Markets continue to run high, and central banks present unexpected surprises once again, oddly enough, trying to at least slightly calm the frightened public. At the same time, the degree of hysteria is only growing, and the media of agitation and misinformation presented the news that the death toll from coronavirus in Italy has already exceeded their number in China, in such a light that a truly apocalyptic picture is drawn in people's heads which, of course, only worsen the situation and adds arguments in favor of a further outflow of capital from around the world to the United States. And if that goes on, the default of some developing countries is not far off. Well, maybe not only the developing ones.

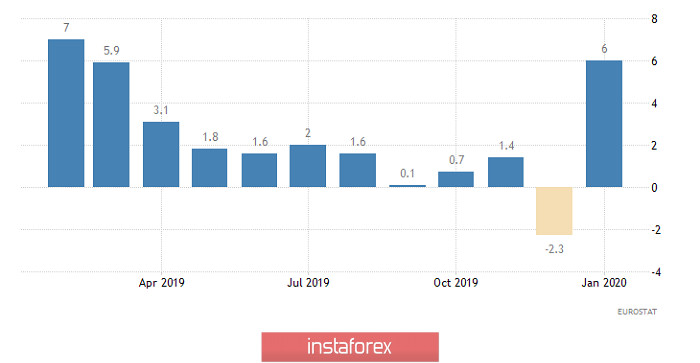

At the same time, some positive signals are visible in Europe at first glance. Thus, the volume of construction unexpectedly increased by 6.0%, while it was supposed to decrease by 2.8%. The situation looks even better in the long-suffering Italy, where the volume of construction suddenly grew by 8.4%, although they expected a decline of 1.6%. However, everything looks great only until you look at the debt market, from which you will be shocked. The yield on 3-year French bonds rose from -0.59% to -0.43% while 5-year-olds from -0.50%, right down to -0.22%. In Spain, it is still worse, as the yield on 3-year bonds rose from -0.416% to 0.024%. On the other hand, the yield on 10-year bonds jumped from 0.169% to 0.661%. Such a sharp increase in government bond yields is possible only in the event of a catastrophic drop in demand, resulting from the banal outflow of financial capital.

Scope of construction (Europe):

Things are even more fun with the pound, which was pushed from side to side like a ping-pong ball yesterday. Initially, it decreased against the background of growth in the yield of 5-year bonds from 0.222% to 0.640%. After that, it increased but at the expense of weak data on applications for unemployment benefits in the United States. On the other hand, the Bank of England presented an unexpected surprise, suddenly lowering the refinancing rate from 0.25% to 0.10%. That is, reducing it to the lower boundary of the previously designated interest rate range. For a while, everyone was trying to realize what exactly happened, after which the pound began to lose its position again. It should be understood that the pound moved more than 300 points from side to side yesterday. It is clear that emotions are beyond expectations, and strangely enough, the actions of the Bank of England are designed to just at least slightly calm the markets.

Refinancing Rate (UK):

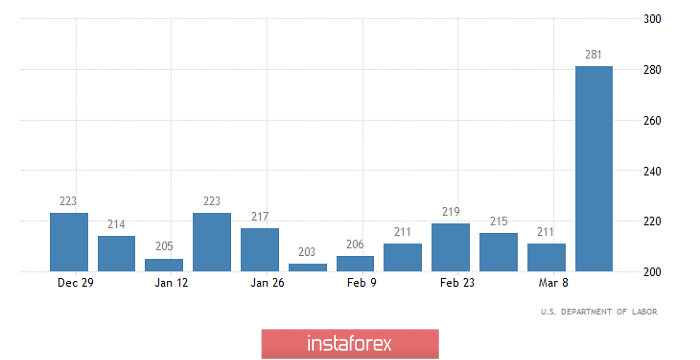

Meanwhile, the main driving force was the data on applications for unemployment benefits in the United States, the total number of which increased by 72 thousand. Moreover, if the number of repeated applications did not increase by 29 thousand, but only by 2 thousand, then with the primary one all otherwise. Their number increased by as much as 70 thousand, while growth by 8 thousand was predicted. Such a sharp increase in the number of applications for unemployment benefits, and primary ones, clearly indicates a high probability of a deterioration in the situation on the labor market as a whole. Though late, it is these data that are the reason for the small rebound in the dollar. After all, not only the pound is increasing, but also the single European currency. However, rather, it is still only a temporary rebound. Moreover, it is worth paying attention to the profitability of already American debt securities, as what is happening with them is extremely significant. For instance, The yield on 4-week bills collapsed from 0.395% to 0.030%. The yield of 8-week bills decreased from 0.290% to 0.030%. But the yield on 10-year bonds increased from 0.036% to 0.680%. Such a strange picture suggests that American investment banks and funds only temporarily park money in the United States, and soon they intend to begin to invest in assets again that are more risky from their point of view around the world. This is nothing but profit taking.

Number of Initial Jobless Claims (United States):

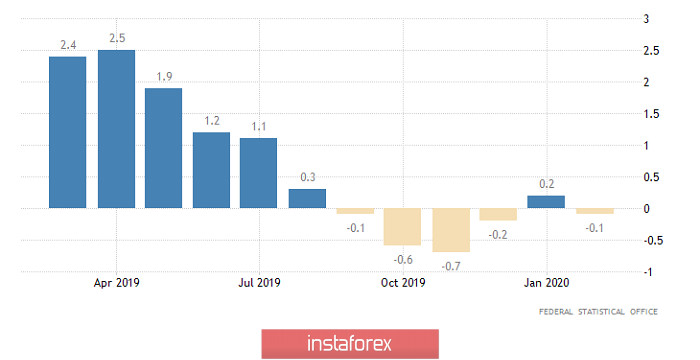

Today, no serious macroeconomic data is released in Europe or the United States. Well, those that have already come out are more likely to indicate that the collapse in the markets is still ongoing. Thus, the growth rate of producer prices in Germany by 0.2% gave way to a decline of 0.1%. Consequently, inflation in Europe is likely to continue to decline, which will put pressure on the single European currency. And the surplus of the balance of payments of the euro area in January should amount to 9.5 billion euros, which looks just ridiculous against the background of December 51.2 billion euros.

Growth rates of producer prices (Germany):

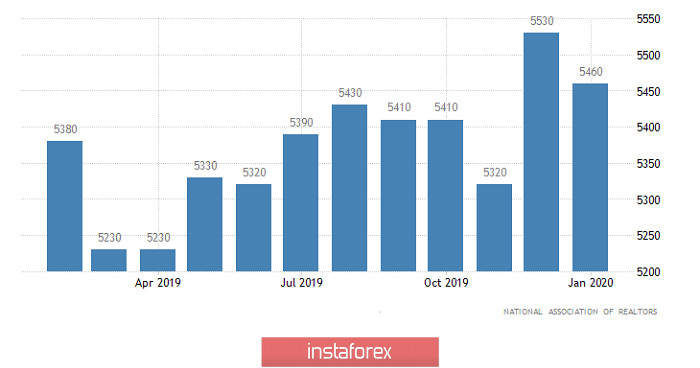

Housing sales in the secondary market In the United States should increase by 0.5%. However, these data have practically no significance for the market. They can have at least some effect only in combination with other more important data.

Secondary Home Sales (United States):

The single European currency is still trying to find an equilibrium point in the region of 1.0800, and, most likely, it will hang around this level all day. Another thing is that volatility is exceeding now, so that any blow of information noise will throw it from 1.0750 to 1.0850.

The pound, realizing the speed with which it set more and more historical lows, was a little scared and trying to adjust. We acknowledge that the actions of the Bank of England helped it in this matter. Now, market participants do not need to wait for any tough actions from the regulator. Thus, the pound will consolidate around the level of 1.1800.