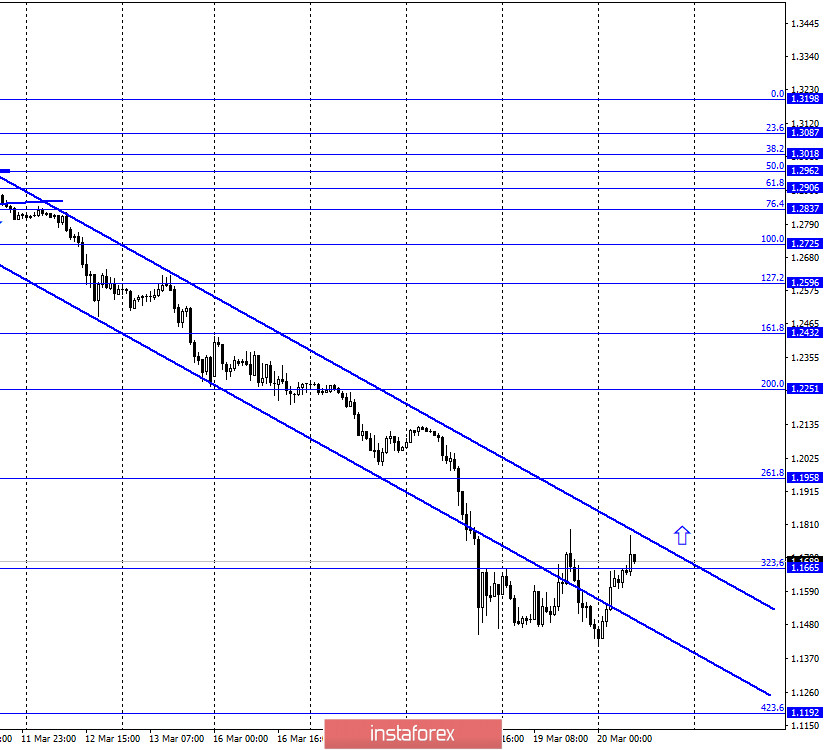

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the strong drop in quotes finally stopped. At the moment, the pound/dollar pair quotes have returned to the downward trend corridor and worked out its upper limit. Thus, closing the pair's rate above this line will work in favor of the British currency and some growth in the direction of the corrective levels of 261.8% (1.1958) and 200.0% (1.2251). However, if there is a rebound from the upper line of the corridor, the pair will again perform a reversal in favor of the US currency and resume the process of falling, according to the continuing "bearish" mood of most traders.

GBP/USD – 4H.

As seen on the 4-hour chart, I removed the grid of Fibo levels, since it is identical to the grid on the hourly chart. There are no new trading ideas on this chart, as there are no special changes in the pair's movement. The British dollar quotes seem to have performed an upward turn, which allows traders to expect some growth. No indicator shows any new emerging divergences on March 20.

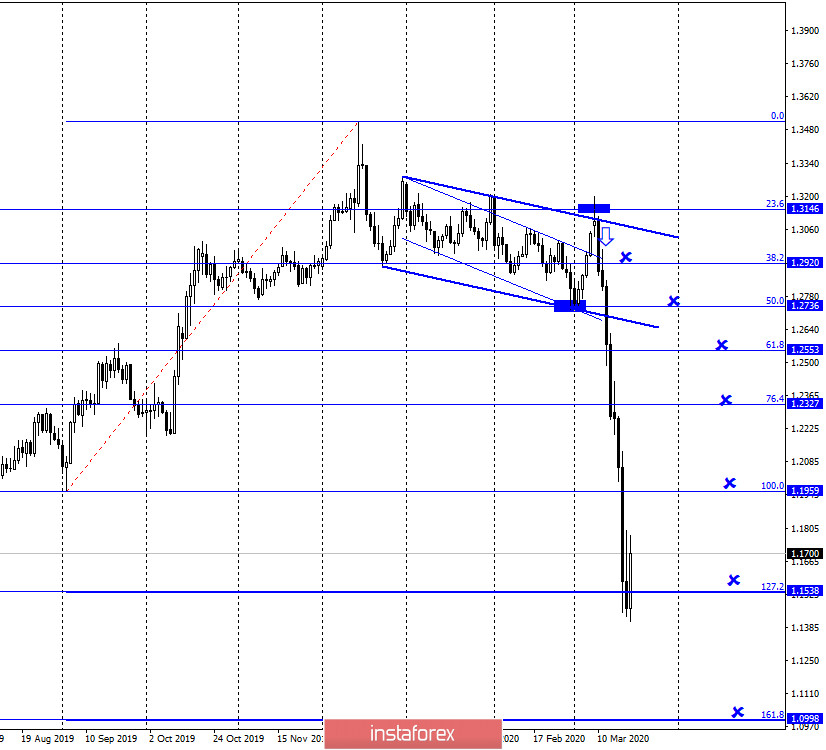

GBP/USD – Daily.

According to the daily chart, the picture is still the most interesting and informative. The GBP/USD pair performed a fall to the corrective level of 127.2% (1.1538) and will still perform a rebound from an important level. Unfortunately, the callback is not clear and it is quite difficult to use it as a signal to buy. Nevertheless, this is a chance for the British to grow. To be more precise, in the direction of the corrective level of 100.0% (1.1959). The pair has passed 1,500 points down over the past 8 days, perhaps it is time for a correction? Anyway, the COVID-19 virus has a negative effect not only on the UK economy but also on the United States. Thus, in some ways, such a strong fall in the pound was not quite "fair and just".

GBP/USD – Weekly.

On the weekly chart of the pound/dollar pair, the most important signal to buy for the British is brewing. The long-term trend line, which is both downward and supportive, dates back to 1993. And at the moment, the pair has completed its testing and the probability of rebounding from it is very high. If the rebound is completed at the end of the week, bull traders will be able to count on the pair's growth in the direction of two downward trend lines, that is, a minimum of growth to the level of 1.2600.

Overview of fundamentals:

No major economic reports were scheduled for Thursday in the UK and the US. However, there were still plenty of events. The Bank of England at an urgent meeting decided to lower the key rate by another 0.15%, as well as expand the QE program by 200 billion pounds. And Prime Minister Boris Johnson decided to introduce a "hard" quarantine and close all educational institutions in the country.

The economic calendar for the US and the UK:

On March 20, important economic reports and events are again not included in the calendar of the UK and the US.

The key place among all the news is still occupied by news about the coronavirus. In the UK, the epidemic continues to spread, but it is good that the rate is not too high and the total number of sick citizens does not yet exceed 3,000.

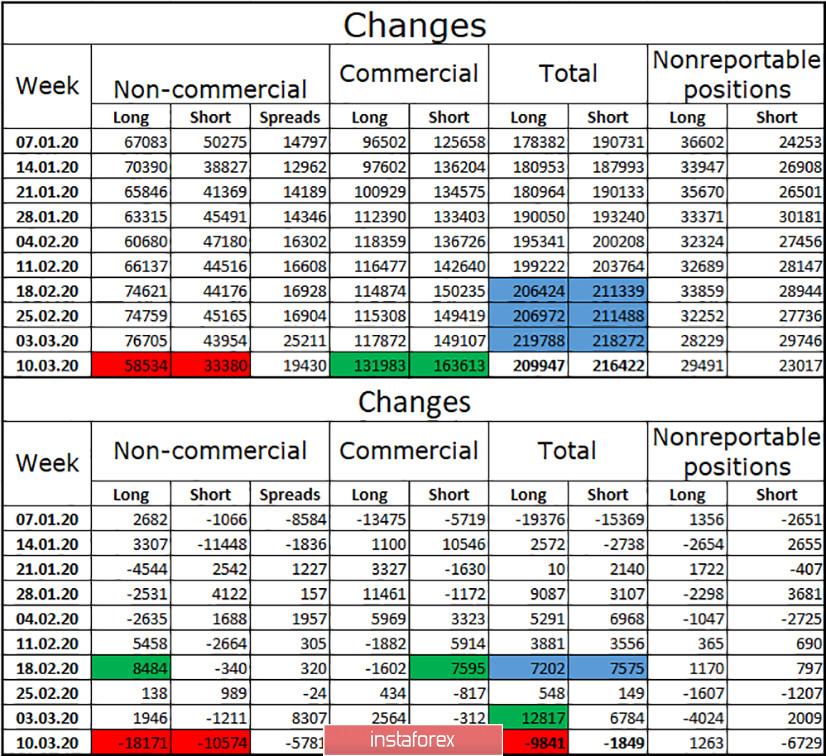

COT report (Commitments of Traders):

The latest COT report showed minor changes in the volume of long and short positions. The next report will be released today, but I believe that it will not contain much useful information for traders. First, because in the last three days after the official date of the report (March 17), the pound has gone down more than 700 points. Accordingly, the volume of contracts among all major market players has changed significantly. Secondly, traders continue to remain in a state of shock, so the market can move anywhere.

Forecast for GBP/USD and recommendations to traders:

I believe that in the current conditions, opening any transactions is still associated with high risks, as the market remains in a state of shock. On the hourly chart, closing quotes above the descending corridor may be a weak signal to buy with targets of 1.1958 and 1.2251. A stronger signal is expected on the weekly chart, but it will be possible to judge it only after the end of Friday.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.