Hello, traders!

As I mentioned earlier, at the end of each five-day trading period, I try to pay attention to the most interesting and popular cross-rates. Today, the euro/pound falls down. However, first again on the topic of coronavirus, which every day covers more and more countries and concerns almost the entire population of the world.

Chief negotiator for Britain's exit from the European Union, Michel Barnier, has contracted a coronavirus. A European official tweeted that the test for COVID-19 was positive. It is a sad fact, but Barnier is optimistic and believes that together with the rest of those infected, he will overcome the pandemic. At the same time, negotiations between the UK and the EU will continue, there are no changes or postponements of the deadline yet.

As for the EUR/GBP cross-rate, it was covered by the strongest volatility. Let's analyze the technical picture in more detail on the price charts of this instrument.

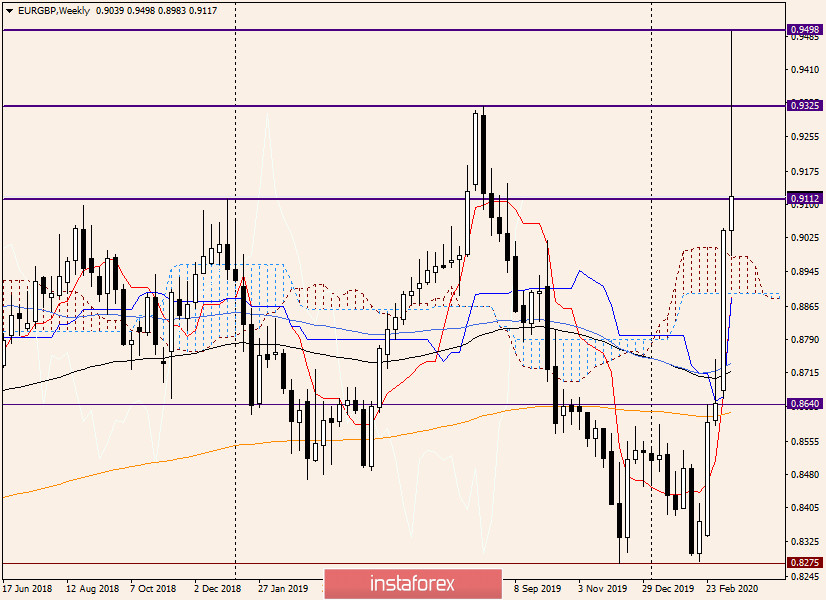

Weekly

For the second week in a row, the strongest growth stopped at the level of 0.9498, that is, in close proximity to the important psychological and technical level of 0.9500.

Now we see that the EUR/GBP bulls are suffering serious losses and losing their control over the pair. The bullish body of the weekly candle is melting before our eyes. If the current weekly candle is a reversal, and this all goes, next week we can expect a trend change and transition cross to descending dynamics. Such candles, as a rule, do not pass without a trace for market participants.

In the event of a return of bullish sentiment, subsequent growth and the end of weekly trading above 0.9325, the assumed bearish scenario is likely to be in question. Now a lot will depend on whether the euro/pound bulls have the strength and time to raise the price above 0.9325. I think it will be extremely difficult to do this. However, for final conclusions, you need to wait for the end of weekly trading and the closing price of the current five-day period.

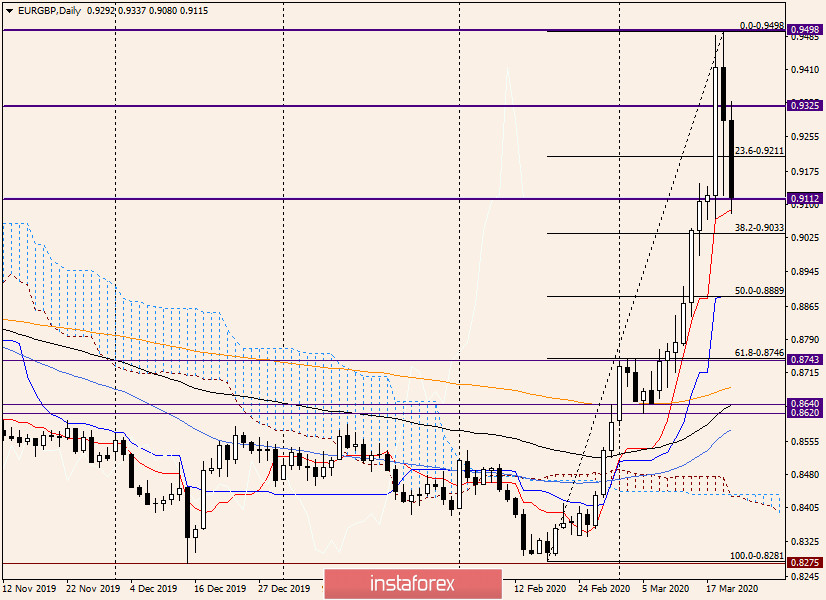

Daily

Despite the fact that the candle for March 19 was formed with a fairly long lower shadow, today the bears for EUR/GBP continue to put pressure on the quote and move the price down.

The current barrier to further decline is provided by the Tenkan line of the Ichimoku indicator, as well as the minimum values of yesterday's trading at 0.9120, where strong support was found.

If today's trading closes under the Tenkan line (0.9089), most likely, the cross expects to continue moving in the south direction, where the next target will be the Kijun line, which is at the level of 0.8889. By the way, there is also a 50% Fibo from the growth of 0.8281-0.9498.

Now it is extremely important to determine whether this is an adjustment to the previous growth or a change in the trend. This is what the formed weekly candle will help to do. Judging by the intensity and strength of the downward movement, most likely this is a change in trend, but this must be verified.

If there is a signal for selling the euro/pound, based on a weekly candle, the biggest problem will be placing a protective stop-loss order. Ideally, it should be taken out for the last highs of 0.9498. As you can see, this is a lot!

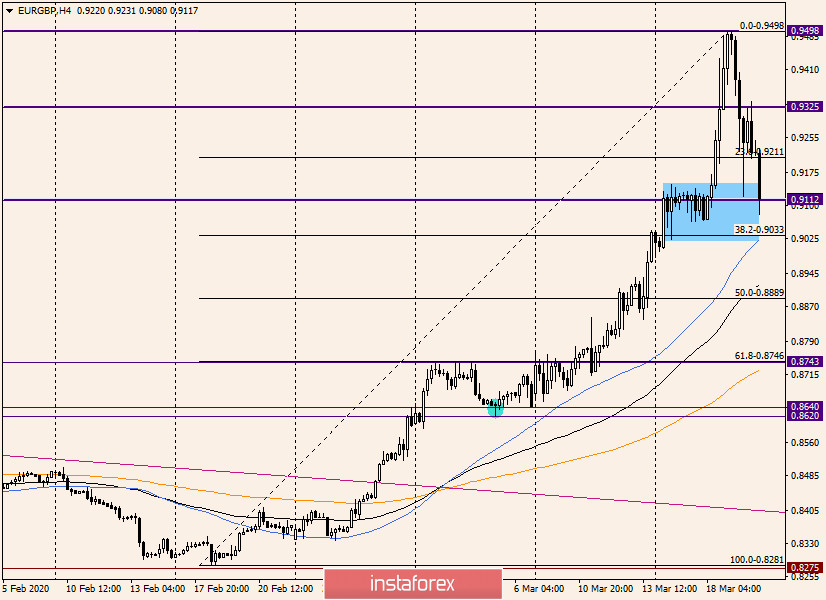

H4

In this timeframe, it is worth noting that the price has fallen into the selected area of trading and is trying to turn up. At least, we see attempts to rebound.

If the pair falls below 38.2 Fibo and 50 simple moving average and is fixed there by three candles in a row (at their closing prices), on the pullback to the area of 0.9023-0.9143, we wait for the appearance of bearish models of Japanese candles, after which we open deals for sale.

The situation is complicated, and the volatility is simply off the scale. For those who are new to the market, it is better not to do anything yet, but just watch what is happening. There may be more clarity on Monday.