To say that the Sunday's emergency meeting of the Federal Committee on Open Market Operations, during which the refinancing rate was reduced once again, surprised the market, is the same thing to say nothing at all. The market expected that on March 18, during a planned meeting of the Federal Committee for Open Market Operations, the refinancing rate would be reduced from 1.25% to 0.50%. But the week for everyone began with the fact that the Federal Reserve did not wait and reduced the refinancing rate three days earlier. Yes, not even up to 0.50%, but up to 0.25%. And what are you supposed to think about it? That everything is so terrible that it is necessary to take such drastic measures in a hurry? And then what?Will they turn on the printing press and throw money from helicopters, following the precepts of Saint Ben Bernanke? In short, there are more questions than answers. And the questions themselves scare to death. Thus, it is not surprising that the currency exchange market fell into a kind of prostration. Although the common European currency tried to even grow at first, but then, asking itself another extremely interesting question, it decided to go back. And the question is extremely simple - what will other central banks do now? All possible variations of the answer to this question do not inspire any optimism. The list of features is really impressive. Here, you have a reduction in refinancing rates of the European Central Bank and the Bank of England to negative values. And the inclusion of a printing press, called the beautiful term quantitative easing and a lot of other wonderful and interesting things. So, yes, it is completely unclear what to expect now.

At the same time, the purely economic situation in Europe, regardless of the epidemic of coronavirus, causes continuous concern and unrest in the minds. Inflation in Italy declined from 0.5% to 0.3%, so the third euro zone economy is already one foot in deflation. And I want to note that this is data for February, when the coronavirus did not yet have the full power to fall on the heads of the descendants of the ancient Romans. Maybe only at the very end of February. In addition, we continue to observe how capital leaves the Old World, as the yield of European debt securities continues to go up. Thus, the yield on 3-month French bills increased from -0.668% to -0.608%. The yield on 6-month bills grew from -0.672% to -0.615%. Well, the yield on 12-month bills increased from -0.716% to -0.625%. Although, against the background of the radical actions of the Federal Reserve System and the practically inaction of the European Central Bank, we should have seen an escape from American debt securities. Moreover, the flight is in European debt securities.

Inflation (Italy):

But strangely enough, they run precisely in American debt securities. For example, the yield on 3-month bills of the United States government fell from 0.39% to 0.29%. The yield of 6-month bills decreased from 0.4% to 0.3%. Thus, investors continue to divert capital to the shining city on the hill. This is not surprising, since the bulk of capital circulating in the financial markets is controlled precisely by American funds and banks. And in times of complete confusion and uncertainty, any person tends to hide in the safest place, from his point of view. And most often a person considers such a place his own house. So capital continues to flow into the United States.

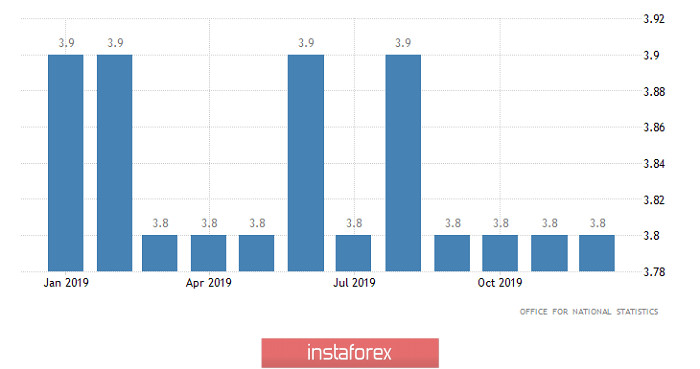

Nevertheless, the dollar may weaken a little today. And not only because of the banal overbought and overheated market. For example, data on the labor market will be published in the UK today, forecasts for which can be called moderately optimistic. Most importantly, the unemployment rate should drop from 3.8% to 3.7%. At the same time, the average wage growth rate is that with bonuses, that without them should remain unchanged. Of course, the number of applications for unemployment benefits can grow from 5.5 thousand to 24.0 thousand, and employment can grow by 150 thousand against 180 thousand in the previous month. However, the increase in the number of applications for unemployment benefits and the slowdown in employment growth amid extremely low unemployment and stable wage growth does not seem serious.

Unemployment Rate (UK):

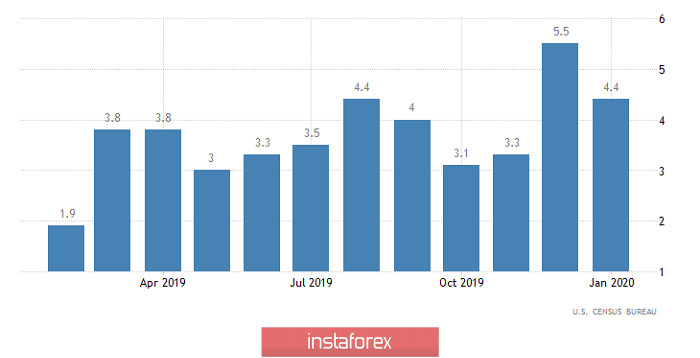

Meanwhile, for the American statistics, more precisely, forecasts for it, inspire certain concerns. In particular, the growth rate of retail sales may slow down from 4.4% to 2.7%, and given that consumer activity is the main engine of the US economy, it really disappoints. In addition, you need to know a lot about distortions in order to call optimistic forecasts for industrial production, the decline of which should slow down from -0.8% to -0.3%. You can talk about slowing down the recession as much as you like. However, this does not negate the fact that industrial production is declining. Moreover, if the forecasts are confirmed, then this will mean that this industry has been declining for six consecutive months.

Retail Sales (United States):

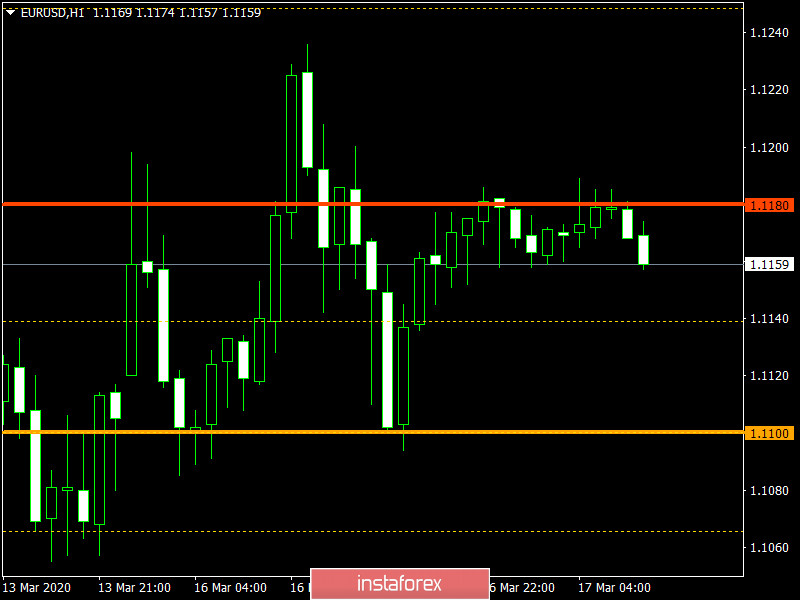

During the high activity, the euro / dollar currency pair managed to form a series of impulses, but as a result, the main concentration fell at the price level of 1.1180, where 1.1155 / 1.1190 stagnation was formed. It is likely to assume that the quote will not move within the given framework for a long time, where it is most logical to consider the tactics of breaking the boundaries of 1.1155 / 1.1190 with local trading operations.

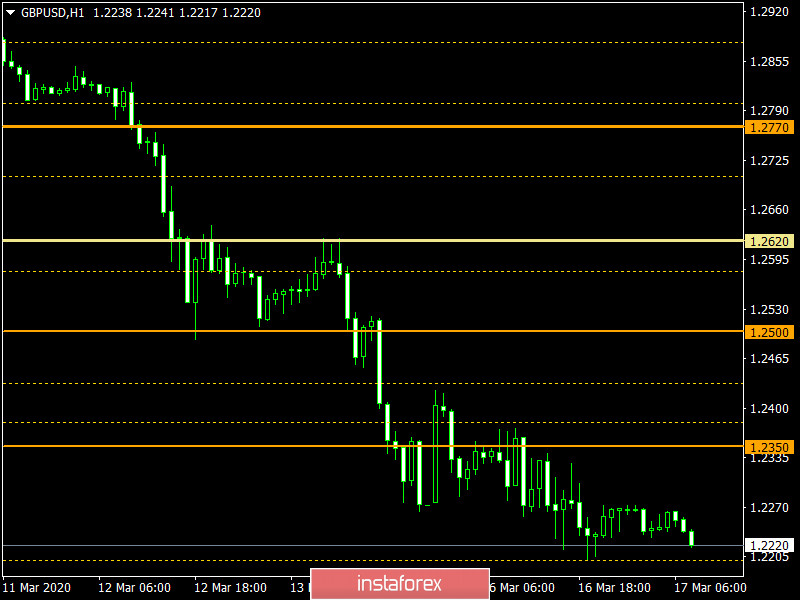

The pound / dollar currency pair maintains downward interest, dropping the pound sterling to the level of 1.2200, where a slowdown occurred within 1.2200 / 1.2270. It is likely to assume that the pullback is already technically close, where a rebound towards the level of 1.2350 is possible. At the same time, due to the high speculative interest, we can consider the tactics of breakdown of the set boundaries of 1.2200 / 1.2270, working at local positions.