Hello, colleagues!

Today's review of the main currency pair of the Forex market will start again with the topic COVID-19. Over the past day, 475 people died from coronavirus in Italy. An appalling figure!

In European countries, educational institutions, businesses, cafes, restaurants and other places where people used to gather are being closed. The purpose of such measures is to prevent the spread of a coronavirus pandemic.

The streets of European cities were empty and almost deserted. The authorities strongly recommend that citizens stay at home and do not leave their homes without urgent need. In countries such as Spain and France, people are fined if they can't justify their appearance on the street.

In the world, the victims of the coronavirus have already become about 3000 people, meaning a fatal outcome. In China, where COVID-19 got its start, the number of deaths from the terrible pandemic is about 3,200, but according to media reports, the situation in the Middle Kingdom is stabilizing, which can not be said about other countries.

If we go back to the Italian tragedy, the number of infected people was 4,207 in the last 24 hours. Shocking statistics! The Italian government has put all its efforts and resources into fighting the pandemic, but this does not help yet and the situation in the country is critical.

Naturally, the consequences of the spread of COVID-19 have a very negative impact on the global economic situation. Experts' voices are increasingly heard about the new global financial and economic crisis. And many believe that it will be more serious than the crisis of 2008-2009.

In this regard, the world's leading central banks are urgently reducing their main interest rates. Most likely, this process will continue in the coming months.

Well, let's go to the charts of the EUR/USD currency pair and start with the daily timeframe.

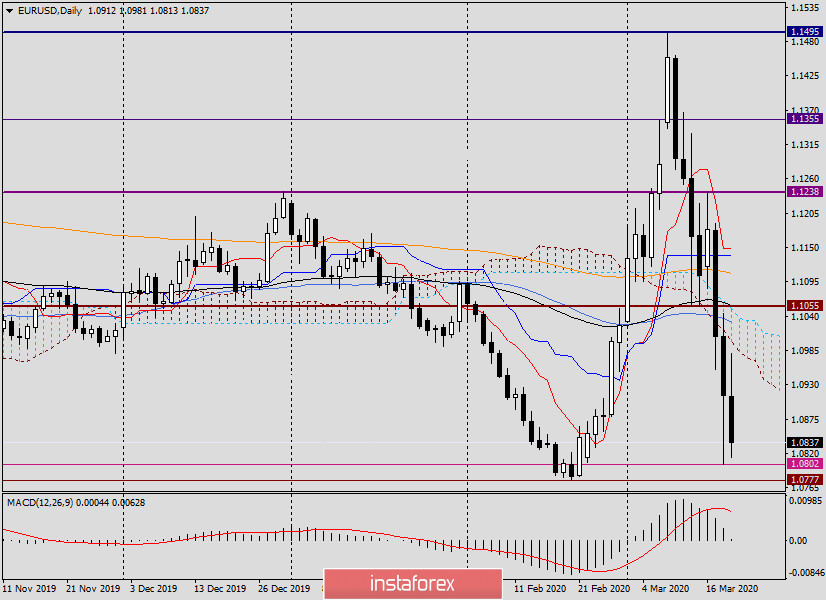

Daily

As you can see, yesterday's trading on the euro/dollar ended with another decline. However, there are some points that are worth paying attention to.

The long lower shadow of yesterday's candle catches the eye. After the quote fell to the strong technical level of 1.0800, there was a rebound up. If we consider that the support level of 1.0777 is lower, where the minimum trading values were shown on February 20, then the key support area at the moment is 1.0802-1.0777.

It is characteristic that before yesterday's fall to the area of 1.0800, the pair tried to return to the cloud of the Ichimoku indicator. What came out of this is clearly visible on the chart. It seems that the 50 simple moving average, which passes at 1.1030, played a significant role as resistance.

Today's trading, at the moment of completion of this review, is multidirectional. The market went up, reached the level of 1.0980, but did not stay at the heights reached. The same can be said about the attempts of bears on EUR/USD to continue the pressure on the pair. The mark of 1.0813 is all that the downside players managed to achieve.

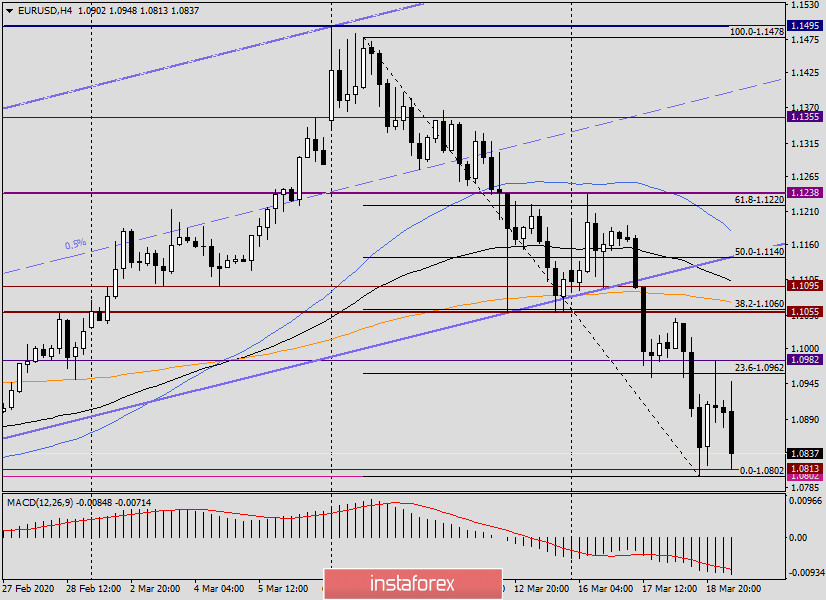

H4

On this chart, the current range in which the euro/dollar is traded can be designated as 1.0982-1.0813. It is logical to assume that the exit from the created corridor will indicate the further direction of the currency.

After going up, the next targets will be 1.1070 and 1.1100, where the 200 and 89 exponential moving averages are located, respectively, as well as 38.2 Fibo from the decline of 1.1478-1.0802.

If it goes down, the euro/dollar will re-test the support level of 1.0777 for a break. If this mark does not withstand bearish pressure and will be broken, then we will determine further goals at the bottom.

Given the strength of the support zone of 1.0802-1.0777, it is possible that the pair will spend some time in the designated range of 1.0980-1.0800. Despite the bearish scenario, there is a possibility of a rate adjustment. In the current situation, it is difficult to find good points to enter the market. If you follow the trend and consider sales, it is better to do it after the correction of EUR/USD in the area of 1.1070-1.1100. In my opinion, it is better to stay out of the market at the moment.

Good luck!