Economic calendar (Universal time)

The economic calendar is not so relevant and influential right now, more global things are moving the markets.

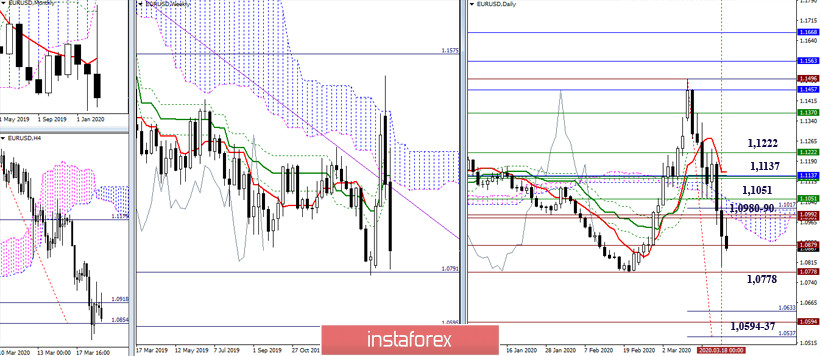

EUR / USD

Yesterday, the pair reached the target for the breakdown of the H4 cloud (1.0854), but could not reach the minimum extremum of 1.0778, fixing under which would restore the monthly downward trend. Currently, the pair is operating between historical levels of 1.0879 and 1.0980-90. The breakdown of the indicated supports (1.0879-54 and 1.0778) will allow us to consider new bearish landmarks - the daily target for the breakdown of the cloud (1.0633 - 1.0537), reinforced by the level of 100% working out of the weekly target for the breakdown of the cloud (1.0594). The return and consolidation above the daily cloud (1.0980-90 and 1.1051) will allow us to consider the next braking and prospects for the restoration of the positions of players to increase. Among the subsequent resistances at the current moment, 1.1137 - 1.1222 - 1.1370 can be designated.

In the lower halves, the advantage still belongs to the players downside. Today, the bulls tested the central Pivot level (1.0920), but they failed to securely gain a foothold above. The support now is the classic Pivot levels 1.0795 - 1.0677 - 1.0552. In the case of a return and consolidation above the central Pivot level (1.0920), we can expect the development of an upward correction. The main guideline of which today will be the resistance to the weekly long-term trend (1.1081).

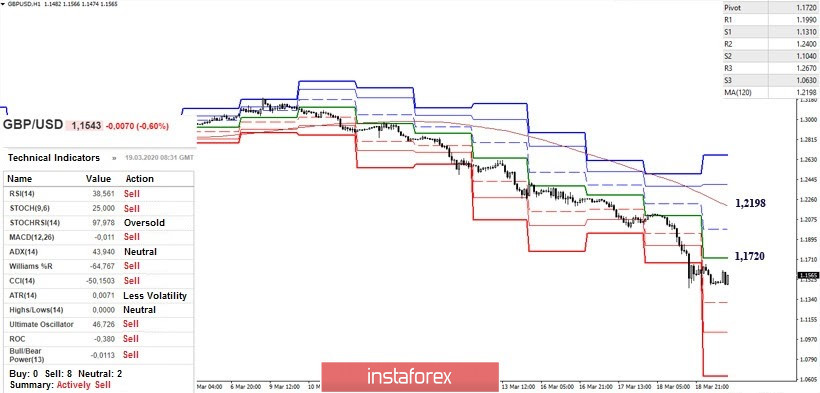

GBP / USD

Yesterday, the players on the downside continued to decline and fulfilled the first target target for the breakdown of the weekly cloud, only slightly falling short of its main target of 1.1388. As a result, it is now possible to slow down. Bears can take a pause and earn profit. The main benchmarks of the upper time intervals now lag behind the price chart by significant distances, so, it is better to look more closely at the intra-day benchmarks in the current circumstances.

In the lower halves, bears retain an advantage. At the moment, the downward trend within the day is the support of the classic Pivot levels, which are located at 1.1310 - 1.1040 - 1.0630. If the players on the increase are now able to reach the development of an upward correction and gain a foothold above the central Pivot level (1.1720), transferring the role of the main upward guideline of the weekly long-term trend (1.2198), then we can expect a longer formation of inhibition on upper time intervals

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)