The CFTC report showed that investors are not optimistic about the dollar in the medium term despite the fact that the US dollar has been trading with a clear advantage over the past two weeks. Moreover, the aggregate dollar position has continued to remain bearish for the second week, which is happening for the first time since 2018.

The main adjustments were made for EUR and JPY. Speculators led the Euro into a bullish area for the first time since September 2018, raising the net position to 4.4 billion dollars. Meanwhile, the net bullish rates on the yen rose by 1 billion and reached the level of 3.823 billion, demand for the franc also increased, although less pronounced.

In the case of commodity currencies, the situation is reversed. We went deeper into the negative CAD and NZD, the Australian dollar net shortened for the Australian dollar. Surprisingly, the long gold rate declined, although based on the logic of a cartel conspiracy between 6 central banks, in order to maintain financial stability, it is necessary to put gold prices under tight control so as not to undermine the dollar-based currency system which we seem to be observing.

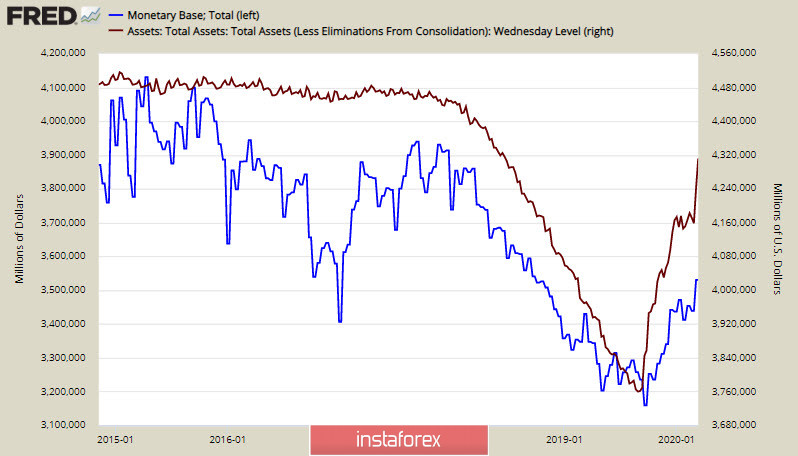

"There are decades when nothing happens, and weeks for which decades happen." This quote by V. Lenin became relevant again. The Fed bought back assets worth 307 billion over the past week, which is much more than the record set at the peak of the previous QE wave.

As US Treasury Secretary Steven Mnuchin said on Sunday, the US Congress is finalizing a bill under which each family will receive $ 3,000 in non-refundable aid, and the Fed will be able to issue 4 trillion. dollars for "lending to the business."

The intended measures are unprecedented, and if similar steps were taken by any other central bank, the exchange rate would have plummeted due to excess supply. However, the current crisis has put hundreds of thousands of enterprises around the world under the threat of bankruptcy; servicing a huge debt mass requires cash, which is not enough. Only these reasons support the demand for the dollar now, because, as shown by the CFTC report, there are no economic reasons for the growth of the dollar. The measures taken around the world are designed to minimize the consequences as far as possible, but not to prevent a recession. Thus, a recession is inevitable.

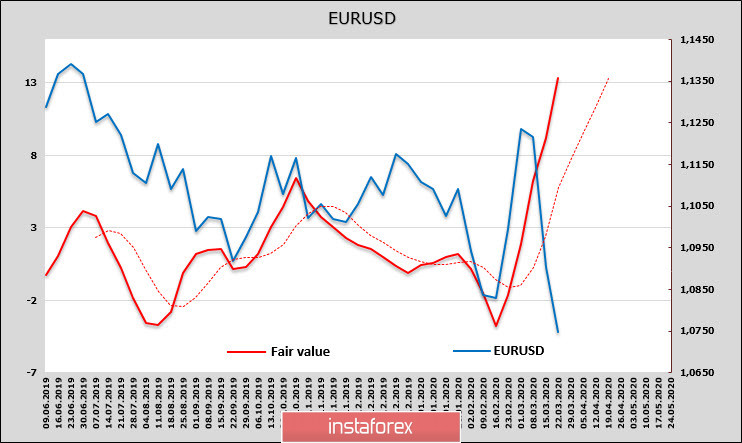

EUR/USD

The sharp increase in the long position in Euro futures did not lead to an increase in EUR/USD on the spot, since Europe is the epicenter of the spread of coronavirus. The fair estimated price is about 1.1350, so the euro may begin to grow at the very second when there is an informational reason for this.

On the other hand, recent statistics from Europe do not look negative, but estimates of prospects have fallen sharply. The ZEW index in Germany fell to -495p in March, which is the lowest since 1991, Ifo indexes also collapsed to 30-year lows. As a result, recession is inevitable according to agencies.

The prospects for EUR/USD entirely depend on the development of the pandemic. There are reasons to believe that the euro has found support for 1.0632. Thus, we expect attempts to rise above the level of 1.0775 and move to the side range or the development of an upward movement, if this is supported by the news background.

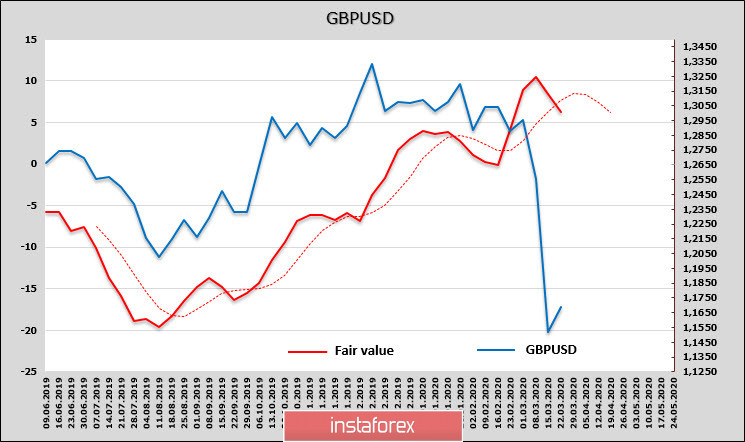

GBP/USD

The Bank of England has joined the rest of the central banks, announcing a rate cut to 0.1% last week and the resumption of QE. The pound has been under strong market pressure in recent days, so a decline in stocks and an increase in purchases of £ 200 billion seems reasonable.

The Bank of England, evaluating the current economic situation, expects the arrival of "economic shock." In an accompanying statement, the Bank of England emphasizes that the measures taken are not the only ones. On March 17, the Treasury launched its own corporate financing program. The actions of the UK financial authorities are fully consistent with market expectations.

As a result, the pound went significantly below the estimated fair price, which gives reason to expect corrective growth.

At the same time, one must proceed from the fact that unlimited swap lines between 6 central banks are designed primarily to keep currency rates from significant fluctuations, so even a reasonable growth of the pound towards a fair level will be restrained. The formation of the local bottom 1.1530 above the low of 1.1405 gives reason to wait for the movement to the resistance level of 1.1931.