Economic calendar (Universal time)

Among the most significant indicators of today's economic calendar are:

9:30 data on unemployment and average wages (UK);

10:00 German economic sentiment index;

12:30 data on retail sales (USA);

14:00 the number of open vacancies in the labor market (USA).

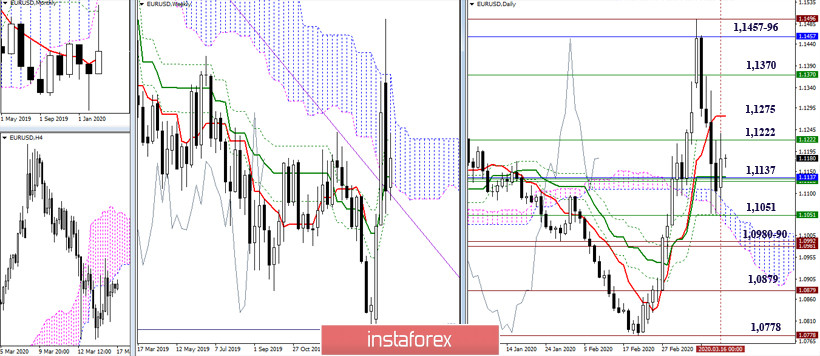

EUR / USD

The deceleration in the area of 1.1052 at the supports of the daily and weekly Ichimoku crosses, as well as the daytime cloud, remains. In addition, the inhibition is facilitated by the attractive force of a sufficiently large accumulation of levels of upper time intervals at the level of 1.1137. Breaking through these boundaries is becoming one of the main tasks for further strengthening the bearish sentiment. The following bearish landmarks can be noted at 1.0980-90 - 1.0879 - 1.0778 (historical levels + minimal extremes). While maintaining deceleration and the development of rebound from the met supports, the pair will test for resistance. The first 1.1222 (weekly Fibo Kijun) was tested yesterday, the next resistance is now located at 1.1275 (daily Tenkan), then the upper border of the weekly cloud (1.1370) and the area that combines the monthly Fibo Kijun (1.1457) and the current maximum extreme (1.1496) can come into operation.

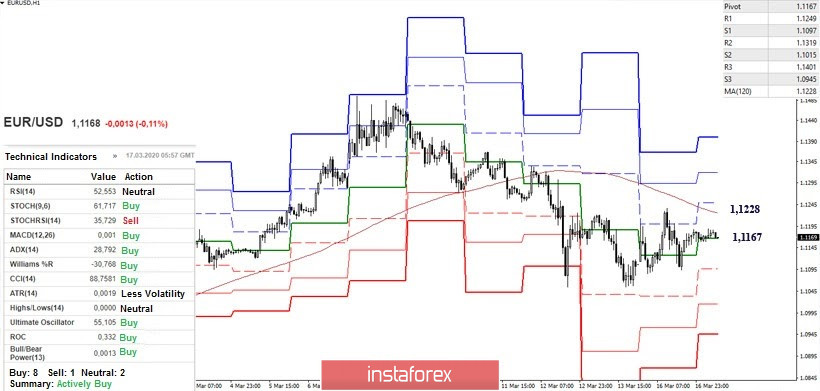

In the lower halves, the pair remains in the zone of influence of the central Pivot level (1.1167). Resistance to the weekly long-term trend is currently located at 1.1228. Consolidation above and reversal of moving will help strengthen the players on the rise, forming new upward benchmarks in front of them. Moreover, resistance within the day can be the classic Pivot levels 1.1249 - 1.1319 - 1.1401. At the same time, support for the classic Pivot levels are located today at 1.1097 - 1.1015 - 1.0945.

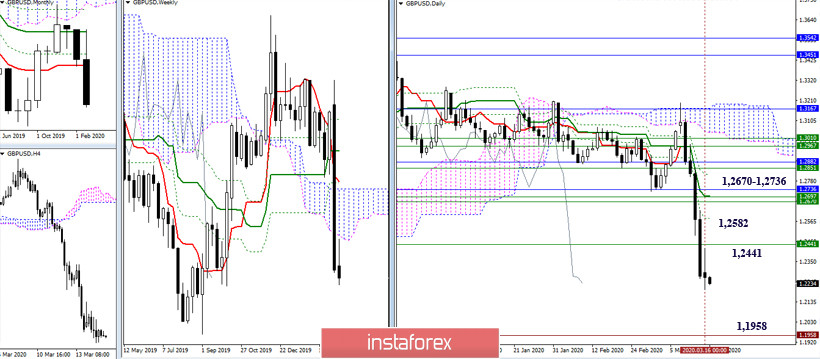

GBP / USD

The pair updated the low of last week, but no active decline has yet been observed, although players to decline retain all their advantages. The main bearish reference point now remains the minimum extremum (1.1958), which separates the pair from the restoration of the monthly downward trend. In this situation, resistances are located at 1.2441 (the lower border of the weekly cloud) - 1.2582 (daily Fibo Kijun) - 1.2670-1.2736 (accumulation of levels of high halves).

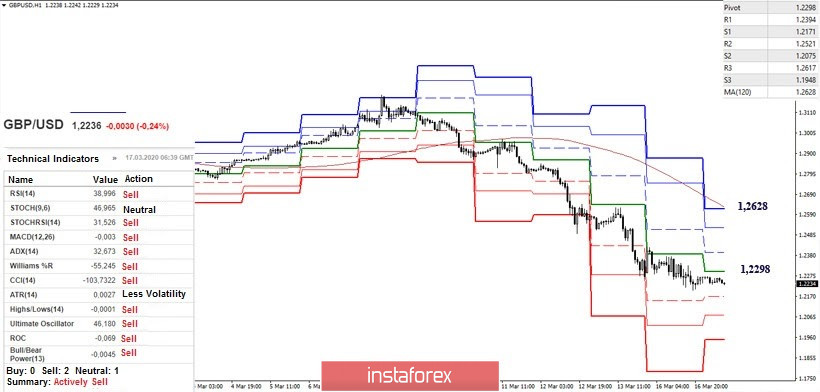

In the lower halves, the development of a downward trend movement retains all the advantages on the downside of the players, they are still supported by all the analyzed technical instruments. The reference points and supports within the day are the classic Pivot levels, located today at 1.2171 - 1.2075 - 1.1948. The first significant resistance to the developing correction is now at 1.2298 (central Pivot level). Consolidation above the level of 1.2298 will lead to the fact that the weekly long-term trend (1.2628) will become the main reference point for correction. Today, the nearest resistance can be noted at 1.2394 (R1) - 1.2521 (R2).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)