Hello, colleagues!

Again, we have to start today's material with sad news. Italy has become the first country to surpass China in the number of deaths from a new type of coronavirus. At the same time, the number of deaths and infected people is constantly growing. The quarantine announced by the Italian government until April 3 is likely to be extended.

The situation is also tense in other European countries. Due to the threat of COVID-19 in Portugal, for the first time in many decades, a state of emergency has been declared. German Chancellor Angela Merkel called the threat of coronavirus next after World War II.

In connection with the unfolding dramatic events, the governing council of the European Central Bank (ECB) has decided to launch a new program for the purchase of public and private sector securities in the amount of 750 billion euros, which will be in effect until the end of 2020. The main reason for this decision is to protect the region's economy from the negative consequences of COVID-19.

Of course, such a measure in the current situation will not be superfluous, but now it is difficult to say how much it can really help the economy of the currency bloc, which is becoming more vulnerable and paralyzed.

Despite the ECB's measures to adopt an anti-crisis program, the euro/dollar currency pair showed an impressive decline in yesterday's trading.

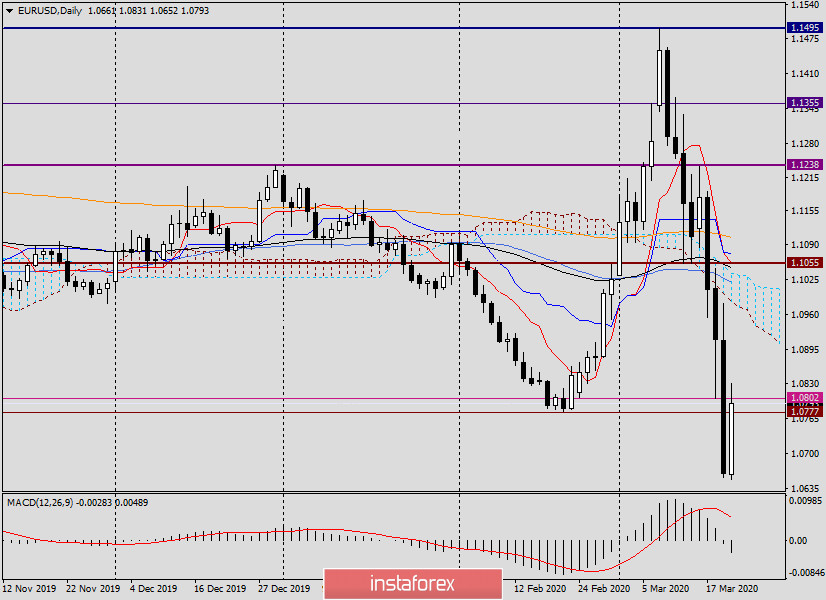

Daily

As a result of the fall, the pair fell below the landmark level of 1.0800, broke through support at 1.0777, and ended Thursday's trading at 1.0662. At the moment of writing, the EUR/USD pair rolled back to the broken support level of 1.0777 and even rose higher to 1.0831. However, here the upward momentum seems to be fading.

In my opinion, much of the further dynamics of the pair will depend on the closing price of the day and the entire week, as well as on the shape of the weekly and daily candlesticks.

If today's candle turns out to have a long lower shadow and the closing price is higher than 1.0813, there is a chance that starting from Monday, the euro/dollar will begin to adjust to the previous decline.

If today's trading closes and the entire weekly session is below the support level of 1.0777, I expect the downward dynamics to continue, which I will set on Monday.

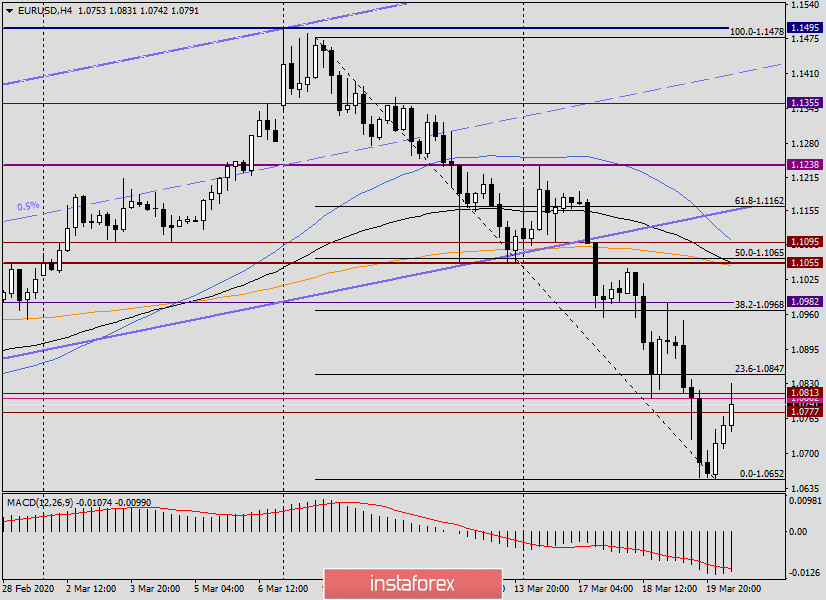

H4

In this timeframe, we observe a classic pullback to the broken support zone of 1.0777-1.0813. In my opinion, this was a good opportunity to open short positions.

At the moment, trading for EUR/USD is near 1.0787, so the price of sales is not so attractive. In addition, I would like to draw your attention to the fact that the weekly trading ends today, and we can only guess how the market will open on Monday. I believe that the negative consequences of COVID-19, the number of cases of illness and deaths over the coming weekend, unfortunately, will increase. This means that trading on the night from Sunday to Monday will open with a price gap. At the same time, whether the expected gap will be bullish or bearish is also in question. At least, due to the spread of the coronavirus pandemic, the US currency is in high demand and is strengthening almost across the entire spectrum of the currency market.

What's all this about? No one knows what will happen next weekend or how the auction will open next week.

In my personal opinion, now is not the time for risks and (or) any experiments. We will see how the market opens on Monday, and then we will analyze and make decisions about opening positions.

Have a nice day!