Hello, dear colleagues.

For the Euro/Dollar pair, the price forms a potential for the top from March 20 and the level of 1.0881 is the key resistance. For the Pound/Dollar pair, we expect the top of the initial conditions for the ascending cycle to reach the level of 1.2051. For the Dollar/Franc pair, we expect the development of a corrective movement from the downward cycle on March 9. For the Dollar/Yen pair, the price is in the correction zone from the upward cycle on March 9. For the Euro/Yen, the price is forming local initial conditions for the high from March 12; the level of 119.85 is the key resistance and the level of 117.11 is the key support. For the pair Pound/Yen, the price forms the initial conditions for the top of March 18 and the level of 131.58 is the key resistance.

Forecast for March 20:

Analytical review of currency pairs on the H1 scale:

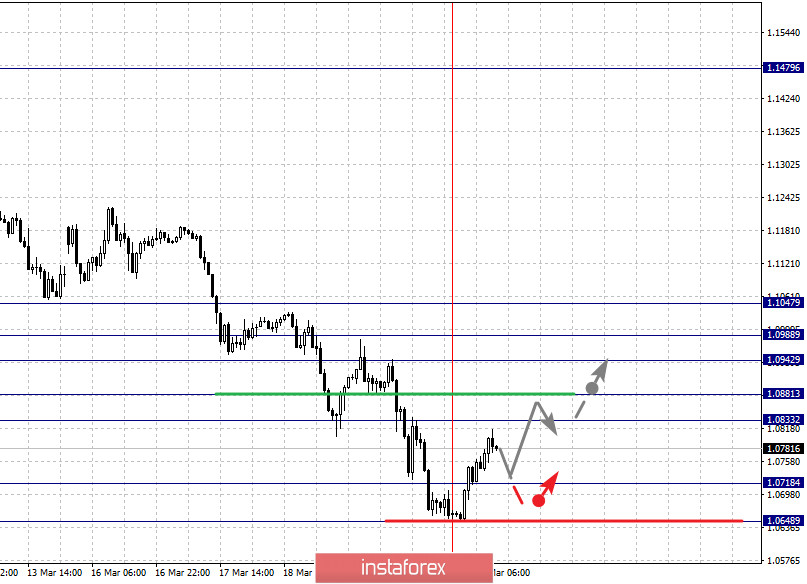

For the Euro/Dollar pair, the key levels on the H1 scale are: 1.1047, 1.0988, 1.0942, 1.0881, 1.0833, 1.0718, and 1.0648. Here, the price forms the potential for the initial conditions of the upward cycle from March 20. A short-term upward movement is expected in the range of 1.0833-1.0881 and the breakdown of the last value will allow us to expect a movement to the level of 1.0942. In the area of 1.0942-1.0988, price consolidation is located. We consider the level 1.1047 as a potential value for the top, after reaching which, we expect a pullback to the bottom.

A short-term downward movement is expected in the range of 1.0718-1.0648.

The main trend is the downward cycle from March 9, forming the potential for the top.

Trading recommendations:

Buy: 1.0833 Take profit: 1.0880

Buy: 1.0882 Take profit: 1.0942

Sell: 1.0718 Take profit: 1.0650

Sell: Take profit:

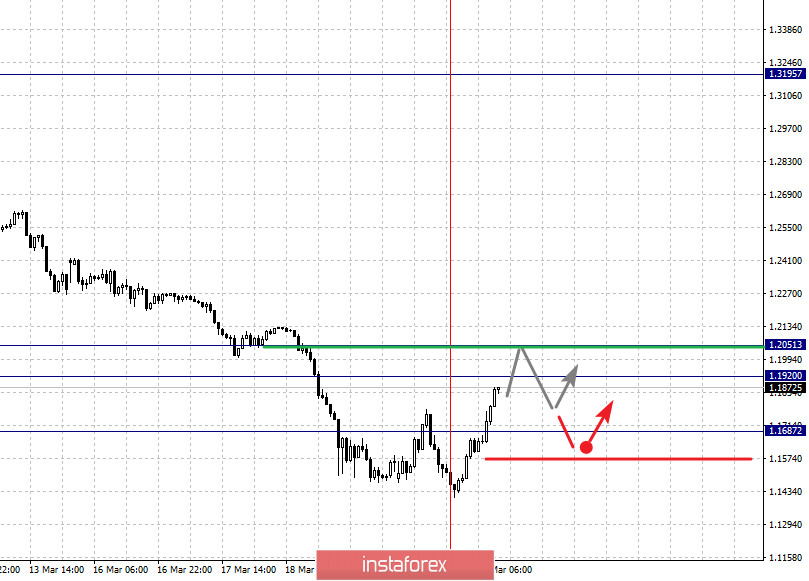

For the Pound/Dollar pair, the key levels on the H1 scale are: 1.2051, 1.1920, and 1.1687. Here, we expect that the top of the initial conditions for the upward cycle of March 19 will be finalized, which should happen to the level of 1.2051. We expect a consolidated movement in the range of 1.1920-1.1687.

The main trend is the formation of initial conditions for the top from March 19.

Trading recommendations:

Buy: Take profit:

Buy: 1.1923 Take profit: 1.2050

Sell: Take profit:

Sell: Take profit:

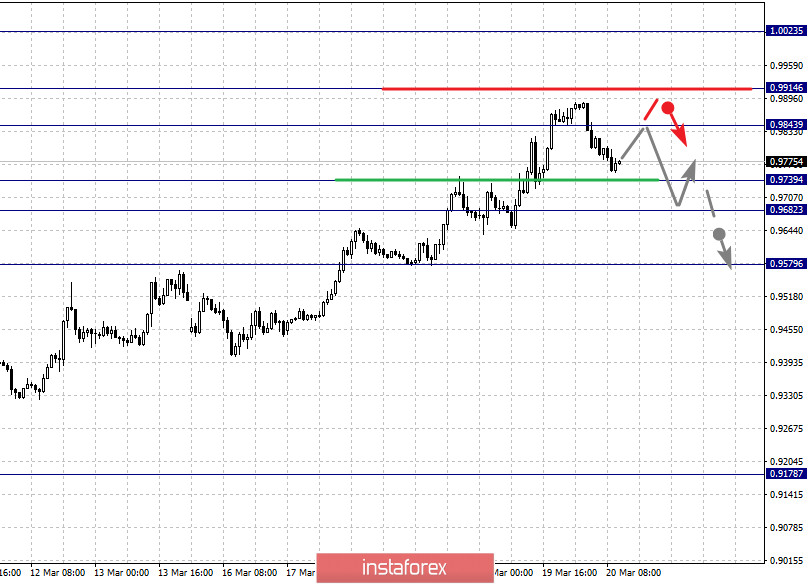

For the Dollar/Franc pair, the key levels on the H1 scale are: 1.0023, 0.9914, 0.9843, 0.9739, 0.9682, and 0.9579. Here, we follow the development of the upward cycle from March 9, and currently, we expect a movement in the correction. A Short-term downward movement is possible in the range of 0.9739-0.9682 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9579, and we expect to see the expressed initial conditions for the downward cycle before this level.

We expect the continuation of the upward movement after the breakout of 0.9843. In this case, the target is 0.9914 and consolidation is near this level. We consider the level of 1.0023 as a potential value for the top, upon reaching which, we expect a pullback to the bottom.

The main trend is the upward cycle from March 9, we expect the correction to develop.

Trading recommendations:

Buy: 0.9845 Take profit: 0.9914

Buy: 0.9916 Take profit: 1.0020

Sell: 0.9739 Take profit: 0.9682

Sell: 0.9680 Take profit: 0.9580

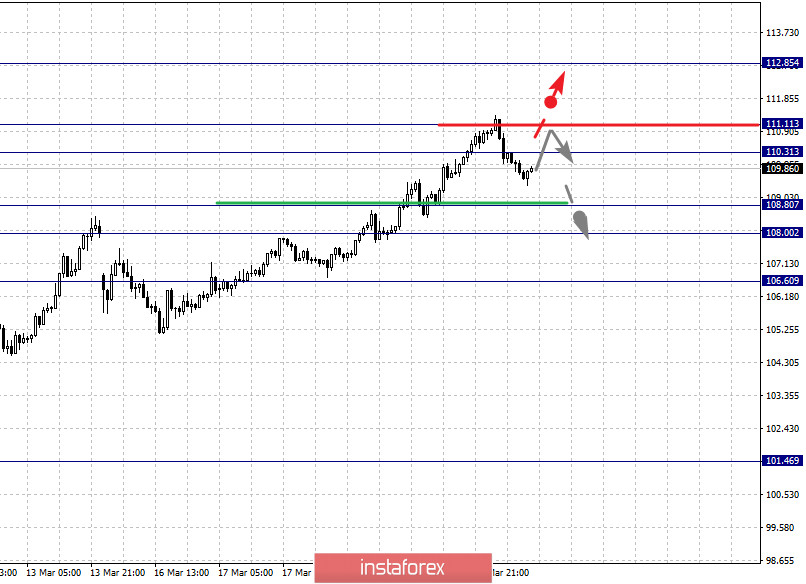

For the Dollar/Yen pair, the key levels in the H1 scale are: 112.85, 111.11, 110.31, 108.80. 108.00, and 106.60. Here, we follow the development of the upward cycle from March 9. A short-term upward movement is expected in the range of 110.31-111.11 and the breakdown of the last value should be accompanied by a pronounced upward movement. Here, the potential target is 112.85, after reaching this level, we expect a pullback to the bottom.

A short-term downward movement is possible in the area of 108.80-108.00 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 106.60 and this level is the key support for the top.

The main trend is the upward cycle from March 9.

Trading recommendations:

Buy: 110.31 Take profit: 111.10

Buy: 111.20 Take profit: 112.85

Sell: 108.80 Take profit: 108.00

Sell: 107.98 Take profit: 106.60

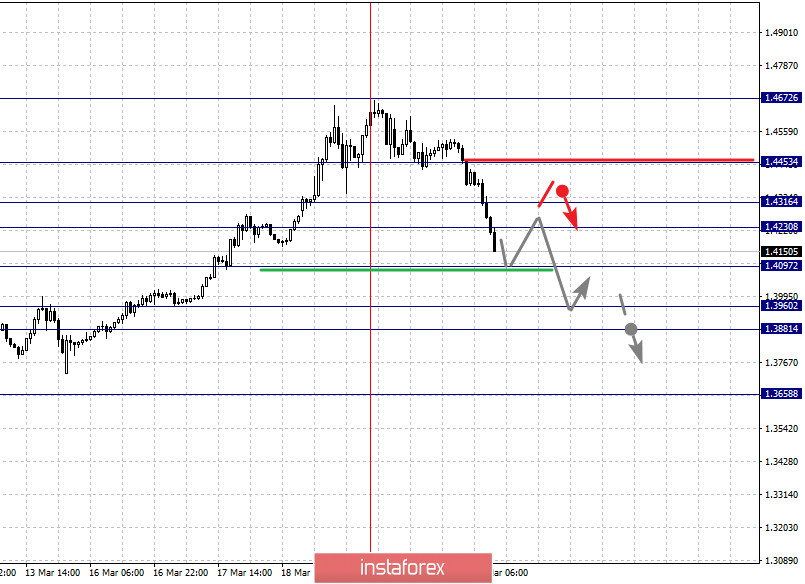

For the Canadian dollar/Dollar pair, the key levels on the H1 scale are: 1.4453, 1.4316, 1.4230, 1.4097, 1.3960, 1.3881, and 1.3658. Here, we expect to formalize the initial conditions for the downward cycle from March 19. We expect the downward movement to continue after the breakout of 1.4097. In this case, the target is 1.3960 and price consolidation is in the area of 1.3960-1.3881. We consider the level of 1.3658 as a potential value for the bottom, upon reaching which, we expect a pullback to the top.

A short-term upward movement is possible in the area of 1.4230-1.4316 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.4453 and this level is the key support for the top.

The main trend is the formation of a downward structure from March 19.

Trading recommendations:

Buy: 1.4230 Take profit: 1.4316

Buy: 1.4318 Take profit: 1.4453

Sell: 1.4095 Take profit: 1.3960

Sell: 1.3880 Take profit: 1.3660

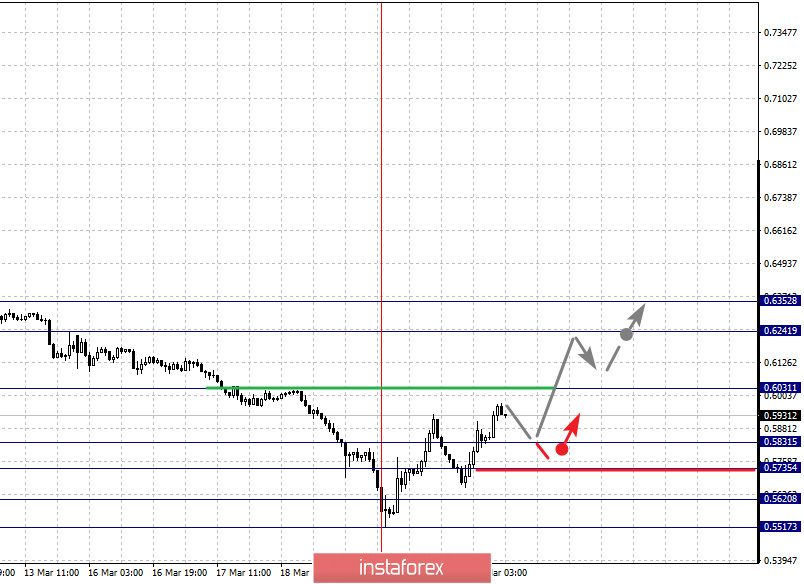

For the Australian dollar/Dollar pair, the key levels on the H1 scale are: 0.6352, 0.6241, 0.6031, 0.5831, 0.5735, 0.5620, and 0.5517. Here, we follow the formation of the potential for the top of March 19. We expect the continuation of the upward movement after the breakout of 0.6031. In this case, the target is 0.6241. Up to the level of 0.6352, we expect the formation of large initial conditions and in the area of 0.6241-0.6352, a short-term upward movement is expected, as well as consolidation.

A short-term downward movement is possible in the area of 0.5831-0.5735 and the breakout of the last value will lead to a deeper correction. Here, the target is 0.5620 and this level is the key support for the top. Its passage of the price will have to develop a downward movement. In this case, the first target is 0.5517.

The main trend is the formation of potential for the top from March 19

Trading recommendations:

Buy: 0.6031 Take profit: 0.6240

Buy: 0.6243 Take profit: 0.6350

Sell: 0.5831 Take profit: 0.5735

Sell: 0.5733 Take profit: 0.5620

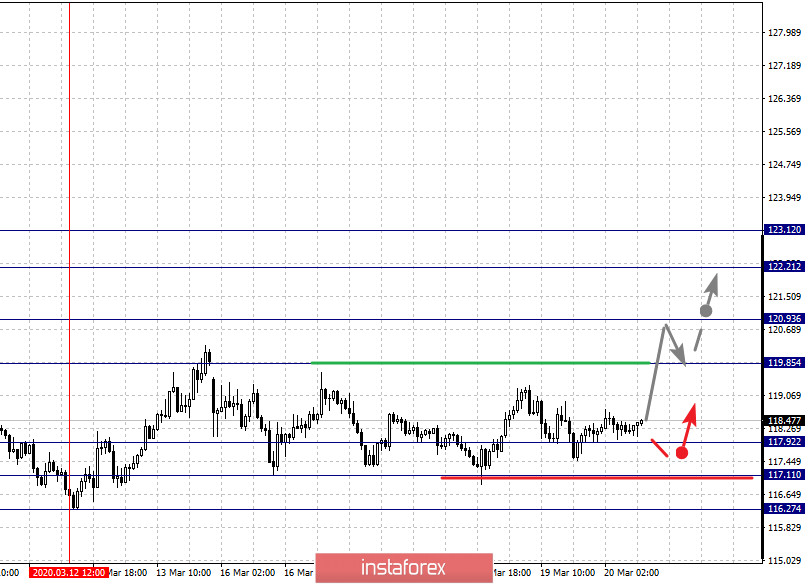

For the Euro/Yen pair, the key levels on the H1 scale are: 123.12, 122.21, 120.93, 119.85, 117.92, 116.27, and 117.11. Here, we follow the formation of initial conditions for the upward cycle from March 12. We expect the continuation of the upward movement after the breakdown of 119.85. In this case, the target is 120.93 and consolidation is near this level. A breakdown of the level of 120.95 will lead to the development of a pronounced movement. In this case, the target is 122.21. We consider the level of 12312 as a potential value for the top, upon reaching this value, we expect a pullback to the bottom.

A short-term downward movement is possible in the range of 117.92-117.11 and the latter is the key support for the ascending structure. Its passage by the price will lead to a movement to the first potential target of 116.27.

The main trend is the formation of local initial conditions for the upward cycle from March 12.

Trading recommendations:

Buy: 119.85 Take profit: 120.90

Buy: 120.95 Take profit: 122.20

Sell: 177.88 Take profit: 117.15

Sell: 117.06 Take profit: 116.28

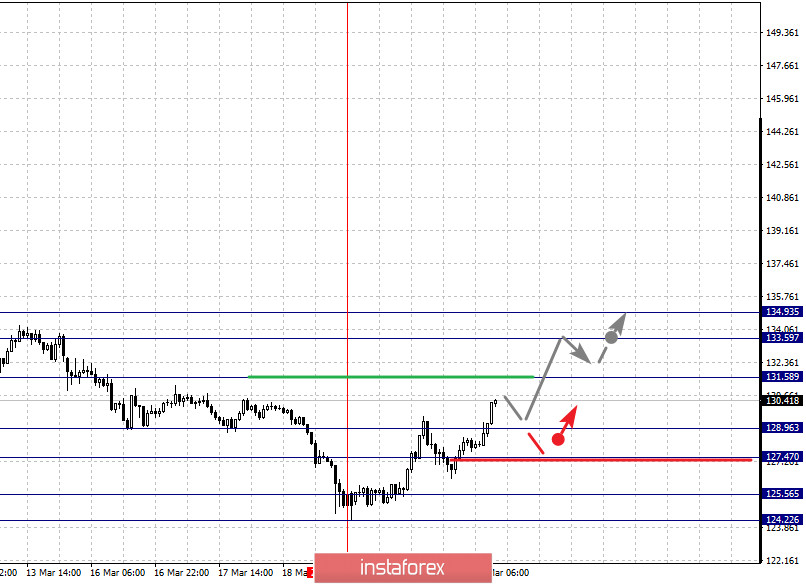

For the Pound/Yen pair, the key levels on the H1 scale are: 134.93, 133.59, 131.58, 128.96, 127.47, 125.56, and 124.22. Here, we follow the formation of the initial conditions for the top of March 18. We expect the upward trend to continue after the breakdown of 131.58. In this case, the target is 133.59. We consider the level of 134.93 as a potential value for the top, upon reaching which, we expect consolidation.

A short-term downward movement is possible in the area of 128.96-127.47 and the breakout of the last value will lead to in-depth movement. Here, the target is 125.56 and this level is the key support for the rising structure. Its passage of the price will have to develop a downward movement. In this case, the first target is 124.22.

The main trend is the formation of initial conditions for the top from March 18.

Trading recommendations:

Buy: 131.60 Take profit: 133.55

Buy: 133.60 Take profit: 134.90

Sell: 128.94 Take profit: 127.50

Sell: 127.44 Take profit: 125.60