Good day!

For most of the week's trading, the US dollar showed strengthening against its namesake from New Zealand. However, yesterday, the situation for the NZD/USD currency pair began to change rapidly.

However, let's talk about everything in order and start analyzing the technical picture for this currency pair with a weekly timeframe.

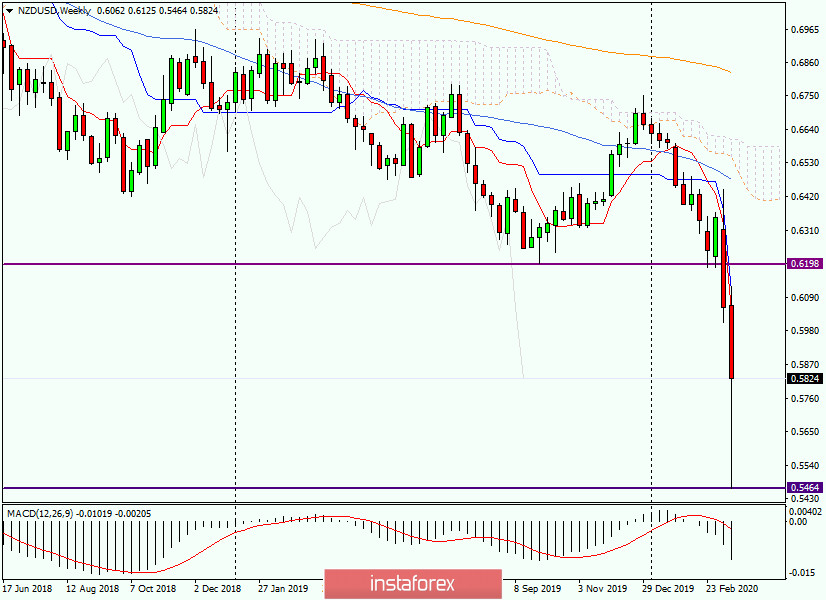

Weekly

Due to the outbreak of a new type of coronavirus (COVID-19) around the world, the US dollar is in demand by investors as a protective asset. However, there is a limit to everything. The New Zealand currency suffered significant losses and fell significantly in price. A correction is overdue, which usually occurs on the eve of the end of weekly trading on the background of profit-taking.

If the kiwi bulls manage to reduce losses even more and the current weekly candle is formed with a long lower shadow and a small bearish body, this may be perceived by market participants as a reversal signal.

In this case, the pair will continue to adjust to its previous quite strong fall, and you will be able to search for points for purchases. However, I would like to remind you that the "New Zealander" is still in a downward trend, so trading on the correction is quite risky.

Now, let's look at the younger timeframes and try to assess the current situation for NZD/USD as objectively as possible.

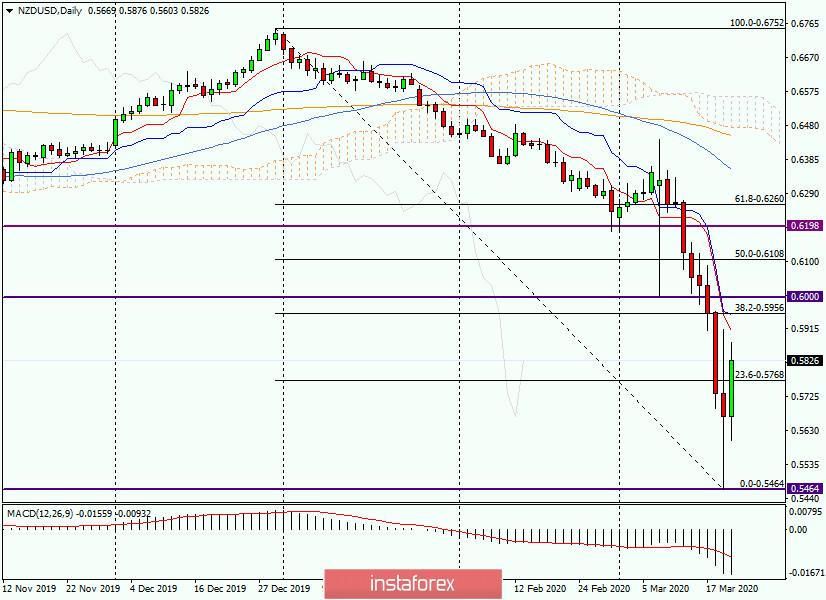

Daily

At this time interval, a reversal signal has already appeared. This is yesterday's candle formed in the form of a "Rickshaw" reversal model. Since this model appeared at the end of a fairly long decline, the chances of its development increase.

At the moment of writing, "kiwi" is growing at today's auction. Once again, I want to emphasize that the growth is corrective at the moment, so the main trading idea is to sell after the rollback is completed.

Stretched the grid of the Fibonacci tool to a decrease of 0.6752-0.5464. I pay attention to the 38.2 Fibo level, where the Kijun line of the Ichimoku indicator is located, and the Tenkan line is slightly lower.

Also, do not discount the most important psychological and technical level of 0.6000, which passes slightly above 38.2 Fibo and Kijun. Thus, we can assume that the exchange rate adjustment will end in the area of 0.5910-0.6000. If a candle or bearish candles appear in this area, this will confirm the decision to open short positions for this currency pair.

It is unlikely that the bulls for the "New Zealander" will have enough time and effort to raise the quote above the mark of 0.6000 and complete the trading there. However, in the current market situation, the most seemingly improbable scenarios are possible. The panic that engulfs the majority of the world's population in connection with the COVID-19 outbreak is naturally transmitted to global financial platforms.

If the daily and weekly trading ends above the landmark level of 0.6000, there is a high probability of a deeper correction of the New Zealand dollar. In this case, I recommend paying all attention to the mark of 0.6100, where the 50th level of correction from the fall of 0.6752-0.5464 passes.

At the end of the article, it is difficult to make a clear conclusion - the pair is being corrected or there has been a trend change. I am more inclined to the first option and believe that at this stage, the main trading idea remains sales after corrective rollbacks to the prices indicated above.

Have a nice weekend!