Economic calendar (Universal time)

There are few events in the economic calendar today, among which, only the data on sales in the secondary housing market can be distinguished (USA, 14 UTC+00).

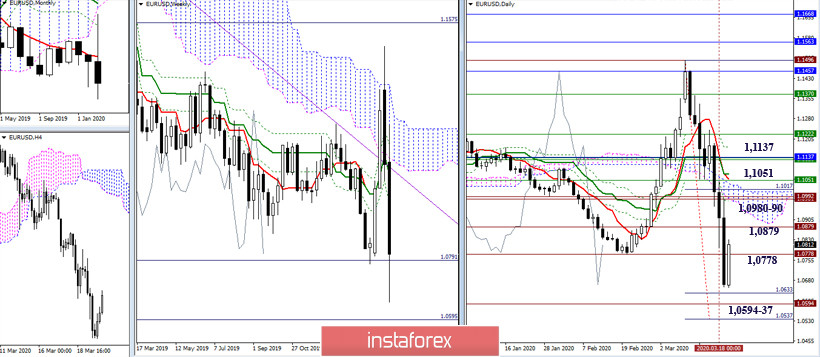

EUR / USD

Yesterday, the pair still tried to break through the support they met and managed to close the last day below the monthly minimum extremum (1.0778). To implement the breakdown and restore the monthly downward trend, we now need a consistent confirmation on the daily, weekly and monthly time intervals. Today, we are closing the week. The long lower shadow on the weekly candle and the bulls returning support 1.0778 may not allow or delay a reliable recovery of the downward trend. The nearest bearish benchmarks - the daily target for breakdown of the cloud (1.0633 - 1.0537) and the level of 100% of working out the weekly target for breakdown of the cloud (1.0594) - remained unworked yesterday, so today, they remain relevant. Among the subsequent resistances in this situation, we can still note 1.0879 - 1.0980-90 - 1.1051 - 1.1137.

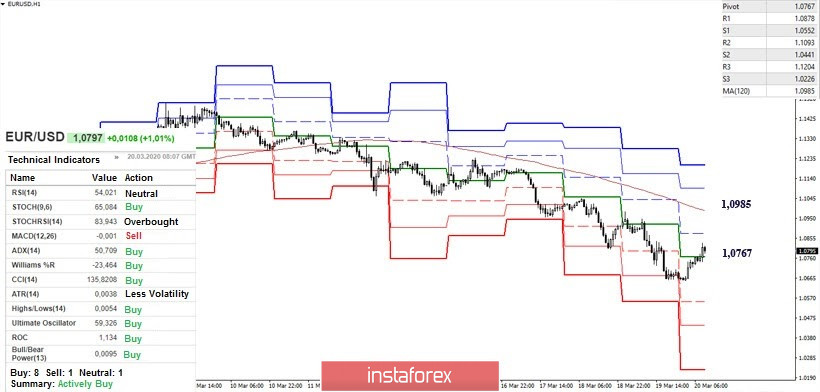

The next developing correction to date has already allowed players to increase the support of most of the analyzed technical indicators, as well as close the last hour above the central Pivot level of the day (1.0767). If the bulls now manage to gain a foothold, then we can expect the development of an upward correction and further restoration of positions, the main reference point at this stage will be the conquest and reversal of the weekly long-term trend, which at the time of analysis is at 1.0985. If the downward trend is restored, the lower halves of the intraday support are located today at 1.0552 - 1.0441 - 1.0226.

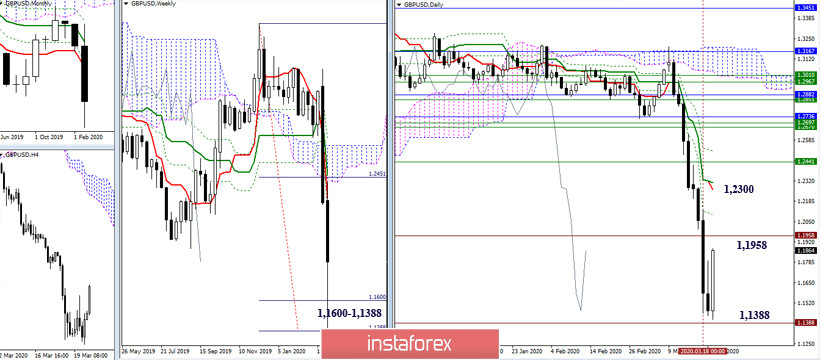

GBP / USD

The expectation of the slowdown on the result of working out the weekly target for the breakdown of the Ichimoku cloud produced successful results. Now, the result is important. If the players on the rise are able to return above the extremum of 1.1958 and close the current week with a long lower shadow, then they will claim not only to slow down, but also to form a rebound from the met support. Thus, further prospects will depend on the outcome of the month.

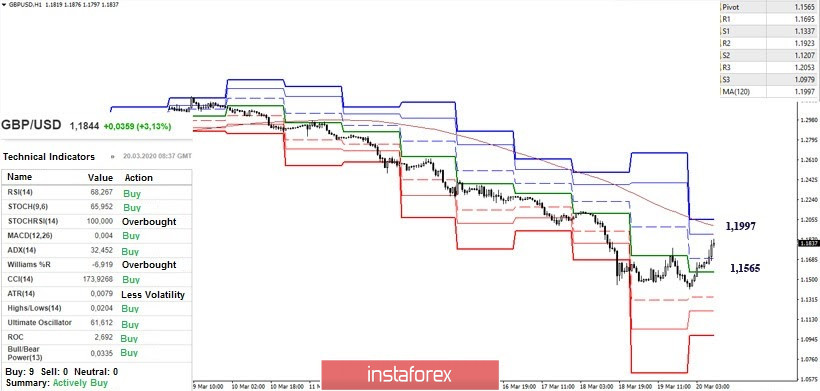

In the lower halves, the players to rise are currently successfully performing the restoration of their positions. Their upward movement has already allowed them to gain a foothold above the central Pivot level of the day and reach the location of most of the analyzed indicators. Now, the main upward guide is the central Pivot level of the day (1.1997). When consolidating above, the current balance of forces will change. As a result, new bullish prospects can be considered with the next assessment of the situation.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)