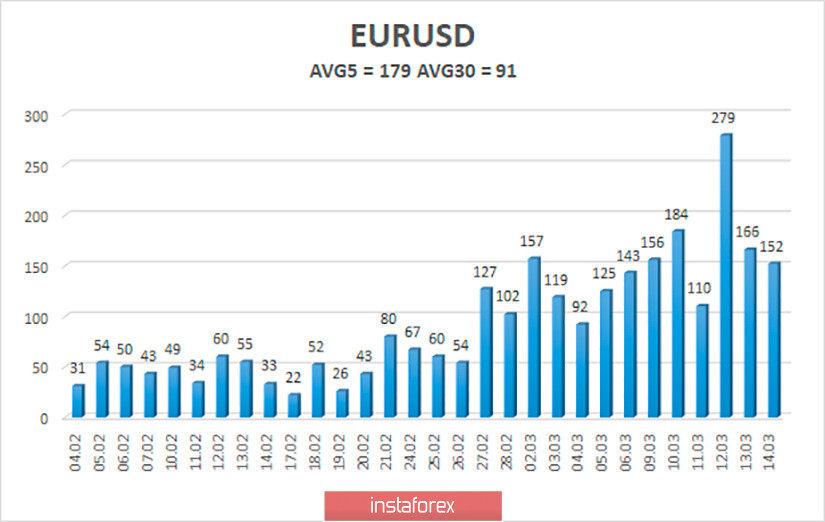

The average volatility of the euro/dollar currency pair remains at record values and continues to grow. At the moment, the average value for 5 days is 179 points. Markets remain in an agitated state and can move in any direction with renewed vigor at almost any moment. Thus, on Tuesday, we again expect a decrease in volatility and movement within the channel, limited by the levels of 1.0991 and 1.1349.

Nearest support levels:

S1 - 1.1108

S2 - 1.0986

S3 - 1.0864

Nearest resistance levels:

R1 - 1.1230

R2 - 1.1353

R3 - 1.1475

Trading recommendations:

The euro/dollar pair started to adjust. Thus, traders are recommended to resume selling the euro with the targets of 1.1108 and 1.0991 after the reversal of the Heiken Ashi indicator down, which will indicate the completion of the correction. You will not be able to buy the pair until the price reverses above the moving average line with the first target of 1.1349.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.